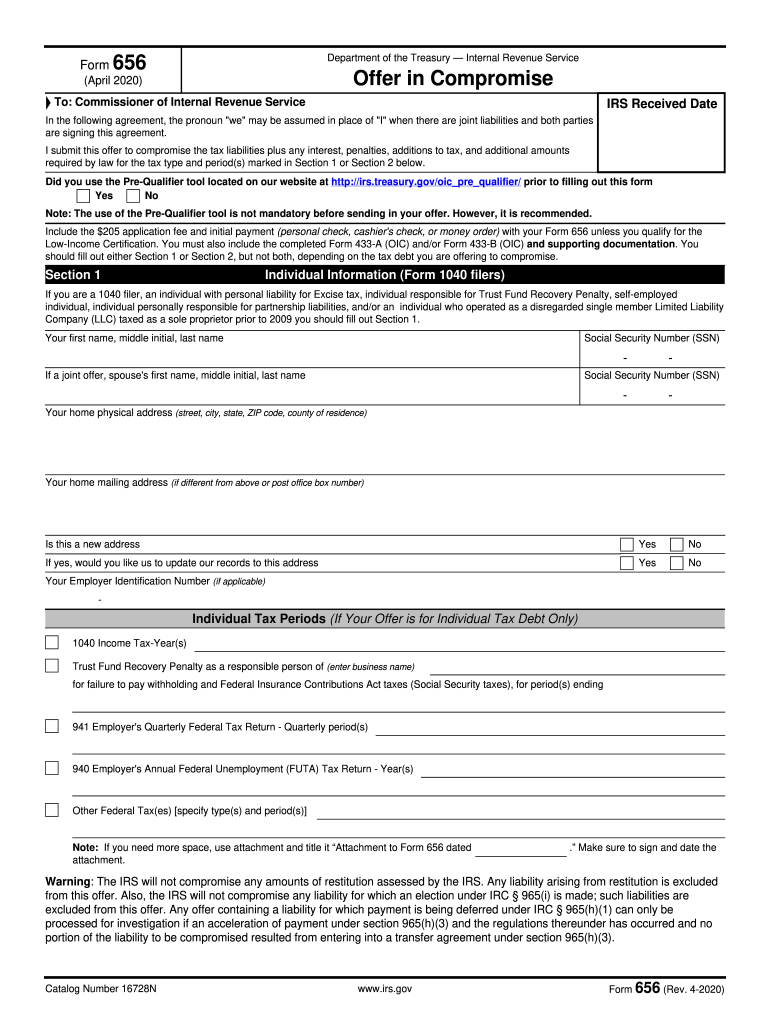

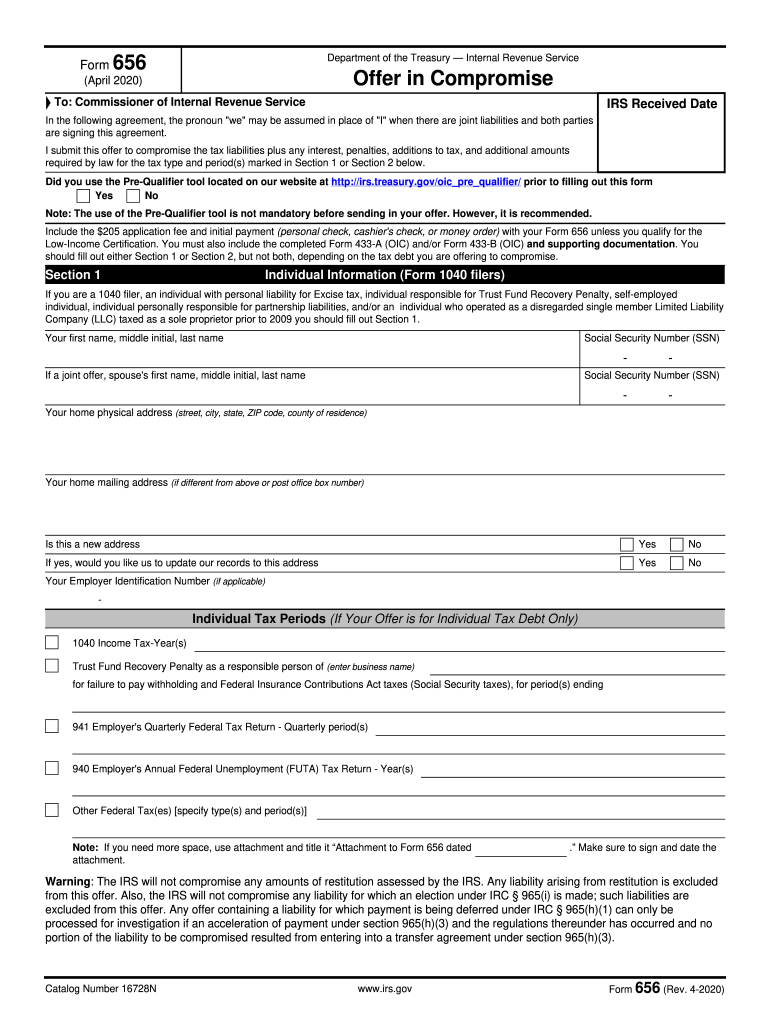

IRS 656 2020 free printable template

Get, Create, Make and Sign IRS 656

Editing IRS 656 online

Uncompromising security for your PDF editing and eSignature needs

IRS 656 Form Versions

How to fill out IRS 656

How to fill out IRS 656

Who needs IRS 656?

Instructions and Help about IRS 656

Hi and welcome to another IRS Forms video Today were tackling IRS Form 656 Offering Compromise This is a form that you definitely want Roget right the first time Any mistake you make can cause a whole host of problems for your client including delaying their offer in compromise by months So lets take a look at a few tips that can help you make sure your Form 656 is absolutely perfect the first time If you think this video is helpful make surety hit that like button and subscribe to the channel Tip 1 What is IRS Form 656 and Who Should It Form 656 is one of the forms required by theirs for requesting an offer in compromise or OIC This form in combination with Form 433-OICFallows the IRS to evaluate your clients financial situation and their tax debt to determine if they will accept the offer Form 656 is where you report the details of your proposed OIC Those details include vital information such as the offer amount and the proposed payment timeline It's also where you make your case for whits in the IRS's the best interest to accept less money than the taxpayer owes This form is for any client business orindividualwho is requesting either a Doubt as to Convertibility or Effective Tax Administration OIC If you are submitting a Doubt as to Liability offer in compromise then you'll use the form 656-L instead of the standard 656 Tip 2 Is Doubt as to Convertibility or Effective Administration Better for Your Client Section three asks you to designate the reason for the offer Doubt as to Convertibility or Effective Tax Administration As stated in the IRM doubt as to collectibilityexists in any case where the taxpayers assets and income are less