CA Declaration Under Probate Code Section 13101 2014 free printable template

Show details

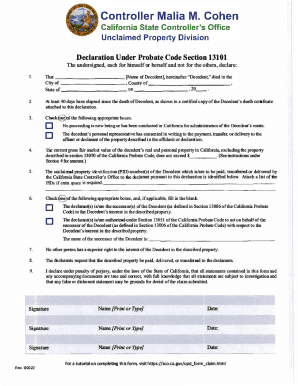

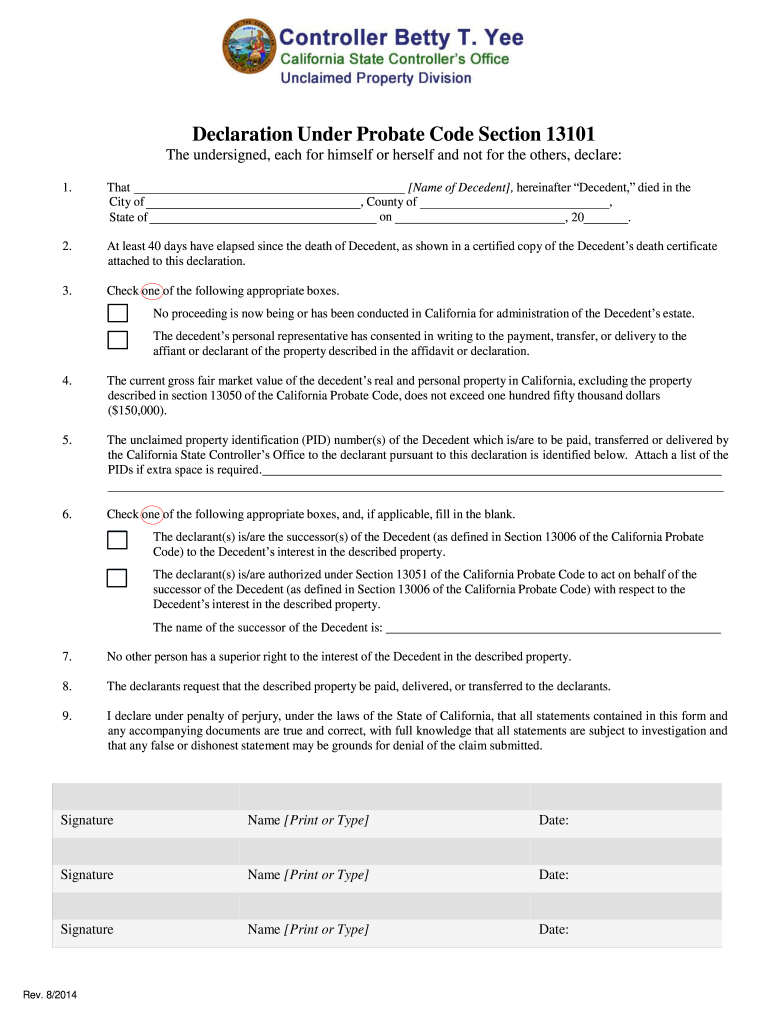

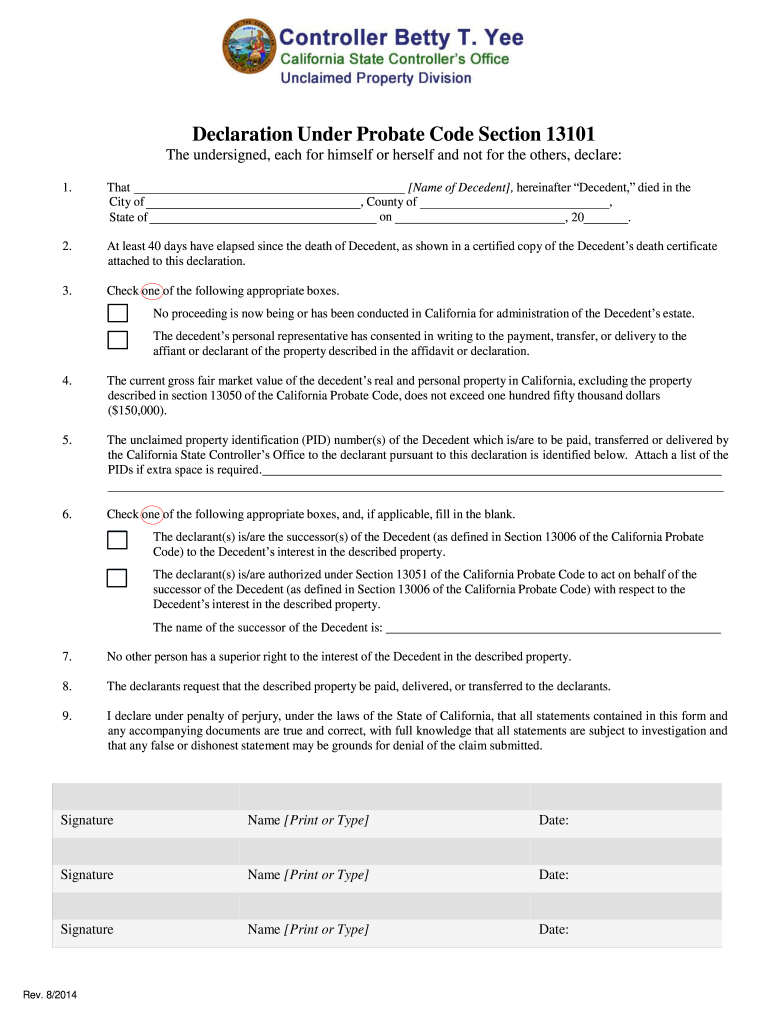

Declaration Under Probate Code Section 13101 The undersigned each for himself or herself and not for the others declare Name of Decedent hereinafter Decedent died in the County of on. The decedent s personal representative has consented in writing to the payment transfer or delivery to the affiant or declarant of the property described in the affidavit or declaration. The current gross fair market value of the decedent s real and personal property in California excluding the property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Declaration Under Probate Code Section 13101

