Get the free CRA QUALIFIED INVESTMENT FUND- INSTITUTIONAL SHARES

Show details

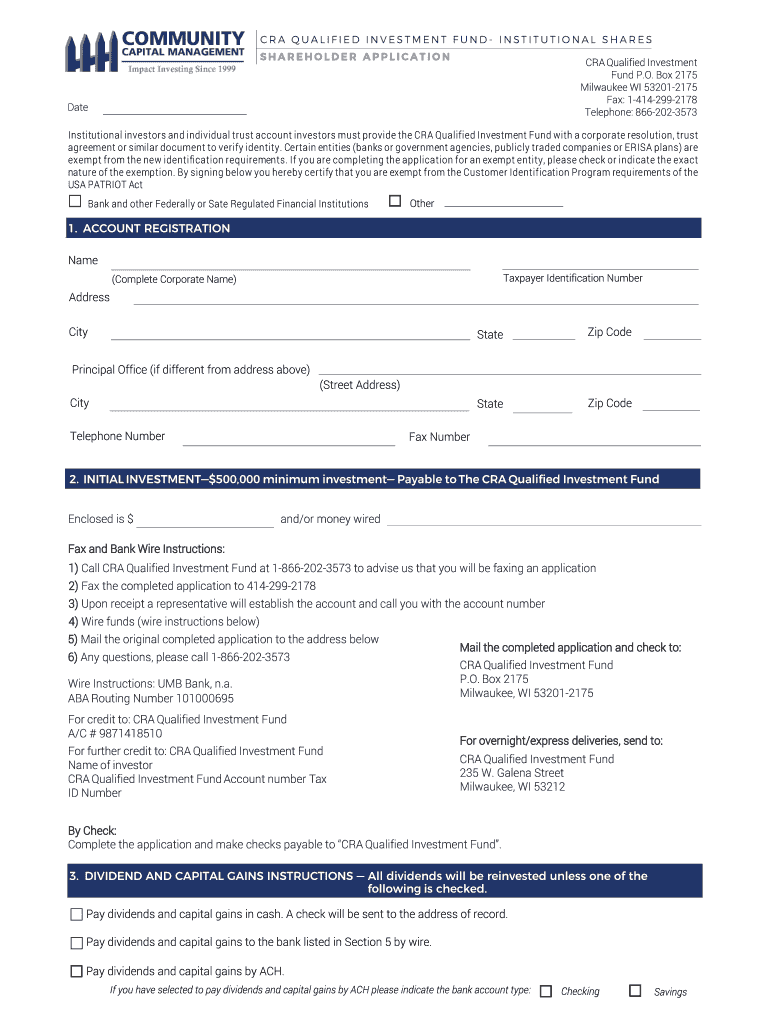

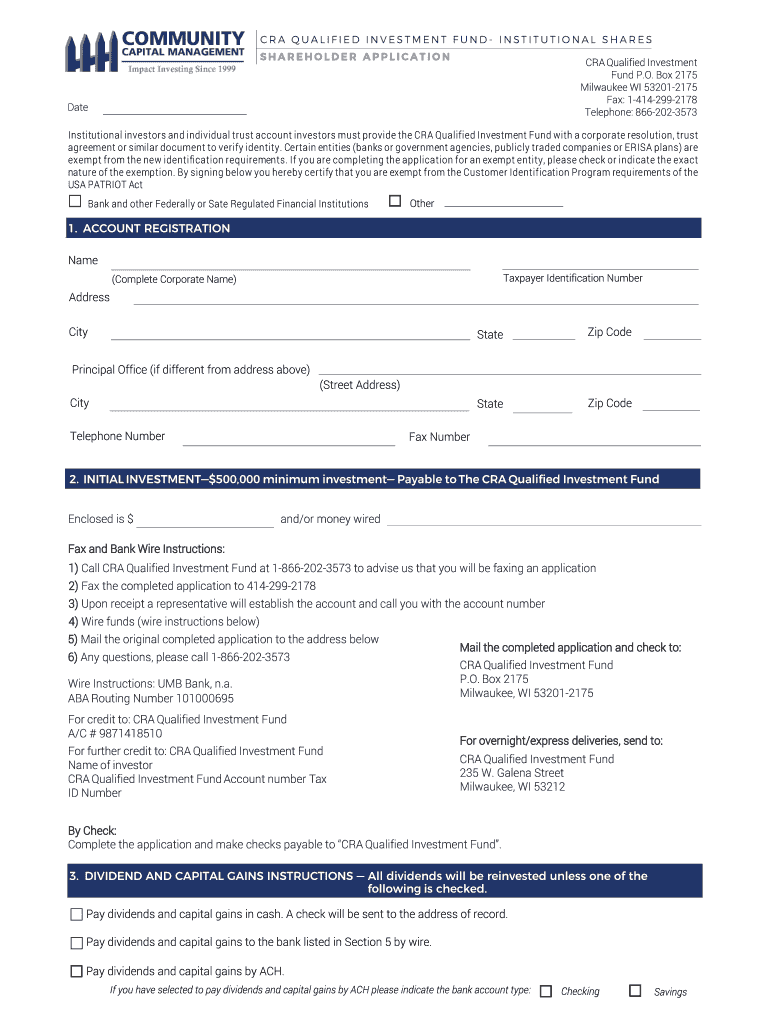

CRA QUALIFIED INVESTMENT FUND INSTITUTIONAL SHARES SHAREHOLDER APPLICATION CRA Qualified Investment Fund P.O. Box 2175 Milwaukee WI 532012175 Fax: 14142992178 Telephone: 8662023573DateI n s t I tut

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cra qualified investment fund

Edit your cra qualified investment fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cra qualified investment fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cra qualified investment fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cra qualified investment fund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cra qualified investment fund

How to fill out cra qualified investment fund

01

To fill out a CRA qualified investment fund, follow these steps:

02

Start by gathering all your financial information including your investment statements, income details, and tax documents.

03

Determine the type of qualified investment fund you want to invest in. This can include mutual funds, exchange-traded funds (ETFs), or segregated funds.

04

Research different qualified investment funds to find one that aligns with your investment goals and risk tolerance.

05

Once you have chosen a fund, contact the financial institution or authorized dealer to obtain the necessary application forms.

06

Fill out the application form accurately, providing all required information such as your personal details, investment amount, and investment options.

07

Double-check all the information provided to ensure its accuracy and completeness.

08

Attach any supporting documents such as identification proof or financial statements if required.

09

Review the terms and conditions of the qualified investment fund before signing the application form.

10

Submit the completed application form along with any required documents to the financial institution or authorized dealer.

11

Keep copies of all the documents submitted for your reference and records.

12

Wait for the confirmation or acknowledgment from the financial institution regarding your qualified investment fund application.

13

Monitor your investment performance periodically and consult with a financial advisor if needed.

14

By following these steps, you can successfully fill out a CRA qualified investment fund.

Who needs cra qualified investment fund?

01

CRA qualified investment funds are typically beneficial for individuals who want to take advantage of tax-deferred growth in their investments while saving for retirement.

02

