Get the free Compensation to be paid to this Employee shall be reduced by the sum

Show details

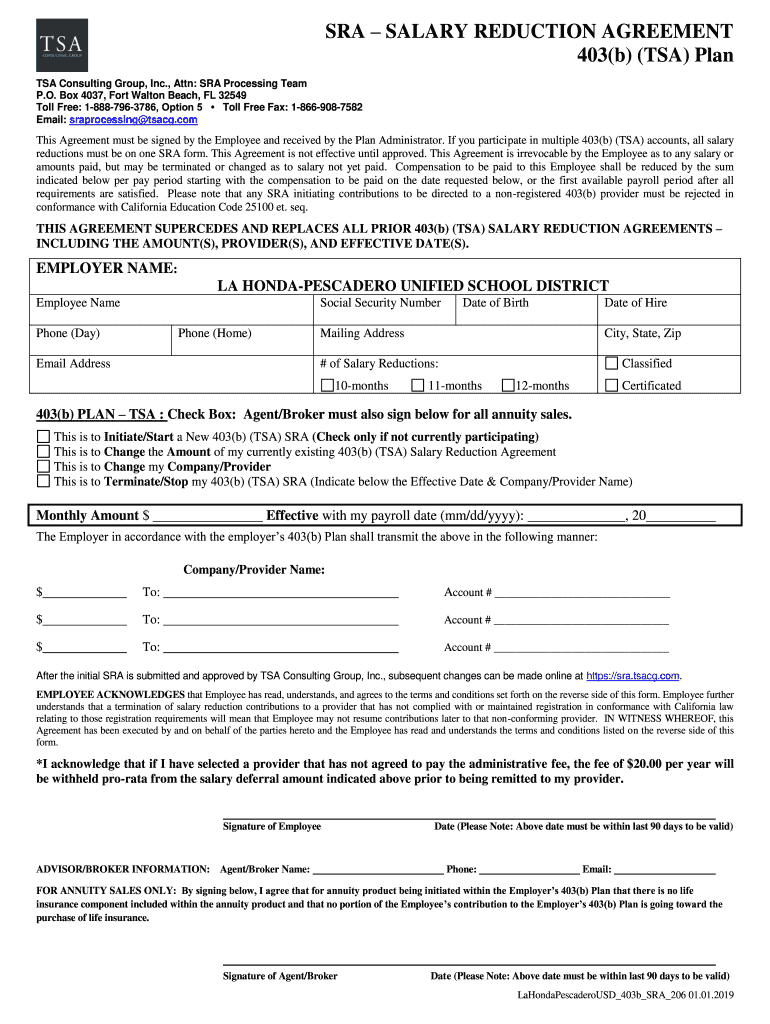

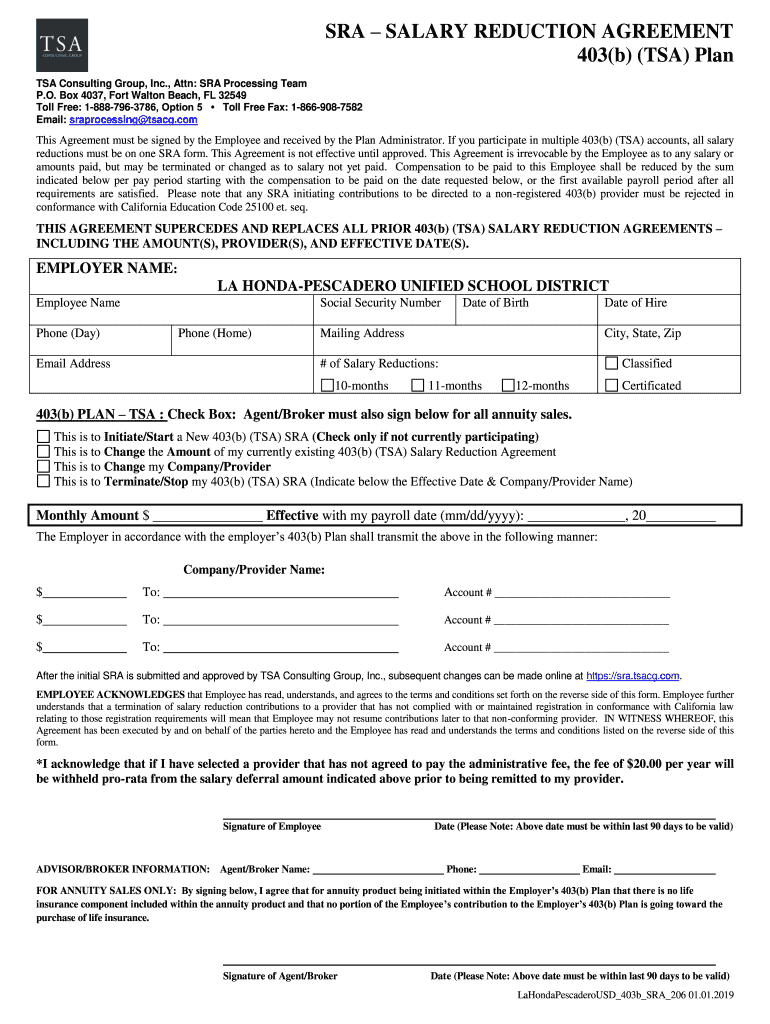

SRA SALARY REDUCTION AGREEMENT 403(b) (TSA) Plan TSA Consulting Group, Inc., Attn: SRA Processing Team P.O. Box 4037, Fort Walton Beach, FL 32549 Toll Free: 18887963786, Option 5 Toll Free Fax: 18669087582

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign compensation to be paid

Edit your compensation to be paid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your compensation to be paid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit compensation to be paid online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit compensation to be paid. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compensation to be paid

How to fill out compensation to be paid

01

Gather all relevant information about the compensation that needs to be paid, such as the reason for the compensation, the amount owed, and any supporting documents.

02

Identify the payee or recipient of the compensation. This could be an individual, a company, or a group of people.

03

Determine the preferred method of payment. This could be through cash, check, bank transfer, or any other agreed-upon medium.

04

Prepare the necessary payment documentation, such as a payment voucher or invoice, detailing the purpose and amount of the compensation.

05

Ensure compliance with any legal or regulatory requirements related to the payment of compensation, such as tax obligations or reporting.

06

Communicate with the payee or recipient to confirm the details of the compensation and obtain any additional information or documentation if required.

07

Process the payment through the chosen payment method, ensuring accuracy and timeliness.

08

Keep proper records of the compensation payment, including transaction details, receipts, and any correspondence related to the payment.

09

Follow up with the payee or recipient to confirm receipt of the compensation and address any concerns or issues.

10

Regularly review and update the compensation process to ensure efficiency and compliance with any changes in regulations or policies.

Who needs compensation to be paid?

01

Anyone who has suffered a loss, injury, or damage due to a certain event or action may need compensation to be paid.

02

This could include individuals who were involved in accidents, customers who received faulty products or services, employees who were not properly compensated for their work, and many others.

03

Entities such as businesses, insurance companies, or government agencies may also need to pay compensation to fulfill their obligations or responsibilities.

04

In short, anyone who has a legal or moral duty to provide compensation for a specific reason or situation needs to pay compensation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify compensation to be paid without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your compensation to be paid into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find compensation to be paid?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the compensation to be paid in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete compensation to be paid online?

Easy online compensation to be paid completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Fill out your compensation to be paid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Compensation To Be Paid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.