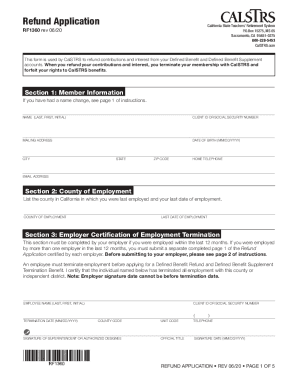

CA CALSTRS RF1360 2015 free printable template

Show details

Attention: Are you thinking about refunding in 2015? ? Please visit CalSTRS.com and log on to your myCalSTRS account to complete your Refund Application online. Submitting your application online

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign calstrs refund

Edit your calstrs refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calstrs refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit calstrs refund online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit calstrs refund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CALSTRS RF1360 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out calstrs refund

How to fill out CA CALSTRS RF1360

01

Obtain the CA CALSTRS RF1360 form from the official California State Teachers' Retirement System website or relevant authority.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill out your personal information, including your name, address, and contact details in the designated sections.

04

Provide your Social Security number or CalSTRS ID number as required.

05

Complete the employment information section, detailing your position, employer, and the period of service.

06

Indicate any additional contributions or retirement options you wish to select on the form.

07

Review all filled sections for accuracy, ensuring no information is missing or incorrect.

08

Sign and date the form to certify the information provided is true and complete.

09

Submit the completed RF1360 form to the appropriate CalSTRS office as indicated in the instructions.

Who needs CA CALSTRS RF1360?

01

Individuals who are members of the California State Teachers' Retirement System (CalSTRS) and need to report their retirement information.

02

Teachers and certificated employees looking to apply for retirement benefits or make changes to their retirement plans.

03

Those seeking to update personal information or make contributions related to their CalSTRS retirement account.

Fill

form

: Try Risk Free

People Also Ask about

Can I take a lump sum from CalSTRS?

If you end all CalSTRS creditable service subject to coverage by the Cash Balance Benefit Program and the Defined Benefit Program for any reason other than death, disability or retirement, you may apply for a lump-sum termination benefit.

What is the CalSTRS supplemental benefit?

The Defined Benefit Supplement Program is a hybrid cash balance plan for Defined Benefit members that provides additional savings for retirement. Funds come from compensation earned from service in one school year in excess of one year of service credit and limited-term salary increases.

Can you pull money out of CalSTRS?

If you no longer work in a CalSTRS-covered position, you can leave your money in CalSTRS until you reach 70½ or request a refund.

Can you borrow money from CalSTRS?

CalSTRS offers an 80/17 combo loan program to help teachers purchase or refinance a home and are members of the California State Teachers Retirement System (CalSTRS).

How do I get a refund from CalSTRS?

If you were employed within the last 12 months, you must terminate all CalSTRS-covered employment in the California public school system and your date of termination must have passed to be eligible to apply for a refund.

What is CalSTRS cash balance benefit program?

The Cash Balance Benefit Program is a hybrid retirement program that can be an alternative to the CalSTRS Defined Benefit Program, Social Security and other retirement plans. It accumulates funds based on dollars contributed by the employee and the employer plus interest, similar to a defined contribution program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send calstrs refund for eSignature?

When your calstrs refund is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the calstrs refund in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your calstrs refund in seconds.

How do I edit calstrs refund on an iOS device?

Create, modify, and share calstrs refund using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is CA CALSTRS RF1360?

CA CALSTRS RF1360 is a form used by employers to report information regarding the participation of employees in the California State Teachers' Retirement System (CalSTRS).

Who is required to file CA CALSTRS RF1360?

Employers who are members of the California State Teachers' Retirement System and who have employees that are participating in the system are required to file CA CALSTRS RF1360.

How to fill out CA CALSTRS RF1360?

To fill out CA CALSTRS RF1360, employers need to provide accurate information regarding their employees, including personal details and retirement contributions. It's crucial to follow the instructions that accompany the form to ensure all necessary data is included.

What is the purpose of CA CALSTRS RF1360?

The purpose of CA CALSTRS RF1360 is to collect information on teachers' employment and compensation for the accurate calculation of retirement benefits from CalSTRS.

What information must be reported on CA CALSTRS RF1360?

Information that must be reported on CA CALSTRS RF1360 includes employee names, Social Security numbers, employment dates, compensation amounts, and any contributions made to the retirement system.

Fill out your calstrs refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Calstrs Refund is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.