Get the free Secondary / Tertiary Coverage

Show details

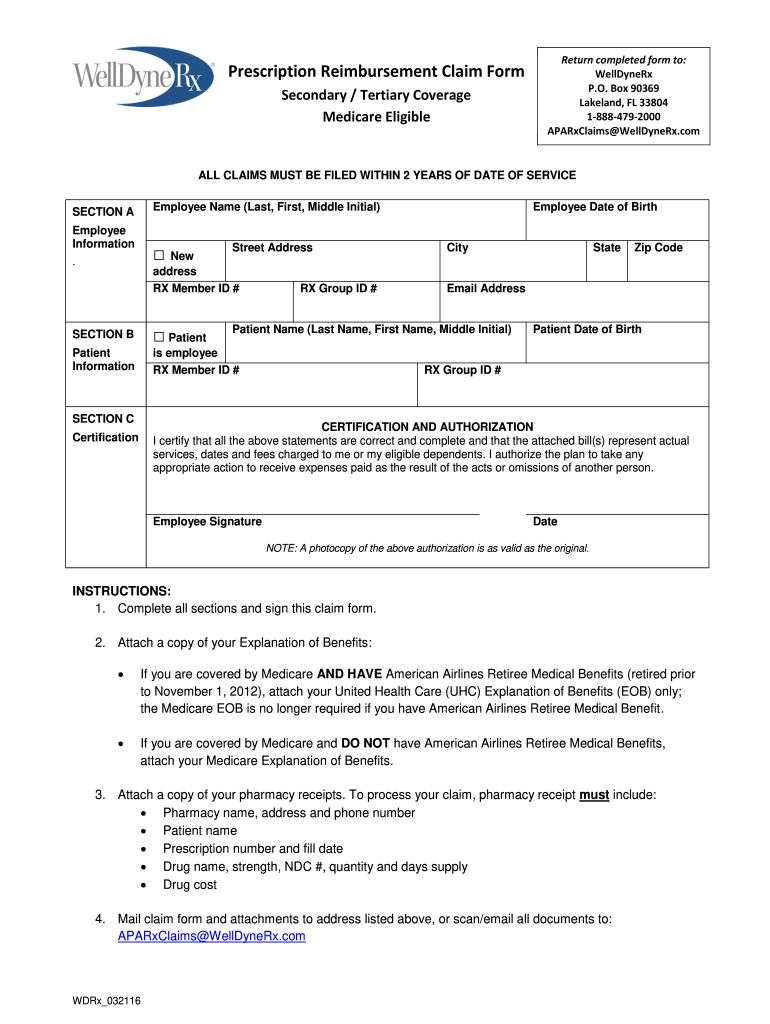

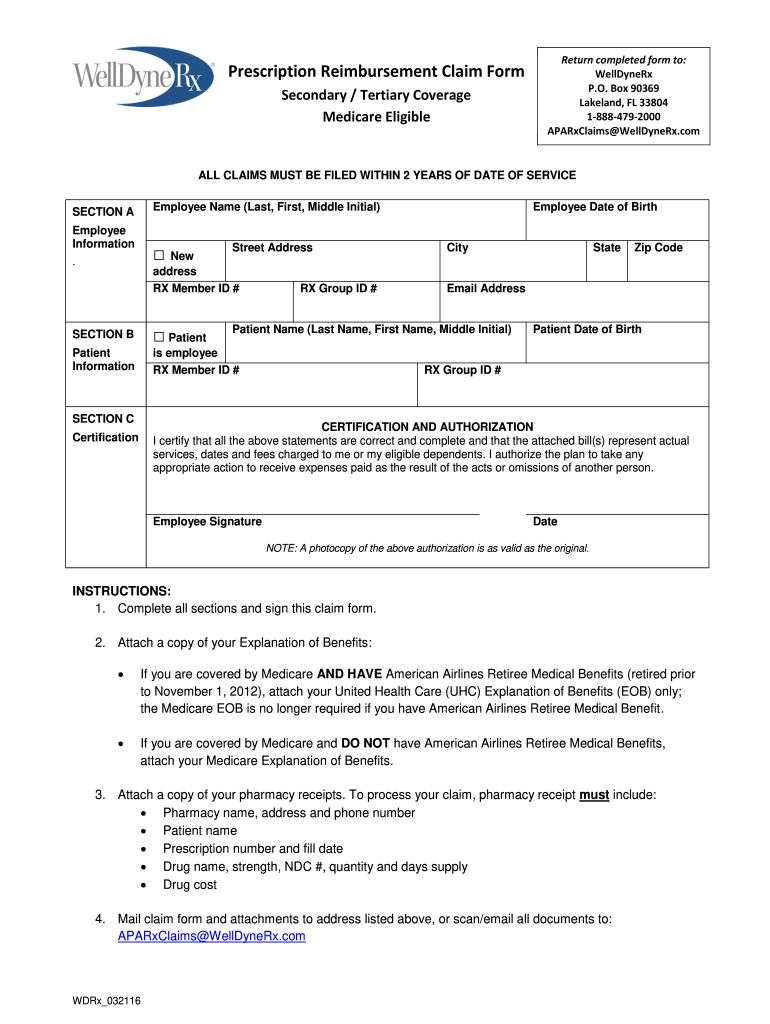

Prescription Reimbursement Claim Form

Secondary / Tertiary Coverage

Medicare EligibleReturn completed form to:

WellDyneRx

P.O. Box 90369

Lakeland, FL 33804

18884792000

APARxClaims@WellDyneRx.comALL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secondary tertiary coverage

Edit your secondary tertiary coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secondary tertiary coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing secondary tertiary coverage online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit secondary tertiary coverage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secondary tertiary coverage

How to fill out secondary tertiary coverage

01

To fill out secondary tertiary coverage, follow these steps:

02

Review your primary health insurance policy to understand the coverage it provides.

03

Identify if the primary policy has any limitations or exclusions, such as high deductibles or limited coverage for specific treatments.

04

Research secondary and tertiary health insurance policies to find the ones that meet your needs and provide additional coverage.

05

Compare the coverage options, benefits, and costs of different secondary and tertiary insurance policies.

06

Select the secondary and tertiary coverage that best complements your primary policy and offers the desired level of protection.

07

Complete the application or enrollment process for the chosen secondary and tertiary insurance policies.

08

Provide all required information, such as personal details, medical history, and any necessary supporting documents.

09

Pay the premiums for the secondary and tertiary coverage as per the respective policy's payment terms.

10

Keep a copy of the policy documents, including policy numbers, contact information, and terms of coverage, for future reference.

11

Understand the claims process and how to submit claims to the secondary and tertiary insurers if needed.

12

Review and update your secondary and tertiary coverage periodically to ensure it aligns with your changing healthcare needs.

13

Remember, it's always advisable to consult with insurance professionals or experts for personalized guidance in filling out secondary tertiary coverage.

Who needs secondary tertiary coverage?

01

