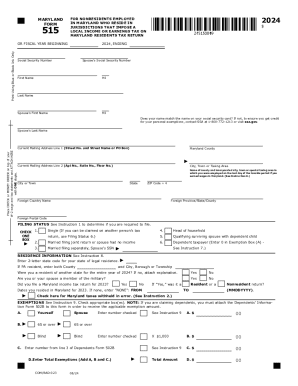

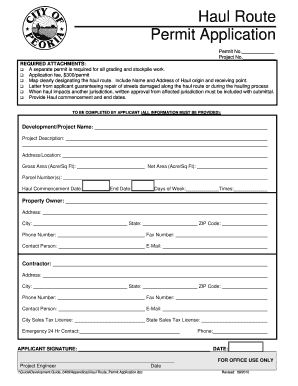

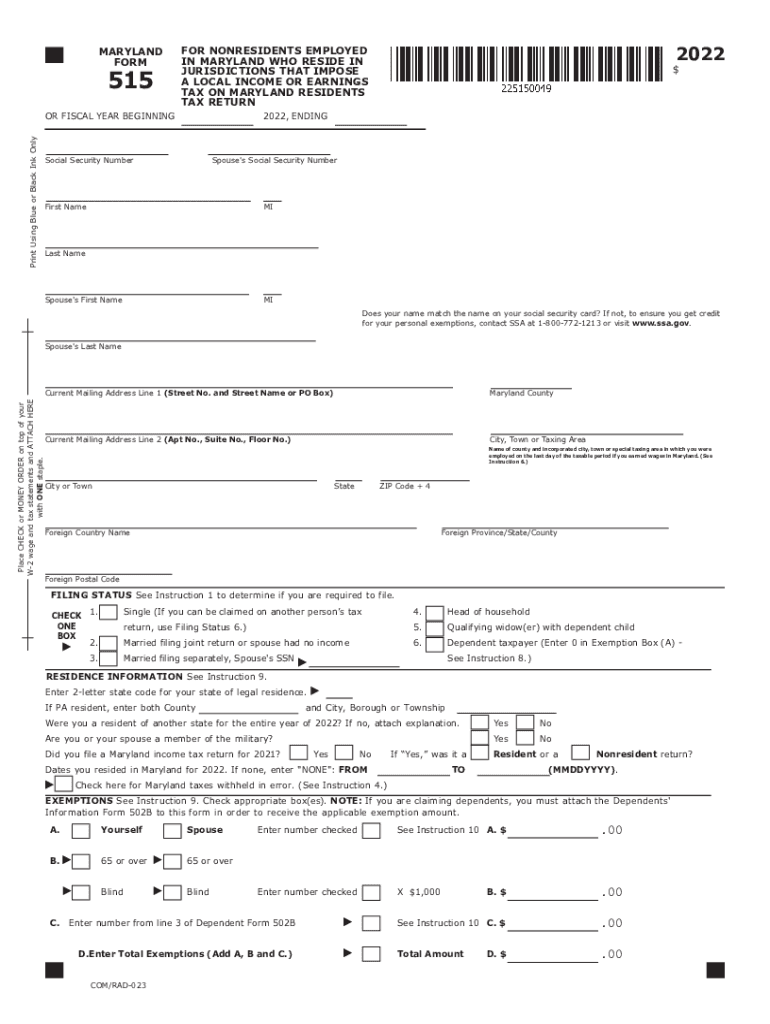

MD Comptroller 515 2022 free printable template

Instructions and Help about MD Comptroller 515

How to edit MD Comptroller 515

How to fill out MD Comptroller 515

About MD Comptroller previous version

What is MD Comptroller 515?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about MD Comptroller 515

What should I do if I need to correct a mistake on my MD Comptroller 515 after submission?

If you realize that there is an error in your MD Comptroller 515 after it has been submitted, you need to file an amended form. Complete a new MD Comptroller 515, clearly indicating that it is a corrected submission, and follow any specific guidelines provided by the Maryland Comptroller's office regarding amendments.

How can I track the status of my submitted MD Comptroller 515?

To verify the receipt and processing status of your MD Comptroller 515, visit the Maryland Comptroller's website. There, you can find tools for status tracking, which will provide updates on whether your submission has been processed or if there were any issues, such as common e-file rejection codes.

Are there specific legal nuances I should be aware of when e-filing the MD Comptroller 515?

Yes, when e-filing the MD Comptroller 515, it's important to know that e-signatures are accepted, provided they comply with Maryland's legal standards. Additionally, ensure you retain records as required by law, focusing on data security and privacy protocols to protect sensitive information.

What should I consider if I'm filing the MD Comptroller 515 on behalf of someone else?

If you are filing the MD Comptroller 515 on behalf of another individual, it’s essential to have proper authorization, such as a Power of Attorney (POA). Also, be mindful of the differences in reporting requirements or special circumstances that might apply to nonresidents or foreign payees.