Get the free Defined Benefit Pension Funds Request for Prior Service Credit Form

Show details

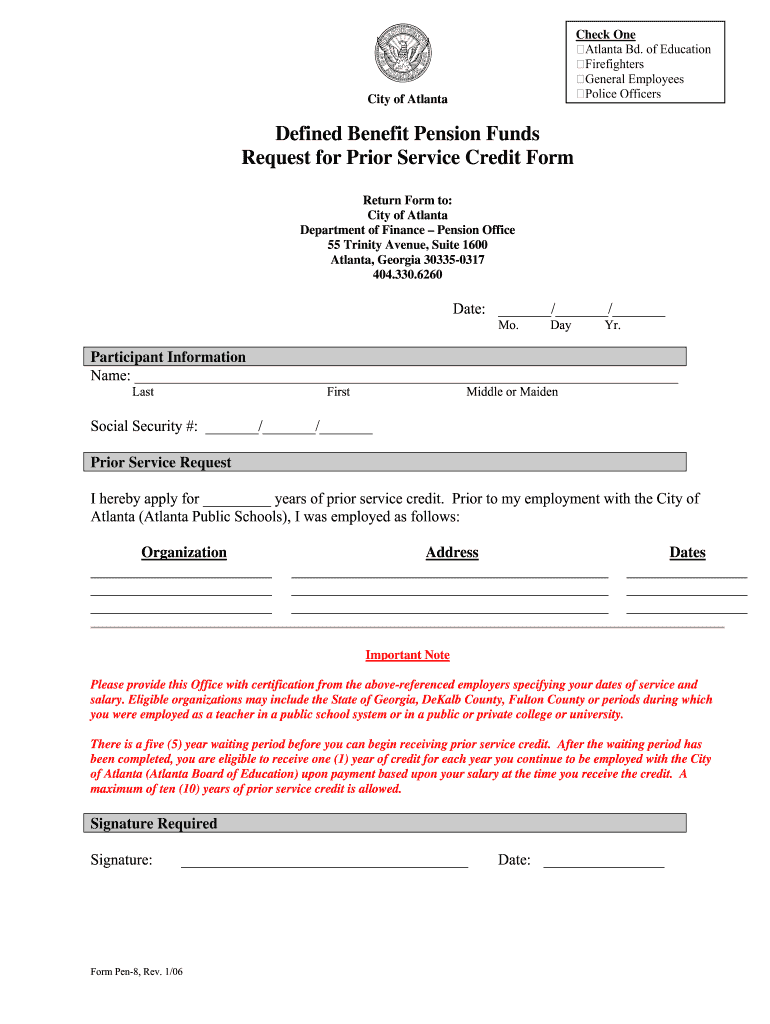

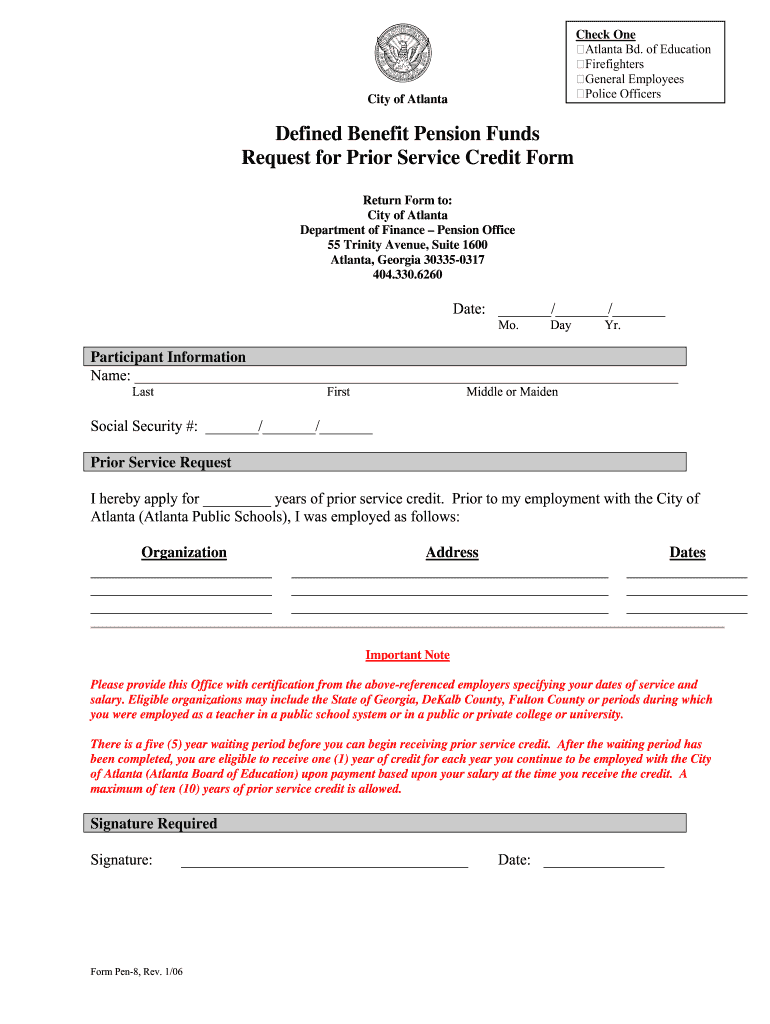

Check One Atlanta BD. of Education Firefighters General Employees Police OfficersCity of AtlantaDefined Benefit Pension Funds Request for Prior to Service Credit Form Return Form to: City of Atlanta

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign defined benefit pension funds

Edit your defined benefit pension funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your defined benefit pension funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing defined benefit pension funds online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit defined benefit pension funds. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out defined benefit pension funds

How to fill out defined benefit pension funds

01

To fill out defined benefit pension funds, follow these steps:

02

Determine the eligibility criteria for the specific defined benefit pension fund you want to fill out.

03

Gather all the necessary personal information, such as your full name, date of birth, social security number, and contact details.

04

Understand the contribution requirements for the defined benefit pension fund. This may involve regular contributions from your salary or other sources of income.

05

Calculate the amount you need to contribute to meet the required benefits. This may vary depending on factors such as your age, salary, and the specific pension fund's rules.

06

Contact the administrator or trustee of the defined benefit pension fund to obtain the necessary forms and documents needed to enroll and contribute.

07

Carefully fill out the forms, ensuring all the information provided is accurate and complete.

08

Submit the filled-out forms, along with any required supporting documents and initial contribution, to the designated address or online portal.

09

Keep track of your contributions and periodically review your benefits statement provided by the pension fund to ensure accuracy and awareness of the accumulated benefits.

10

Seek professional financial advice if needed, especially if you have questions about investment options within the pension fund or any tax implications.

11

Regularly review and update your beneficiary designation to ensure your defined benefit pension fund benefits are passed on according to your wishes in case of your death.

Who needs defined benefit pension funds?

01

Defined benefit pension funds are beneficial for individuals who:

02

- Are employees of companies or organizations that offer such pension plans as part of their employee benefits package.

03

