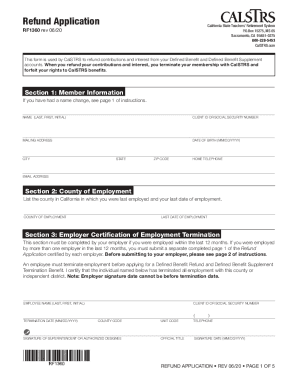

CA CALSTRS RF1360 2020 free printable template

Get, Create, Make and Sign CA CALSTRS RF1360

How to edit CA CALSTRS RF1360 online

Uncompromising security for your PDF editing and eSignature needs

CA CALSTRS RF1360 Form Versions

How to fill out CA CALSTRS RF1360

How to fill out CA CALSTRS RF1360

Who needs CA CALSTRS RF1360?

Instructions and Help about CA CALSTRS RF1360

Hi IN×39’m Jason. Members sometimes ask if they can take a refund of the contributions they've made to their Casts defined-benefit account. While this is allowed, you should carefully consider the consequences of applying for a refund. Even if you think you may not return to teaching, your Casts defined benefit may be your greatest asset in retirement and applying for a refund may not be in your best long-term financial interest. Let×39;explore some ways a refund can affect your financial future. If you take refund of your contributions, you also forfeit the Casts service credit you have earned and all rights to Cast benefits. Keep in mind, this includes your survivor and disability benefits. You×39’ll also be required to take a refund of your defined benefit supplement account. You will not be able to redeposit the funds from your defined benefit supplement account. If you later return to a Casts covered position, you'll have the opportunity to buy back your forfeited service credit, but you must also pay interest, causing the costs to increase over time. There are tax implications as well, unless you roll over your account into a qualified tax deferred retirement plan. When you refund, Casts is required to withhold 20% federal income tax. A 2% state income taxman also be withheld. Additionally, if you take a refund before age 59 and a half, you may be subject to an additional 10% federal and 2.5% state tax penalty. It's important to speak with a tax professional before making the decision to refund. Let's take a look at an example. Sandy is 49 and taught full time for six years after college, but now plans to open a kayak rental business. She wants to take a refund of her $12,720in Casts contributions to start her business. If she takes the money as a direct payment, she×39’ll only receive $8332 after withholding to invest in her business. If Sandy never returns to teaching, but keeps her money in Casts until age sixty when she retires, she could receive $300 monthly retirement benefit for the rest of her life. After ten years, she would have received nearly $40,000 in retirement benefits, significantly more than her net refund of $8332. Please note, there another considerations for members who refund and return to Casts covered employment. You must earn one year of Casts services credit since your last refund and have at least five years of service credit before being eligible for a Casts retirement benefit. If you've evaluated your personal financial situation and decide to apply for a refund, here are some things you need to know about the application process. Complete your application accurately and thoroughly. An incomplete application could delay the processing of your refund. If we receive your refund application after November 15, we cannot guarantee you will receive your refund payment by the end of the calendar year. Also, be aware that the DBS portion of your refund will not be distributed to you until six months after your last day...

People Also Ask about

Can I take a lump sum from CalSTRS?

What is the CalSTRS supplemental benefit?

Can you pull money out of CalSTRS?

Can you borrow money from CalSTRS?

How do I get a refund from CalSTRS?

What is CalSTRS cash balance benefit program?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA CALSTRS RF1360 without leaving Google Drive?

How do I edit CA CALSTRS RF1360 straight from my smartphone?

How do I complete CA CALSTRS RF1360 on an iOS device?

What is CA CALSTRS RF1360?

Who is required to file CA CALSTRS RF1360?

How to fill out CA CALSTRS RF1360?

What is the purpose of CA CALSTRS RF1360?

What information must be reported on CA CALSTRS RF1360?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.