Get the free TRADITIONAL IRA POST-70

Show details

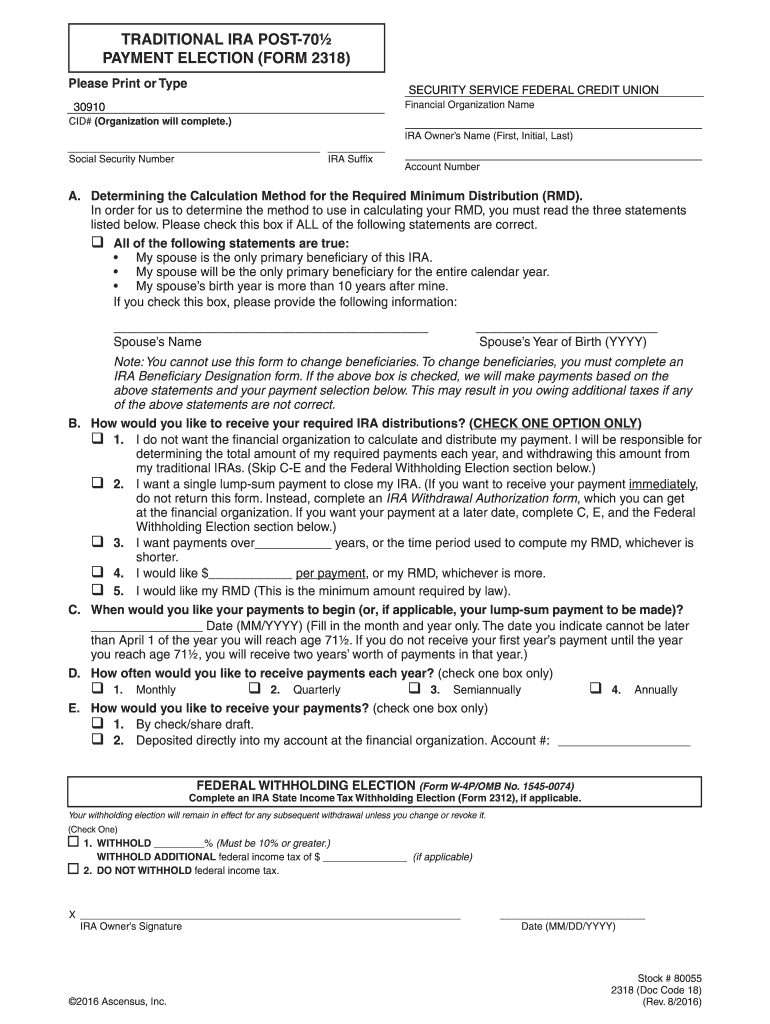

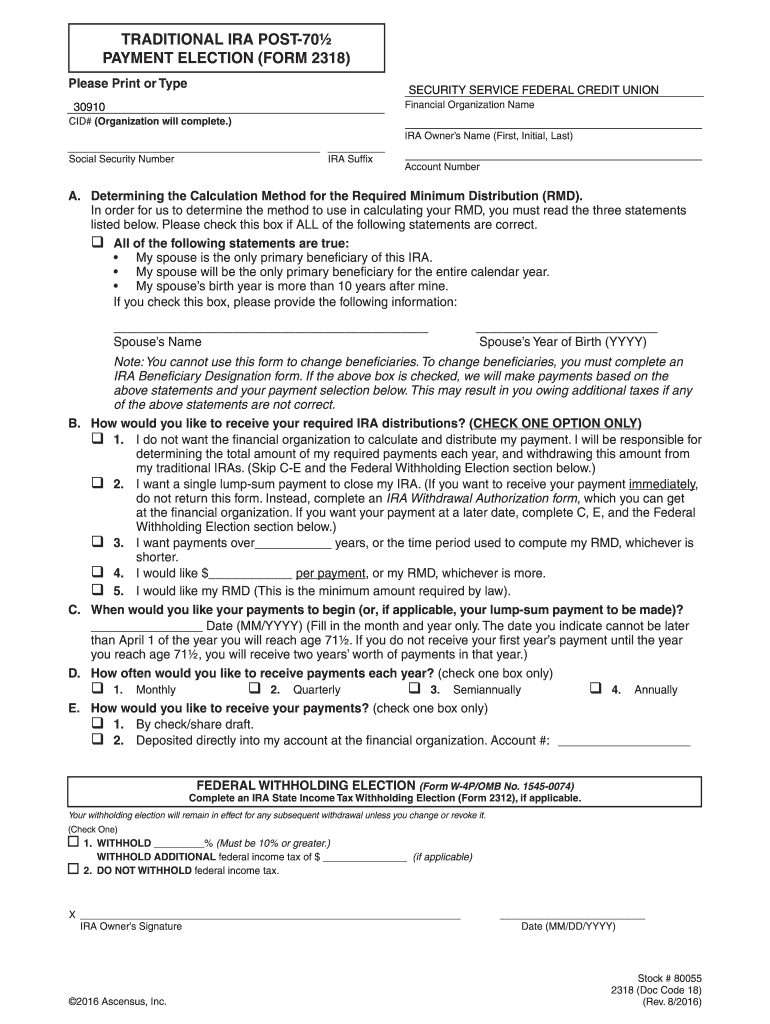

TRADITIONAL IRA POST70

PAYMENT ELECTION (FORM 2318)

Please Print or Cybersecurity SERVICE FEDERAL CREDIT UNION

Financial Organization Name30910

CID# (Organization will complete.)IRA Owners Name (First,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional ira post-70

Edit your traditional ira post-70 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional ira post-70 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit traditional ira post-70 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit traditional ira post-70. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional ira post-70

How to fill out traditional ira post-70

01

To fill out a Traditional IRA post-70, follow these steps:

02

Determine your eligibility: Make sure you meet the age requirement of being 70 ½ or older.

03

Gather necessary documents: Collect your personal identification documents, such as your social security number, date of birth, and address.

04

Obtain the IRA application form: Visit the website of your chosen financial institution or contact them directly to obtain the application form for a Traditional IRA.

05

Complete the application form: Fill out the form with accurate and up-to-date information, including your name, address, and contact details.

06

Provide beneficiary information: Specify the beneficiaries who will receive the assets in your Traditional IRA after your demise. Include their names, addresses, and social security numbers.

07

Choose investment options: Decide how you want the funds in your Traditional IRA to be invested. You may choose from various investment options offered by your financial institution, such as stocks, bonds, mutual funds, or certificates of deposit.

08

Review and sign the form: Carefully review the filled-out application form to ensure all information is accurate. Then, sign the form according to the provided instructions.

09

Submit the application form: Send the completed application form to the financial institution via mail or electronically, depending on their preferred method.

10

Fund your Traditional IRA: Once your application is processed and approved, you need to contribute funds to your Traditional IRA. Determine how much you want to contribute and follow the instructions provided by your financial institution to transfer the funds.

11

Manage your account: Keep track of your Traditional IRA investments and make any necessary adjustments as per your financial goals and market conditions. Regularly review your account statements and stay informed about any changes in tax laws or regulations that may affect your IRA.

12

Remember to consult with a financial advisor or tax professional for personalized guidance and to ensure you fully understand the rules and regulations associated with filling out a Traditional IRA post-70.