Edit your CA Declaration Under Probate Code Section 13101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Declaration Under Probate Code Section 13101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA Declaration Under Probate Code Section 13101 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA Declaration Under Probate Code Section 13101. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Declaration Under Probate Code Section 13101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Declaration Under Probate Code Section 13101

How to fill out CA Declaration Under Probate Code Section 13101

01

Obtain the CA Declaration Under Probate Code Section 13101 form from the appropriate court or legal resource.

02

Fill out your personal information at the top of the form, including your full name, address, and contact information.

03

Provide details about the estate, including the decedent's name, date of death, and any relevant case number.

04

Clearly indicate your relationship to the decedent (e.g., heir, beneficiary, etc.).

05

Complete any sections that require you to affirm your eligibility to file the declaration and your understanding of its implications.

06

Review the filled-out declaration for accuracy and completeness.

07

Sign and date the form as required.

08

File the declaration with the appropriate probate court as instructed.

Who needs CA Declaration Under Probate Code Section 13101?

01

Individuals who are heirs or beneficiaries of an estate in California.

02

Executors or personal representatives of an estate.

03

Any party involved in probate proceedings related to the decedent's estate.

Fill

form

: Try Risk Free

People Also Ask about

What is California Civil Code 13100?

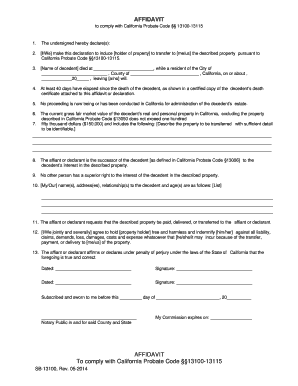

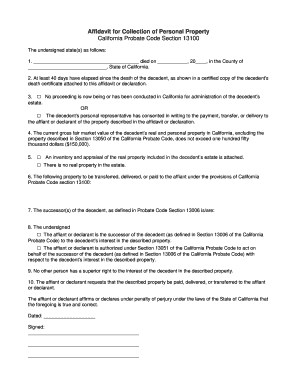

Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

What is a declaration under Probate Code section 13101?

This form may be used to collect the unclaimed property of a decedent without procuring letters of administration or awaiting probate of the decedent's will if you are entitled to the decedent's property under Section 13101 of the California Probate Code.

Does a California small estate affidavit need to be notarized?

While the state of California does not require you to get the form notarized, you will need to present the document to financial institutions to get the deceased's property transferred, and they will require that it be notarized.

What is the probate code 13100 limit?

Maximum Value of Small Estate: $166,250→$184,500 To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500.

What is Section 13051 of the California Probate Code T?

Section 13051. 13051. For the purposes of this part: (a) The guardian or conservator of the estate of a person entitled to any of the decedent's property may act on behalf of the person without authorization or approval of the court in which the guardianship or conservatorship proceeding is pending.

What is California Probate Code 13100 declaration?

Probate Code §§ 13100 – 13115 provide for a summary procedure to transfer the personal property of a decedent without going through a probate action if the decedent's estate is valued at less than $150,000 and at least forty (40) days have elapsed since the death of the decedent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CA Declaration Under Probate Code Section 13101 online?

pdfFiller has made it easy to fill out and sign CA Declaration Under Probate Code Section 13101. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the CA Declaration Under Probate Code Section 13101 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your CA Declaration Under Probate Code Section 13101 in minutes.

How can I edit CA Declaration Under Probate Code Section 13101 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing CA Declaration Under Probate Code Section 13101 right away.

What is CA Declaration Under Probate Code Section 13101?

The CA Declaration Under Probate Code Section 13101 is a legal document that certifies the status of a decedent's estate and the qualifications of the personal representative, if applicable, in accordance with California probate law.

Who is required to file CA Declaration Under Probate Code Section 13101?

The declaration must be filed by the personal representative or executor of the estate, or in some cases, by the administrator if there is no will.

How to fill out CA Declaration Under Probate Code Section 13101?

To fill out the declaration, one must provide identifying information about the decedent, detail the relationship of the filer to the decedent, and include specifics about the estate's assets and liabilities.

What is the purpose of CA Declaration Under Probate Code Section 13101?

The purpose of the declaration is to provide the court with verified information regarding the decedent's estate, ensuring transparency and compliance with California probate laws.

What information must be reported on CA Declaration Under Probate Code Section 13101?

The declaration must report the decedent’s name, date of death, details of the probate proceedings, information about assets, claims against the estate, and the names of all beneficiaries.

Fill out your CA Declaration Under Probate Code Section 13101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Declaration Under Probate Code Section 13101 is not the form you're looking for?Search for another form here.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.