Secondary tertiary coverage is beneficial for individuals who:

02

- Have high deductibles or limited coverage under their primary health insurance policy.

03

- Require additional financial protection and coverage for specialized treatments, surgeries, or medical procedures.

04

- Want to limit out-of-pocket expenses and potential financial burdens associated with medical emergencies.

05

- Have a family history of specific medical conditions and want extended coverage for preventive care or early interventions.

06

- Travel frequently and desire coverage for medical emergencies that may occur outside their primary policy's network.

07

- Seek peace of mind and comprehensive health insurance that offers broader protection against unforeseen healthcare costs.

08

- Prefer having multiple layers of insurance coverage to ensure higher levels of financial security and access to quality healthcare services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit secondary tertiary coverage online?

The editing procedure is simple with pdfFiller. Open your secondary tertiary coverage in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit secondary tertiary coverage in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your secondary tertiary coverage, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the secondary tertiary coverage electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your secondary tertiary coverage and you'll be done in minutes.

What is secondary tertiary coverage?

Secondary tertiary coverage refers to additional insurance coverage that supplements primary coverage.

Who is required to file secondary tertiary coverage?

Insurance providers or individuals who have secondary tertiary coverage are required to file this information.

How to fill out secondary tertiary coverage?

Secondary tertiary coverage can be filled out by providing relevant information about the additional insurance coverage.

What is the purpose of secondary tertiary coverage?

The purpose of secondary tertiary coverage is to provide extra protection and support beyond the primary coverage.

What information must be reported on secondary tertiary coverage?

Information such as policy details, coverage limits, and contact information of the secondary tertiary insurer must be reported.

Fill out your secondary tertiary coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secondary Tertiary Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.