than the full amount of the assessed liability In other words a Doubt as to CollectibilityOIC is for clients who don't have enough disposable income and assets to pay their tax debt The evidence for this type of offer in compromises collected largely through Form 433-OIC along with supporting documentation such as bank and credit card statements If your client simply can't afford to pay their tax debt Doubt as to Convertibility is the best offer for them Effective Tax Administration on the other hand is for clients who can technically afford to pay their tax debt but doing so would cause undue harm to the taxpayer or undermine public faith in IRS Basically you have to convince the IRS that in this case not collecting the tax is more beneficial to the agency than collecting the tax The IRS isn't going to seize the assets of a 90-year-old woman living on social security or force a disabled man to sell the home he has specially equipped to accommodate his disability For more examples of Effective Tax Administration cases check out the links in the description Tip 3 How Do You Determine Payment Terms Section four prompts you to choose between two different payment options lump sum and periodic payment A lump sum offer is for clients who can afford to pay their offer amount in 5 months or less When submitting a lump...

People Also Ask about

How hard is it to get an IRS offer in compromise?

Can I do an offer in compromise myself?

What forms do I need for offer in compromise?

How do I write an offer in compromise letter to the IRS?

How much does an offer in compromise cost?

How do you fill out an offer in compromise?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 656 from Google Drive?

Can I create an electronic signature for the IRS 656 in Chrome?

How do I complete IRS 656 on an Android device?

What is IRS 656?

Who is required to file IRS 656?

How to fill out IRS 656?

What is the purpose of IRS 656?

What information must be reported on IRS 656?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.