CA Declaration Under Probate Code Section 13101 2020 free printable template

Show details

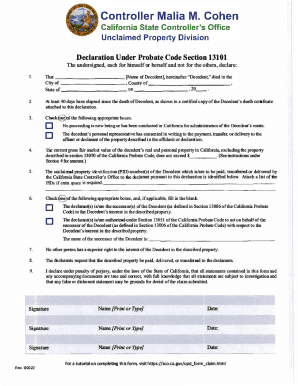

Declaration Under Probate Code Section 13101 The undersigned, each for himself or herself and not for the others, declare: Name of Decedent, hereinafter Decedent, died in the , County of, on, 20 .1.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Declaration Under Probate Code Section 13101

Edit your CA Declaration Under Probate Code Section 13101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Declaration Under Probate Code Section 13101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Declaration Under Probate Code Section 13101 online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA Declaration Under Probate Code Section 13101. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Declaration Under Probate Code Section 13101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Declaration Under Probate Code Section 13101

How to fill out CA Declaration Under Probate Code Section 13101

01

Start by obtaining the form for the CA Declaration Under Probate Code Section 13101 from the appropriate court or legal website.

02

Fill in the title of the document at the top, indicating it is a Declaration under Probate Code Section 13101.

03

Provide your full name, address, and contact information in the designated sections.

04

Clearly state the purpose of the declaration, including the details of the decedent and your relationship to them.

05

Include any relevant factual information that supports the declaration, such as dates and descriptions of events.

06

Provide your signature, and date the document at the bottom.

07

If required, notarize the document by taking it to a notary public.

Who needs CA Declaration Under Probate Code Section 13101?

01

Individuals who are involved in the estate of a deceased person under California law may need to file this declaration.

02

Executors or administrators of an estate needing to clarify their authority may require this form.

03

Heirs or beneficiaries of an estate who want to confirm their relationship to the decedent may also need this declaration.

Fill

form

: Try Risk Free

People Also Ask about

What is California Civil Code 13100?

Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

What is a declaration under Probate Code section 13101?

This form may be used to collect the unclaimed property of a decedent without procuring letters of administration or awaiting probate of the decedent's will if you are entitled to the decedent's property under Section 13101 of the California Probate Code.

Does a California small estate affidavit need to be notarized?

While the state of California does not require you to get the form notarized, you will need to present the document to financial institutions to get the deceased's property transferred, and they will require that it be notarized.

What is the probate code 13100 limit?

Maximum Value of Small Estate: $166,250→$184,500 To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500.

What is Section 13051 of the California Probate Code T?

Section 13051. 13051. For the purposes of this part: (a) The guardian or conservator of the estate of a person entitled to any of the decedent's property may act on behalf of the person without authorization or approval of the court in which the guardianship or conservatorship proceeding is pending.

What is California Probate Code 13100 declaration?

Probate Code §§ 13100 – 13115 provide for a summary procedure to transfer the personal property of a decedent without going through a probate action if the decedent's estate is valued at less than $150,000 and at least forty (40) days have elapsed since the death of the decedent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA Declaration Under Probate Code Section 13101?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific CA Declaration Under Probate Code Section 13101 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit CA Declaration Under Probate Code Section 13101 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing CA Declaration Under Probate Code Section 13101, you can start right away.

How do I edit CA Declaration Under Probate Code Section 13101 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share CA Declaration Under Probate Code Section 13101 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is CA Declaration Under Probate Code Section 13101?

The CA Declaration Under Probate Code Section 13101 is a legal document that provides a declaration of the heirs or beneficiaries of a decedent's estate, used in California probate proceedings.

Who is required to file CA Declaration Under Probate Code Section 13101?

The declaration is generally required to be filed by the personal representative of the estate or by the individual who is seeking to administer the estate.

How to fill out CA Declaration Under Probate Code Section 13101?

To fill out the declaration, the filer must provide the decedent's information, details about the decedent's heirs or beneficiaries, and any pertinent information required by the court, ensuring all sections are completed accurately.

What is the purpose of CA Declaration Under Probate Code Section 13101?

The purpose of the declaration is to formalize the identification and rights of heirs or beneficiaries, facilitate probate proceedings, and ensure transparency in the distribution of the decedent's assets.

What information must be reported on CA Declaration Under Probate Code Section 13101?

The declaration must include the decedent's name, date of death, known heirs or beneficiaries' names and their relationships to the decedent, and any other related information that may affect the estate's administration.

Fill out your CA Declaration Under Probate Code Section 13101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Declaration Under Probate Code Section 13101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.