Get the free Non-Qualified Stock Option (Right

Show details

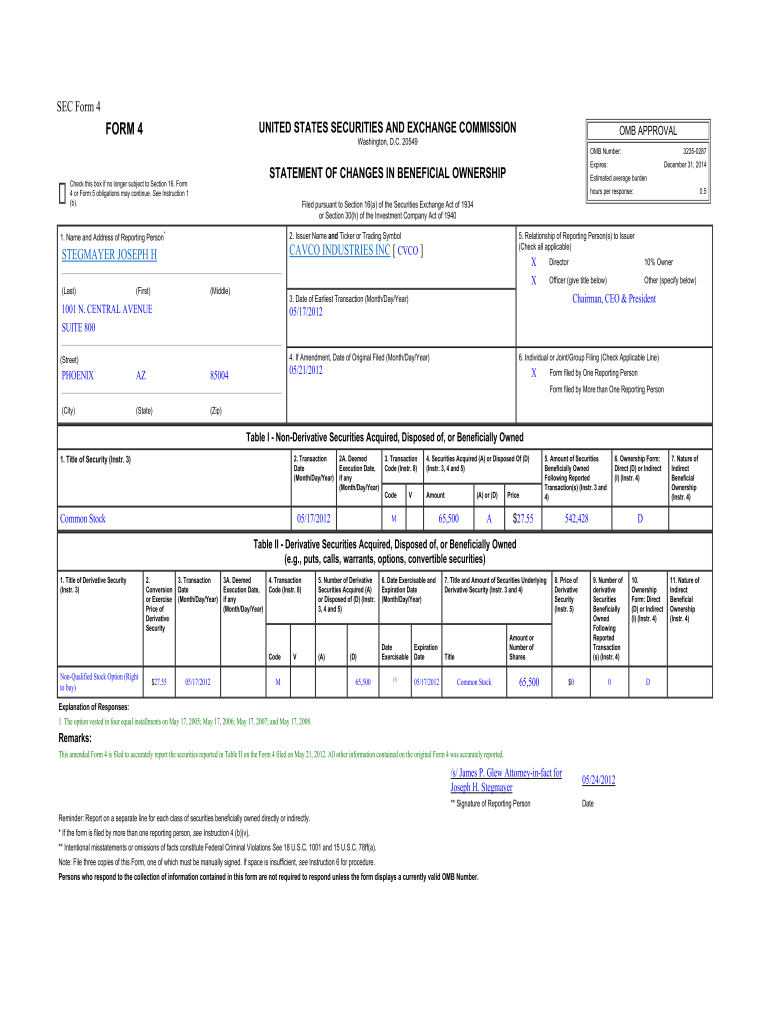

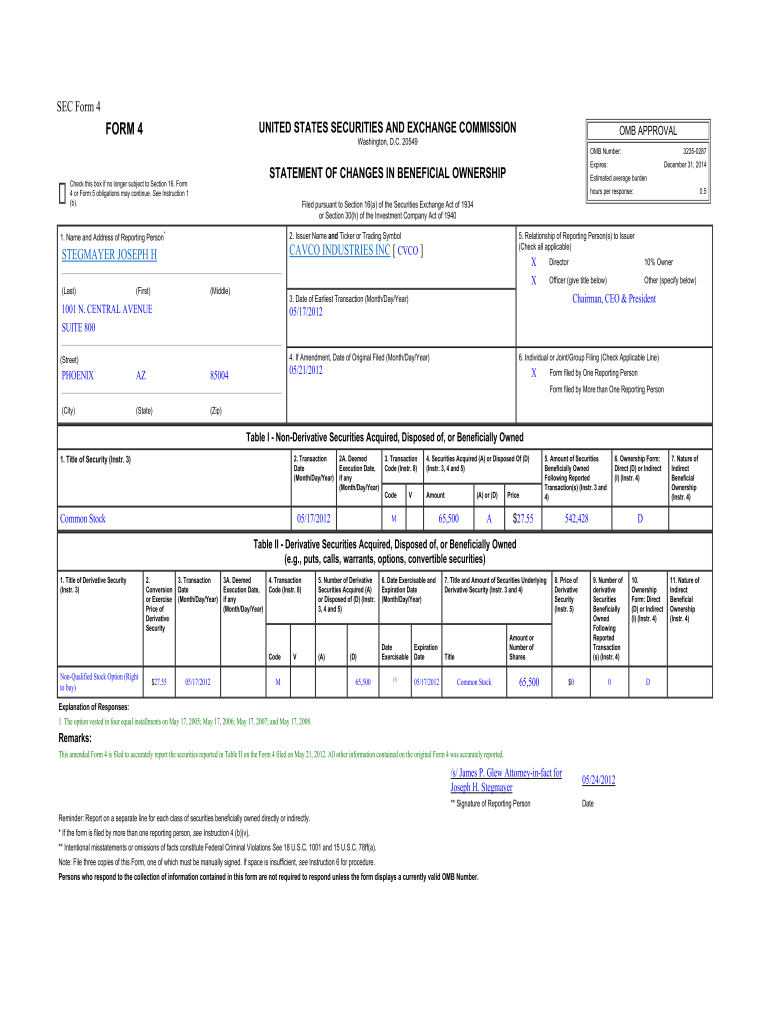

SEC Form 4 UNITED STATES SECURITIES AND EXCHANGE COMMISSIONER 432350287Expires:December 31, 2014Estimated average burden hours per response:0.5Filed pursuant to Section 16(a) of the Securities Exchange

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-qualified stock option right

Edit your non-qualified stock option right form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-qualified stock option right form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-qualified stock option right online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non-qualified stock option right. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-qualified stock option right

How to fill out non-qualified stock option right

01

Determine the exercise price of the non-qualified stock option.

02

Decide on the number of shares you want to purchase.

03

Fill out the non-qualified stock option agreement form provided by the company.

04

Provide all the required personal information, such as your name, address, and social security number.

05

Specify the grant date and expiration date of the non-qualified stock option.

06

Calculate the total cost of exercising the option, including the exercise price and any applicable taxes.

07

Submit the completed form to the company's human resources or stock plan administration department.

08

Await confirmation from the company regarding the acceptance of your non-qualified stock option right.

09

Arrange for the payment of the exercise price, either through cash or stock transfer.

10

Once the payment is made, the company will issue the shares to you, completing the filling out process of the non-qualified stock option right.

Who needs non-qualified stock option right?

01

Non-qualified stock option rights are typically offered to employees as a form of incentive compensation.

02

Executives, managers, and employees of companies, both private and public, may be eligible for non-qualified stock option rights.

03

These options allow employees to purchase company stock at a predetermined price, usually lower than the current market price.

04

Non-qualified stock option rights can be used as a means to attract and retain talented employees.

05

It provides employees with an opportunity to benefit from any future increase in the company's stock price.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-qualified stock option right in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your non-qualified stock option right as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit non-qualified stock option right in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your non-qualified stock option right, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the non-qualified stock option right in Gmail?

Create your eSignature using pdfFiller and then eSign your non-qualified stock option right immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is non-qualified stock option right?

Non-qualified stock options are a type of employee stock option that does not qualify for special tax treatment by the IRS.

Who is required to file non-qualified stock option right?

Employees who receive non-qualified stock options as part of their compensation are required to file them.

How to fill out non-qualified stock option right?

Non-qualified stock options are typically reported on IRS Form 1099-MISC or Form W-2, depending on how the options are exercised.

What is the purpose of non-qualified stock option right?

The purpose of non-qualified stock options is to provide employees with additional compensation and a stake in the company's performance.

What information must be reported on non-qualified stock option right?

The amount of income recognized, the exercise price, the grant date, and the expiration date of the option must be reported.

Fill out your non-qualified stock option right online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Qualified Stock Option Right is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.