Specifically, those who may need CRA qualified investment funds include:

03

- Individuals who have reached their contribution limit in registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs).

04

- High-income earners who are looking for tax-efficient investment options.

05

- Investors who are willing to hold their investments for the long term and can tolerate market volatility.

06

- Individuals who are interested in diversifying their investment portfolio and accessing a wide range of investment options.

07

- Investors who want to benefit from the potential growth of the underlying securities in a qualified investment fund.

08

Before investing in a CRA qualified investment fund, it is advisable to consult with a financial advisor to determine if it aligns with your financial goals and risk profile.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cra qualified investment fund to be eSigned by others?

Once your cra qualified investment fund is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in cra qualified investment fund?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your cra qualified investment fund and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete cra qualified investment fund on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your cra qualified investment fund. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is cra qualified investment fund?

A CRA Qualified Investment Fund is an investment fund that meets specific criteria established by the Canada Revenue Agency to ensure that the funds are used for purposes that qualify for tax benefits.

Who is required to file cra qualified investment fund?

Entities that manage or operate a CRA Qualified Investment Fund are required to file this information with the Canada Revenue Agency.

How to fill out cra qualified investment fund?

To fill out the CRA Qualified Investment Fund form, businesses need to provide accurate investment data, financial information, and any other required documentation as specified by the CRA.

What is the purpose of cra qualified investment fund?

The purpose of a CRA Qualified Investment Fund is to encourage investments in certain sectors or projects that can benefit from tax advantages, promoting economic growth.

What information must be reported on cra qualified investment fund?

Information reported on a CRA Qualified Investment Fund includes investment amounts, income generated, beneficiaries, and compliance with CRA guidelines.

Fill out your cra qualified investment fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cra Qualified Investment Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.