- Desire a reliable and predetermined income stream during retirement, as defined benefit pension funds provide regular pension payments based on factors such as salary, years of service, and plan rules.

04

- Prefer a pension plan with lower investment risks, as the investment decisions and risks are typically managed by the pension fund's administrators.

05

- Value the ability to transfer some or all of their retirement income risks to the pension fund or employer, as defined benefit plans often provide lifetime income guarantees and potential survivor benefits.

06

- Have a long-term employment commitment with the company or organization offering the defined benefit pension plan, as the benefits usually accrue based on years of service.

07

- Want to have a pension plan that is less dependent on market fluctuations and investment performance, as the pension payment amounts are predetermined based on a formula configured by the plan.

08

- Are willing to comply with the contribution requirements and any other plan rules set by the defined benefit pension fund.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute defined benefit pension funds online?

Completing and signing defined benefit pension funds online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in defined benefit pension funds without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing defined benefit pension funds and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit defined benefit pension funds on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing defined benefit pension funds.

What is defined benefit pension funds?

Defined benefit pension funds are retirement plans in which the employer guarantees a specific benefit amount to employees upon retirement.

Who is required to file defined benefit pension funds?

Employers who offer defined benefit pension plans are required to file the necessary forms with the appropriate regulatory agencies.

How to fill out defined benefit pension funds?

Defined benefit pension funds can be filled out by providing detailed information about the plan, including participant data, contribution amounts, and investment returns.

What is the purpose of defined benefit pension funds?

The purpose of defined benefit pension funds is to provide retirement income security to employees by guaranteeing a specific benefit amount.

What information must be reported on defined benefit pension funds?

Information such as participant data, contribution amounts, investment returns, and actuarial assumptions must be reported on defined benefit pension funds.

Fill out your defined benefit pension funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Defined Benefit Pension Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.