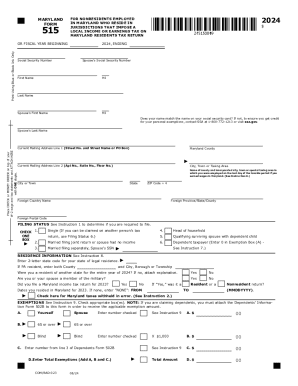

MD Comptroller 515 2019 free printable template

Instructions and Help about MD Comptroller 515

How to edit MD Comptroller 515

How to fill out MD Comptroller 515

About MD Comptroller previous version

What is MD Comptroller 515?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about MD Comptroller 515

What should I do if I need to amend my submitted Maryland Form 515?

If you need to amend your Maryland Form 515 after submission, you will have to complete a new version of the form, marking it as amended. Ensure that you include any necessary corrected information and clearly indicate that it is an amendment. After completing the amended form, submit it following the original submission method you used, whether by mail or e-file.

How can I verify the status of my submitted Maryland Form 515?

To check the status of your submitted Maryland Form 515, you can contact the Maryland state taxation authority directly through their official website or customer service line. Additionally, if you e-filed, you may be able to track your submission status through the software you used or via the state e-file portal to identify whether it has been received and processed.

What common mistakes should I avoid when filing Maryland Form 515?

Common mistakes when filing the Maryland Form 515 include incorrect taxpayer identification numbers, missing signatures, and failing to report all required types of income. To avoid these errors, double-check all entries, ensure all supporting documents are included, and confirm that the form is signed before submission.

Are e-signatures acceptable for Maryland Form 515 submissions?

Yes, e-signatures are generally acceptable for Maryland Form 515 submissions, especially for forms filed electronically. However, ensure that you follow the e-file provider's guidelines for capturing and submitting your e-signature securely to comply with state regulations.

What should I do if I receive a notice or audit related to my Maryland Form 515?

If you receive a notice or audit regarding your Maryland Form 515, review the correspondence carefully to understand the issues raised and gather any requested documentation. It's advisable to respond promptly, addressing each point raised in the notice, and, if uncertain, consider consulting a tax professional for assistance.