Who needs traditional ira post-70?

01

Individuals who are 70 ½ years of age or older may need a Traditional IRA post-70 for the following reasons:

02

- To continue saving for retirement: Traditional IRAs allow individuals to contribute to their retirement savings even after reaching the age of 70 ½, unlike other retirement accounts that may have contribution restrictions after a certain age.

03

- To take advantage of potential tax benefits: Contributions made to a Traditional IRA post-70 can be tax-deductible, potentially reducing an individual's taxable income for the year. It is essential to consult with a tax professional to understand the specific tax implications for your situation.

04

- To delay required minimum distributions (RMDs): By keeping funds in a Traditional IRA post-70, individuals can delay taking RMDs until they actually need the funds or are required to take them by law. This can be advantageous for those who have other sources of income and don't want to be forced to withdraw funds from their retirement account.

05

It is important to note that eligibility and the specific benefits of a Traditional IRA post-70 may vary depending on individual circumstances and should be discussed with a financial advisor or tax professional.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify traditional ira post-70 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your traditional ira post-70 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the traditional ira post-70 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your traditional ira post-70.

How do I fill out the traditional ira post-70 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign traditional ira post-70 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is traditional ira post-70?

Traditional IRA post-70 refers to rules and requirements for individuals who are over 70 years old and have traditional IRAs.

Who is required to file traditional ira post-70?

Individuals who are over 70 years old with traditional IRAs are required to follow the rules for traditional IRA post-70.

How to fill out traditional ira post-70?

To fill out traditional IRA post-70, individuals must ensure they meet the distribution requirements and follow the necessary reporting guidelines.

What is the purpose of traditional ira post-70?

The purpose of traditional IRA post-70 is to ensure that individuals over 70 years old with traditional IRAs comply with distribution rules and reporting requirements.

What information must be reported on traditional ira post-70?

Information such as the amount of distributions, taxes owed, and any required minimum distributions must be reported on traditional IRA post-70.

Fill out your traditional ira post-70 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Ira Post-70 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.