PA REV-677 LE 2002 free printable template

Show details

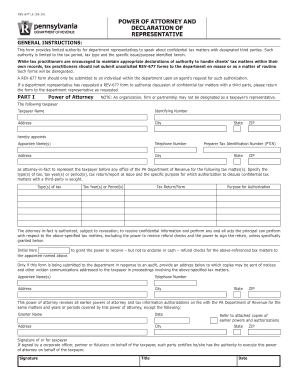

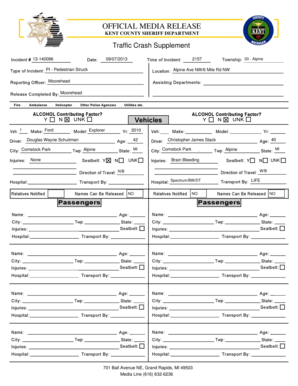

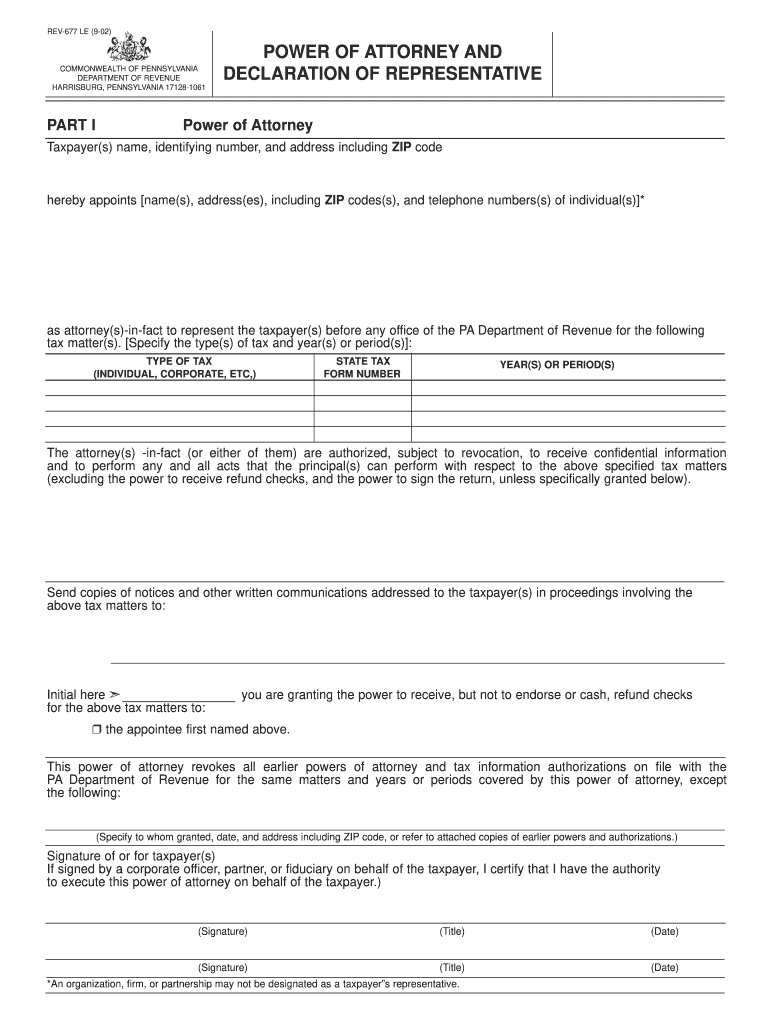

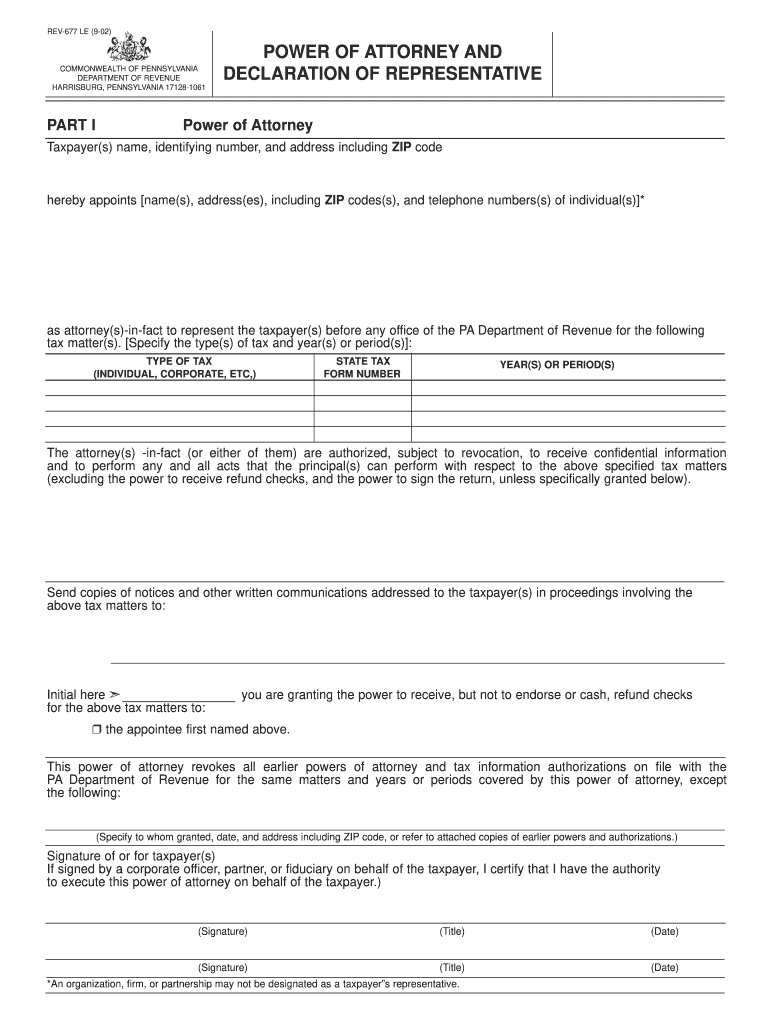

REV-677 LE (9-02) COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE HARRISBURG, PENNSYLVANIA 17128-1061 PART I POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE Power of Attorney Taxpayer(s) name,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-677 LE

Edit your PA REV-677 LE form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-677 LE form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA REV-677 LE online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA REV-677 LE. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-677 LE Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-677 LE

How to fill out PA REV-677 LE

01

Download the PA REV-677 LE form from the official Pennsylvania Department of Revenue website.

02

Begin with filling out the taxpayer's identification information at the top of the form, including name, address, and Social Security number.

03

Indicate the type of claim you are filing in the designated section.

04

Provide any required additional information regarding income, deductions, and credits as specified on the form.

05

Review the instructions for any additional documentation that may need to be attached.

06

Ensure all sections of the form are filled out completely and accurately to avoid delays.

07

Sign and date the form at the bottom before submitting it to the appropriate office.

Who needs PA REV-677 LE?

01

Individuals or businesses in Pennsylvania seeking to amend their tax returns.

02

Taxpayers who have experienced changes in their financial situation that affect their tax liability.

03

Those who need to claim a refund for overpaid taxes or correct errors in previous filings.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of Rev 677 for authorization?

This form provides limited authority for department representatives to speak about confidential tax matters with designated third parties.

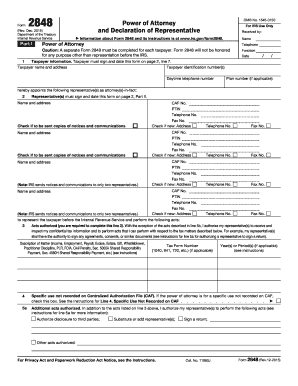

What is a POA in tax?

A Power of Attorney (POA) allows a third party to represent you before the IRS. The authorized individual can advocate, negotiate, and sign on your behalf. They can argue facts and the application of law. POAs can receive copies of notices and transcripts of your account.

How do I get a PA tax clearance certificate?

THE PA DEPARTMENT OF STATE To obtain a Tax Clearance Certificate, the entity must complete and file an Application for Tax Clearance Certificate (REV-181). Entities are defined as a corporation, partnership or two or more individuals associated in a common interest or undertaking.

What is a POA for Pennsylvania tax?

A Pennsylvania tax power of attorney (Form REV-677 LE) is a state-issued document that authorizes a third party (the “appointee”) to act as a taxpayer's representative before the Pennsylvania Department of Revenue.

What is the power of attorney form for taxes in PA?

A Pennsylvania tax power of attorney (Form REV-677) can be used when you intend to appoint a tax professional to make filings, obtain information, and otherwise act on your behalf.

Where do I file my PA state tax return?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute PA REV-677 LE online?

pdfFiller has made it easy to fill out and sign PA REV-677 LE. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my PA REV-677 LE in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your PA REV-677 LE right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the PA REV-677 LE form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PA REV-677 LE and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is PA REV-677 LE?

PA REV-677 LE is a Pennsylvania revenue form used for reporting various tax liability information specific to certain entities or transactions.

Who is required to file PA REV-677 LE?

Entities such as partnerships, corporations, and other organizations that meet specific criteria set by the Pennsylvania Department of Revenue are required to file PA REV-677 LE.

How to fill out PA REV-677 LE?

To fill out PA REV-677 LE, individuals must provide accurate information about income, deductions, and any relevant tax credits, ensuring all required fields are completed and supported by documentation.

What is the purpose of PA REV-677 LE?

The purpose of PA REV-677 LE is to facilitate the reporting and reconciliation of tax liabilities to the Pennsylvania Department of Revenue for the specified entities.

What information must be reported on PA REV-677 LE?

The information that must be reported on PA REV-677 LE includes income, deductions, credits, entity identification details, and any other relevant financial data as required by the form.

Fill out your PA REV-677 LE online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-677 LE is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.