Get the free Form CT-501:2018:Temporary Deferral ... - TAX.NY.gov

Show details

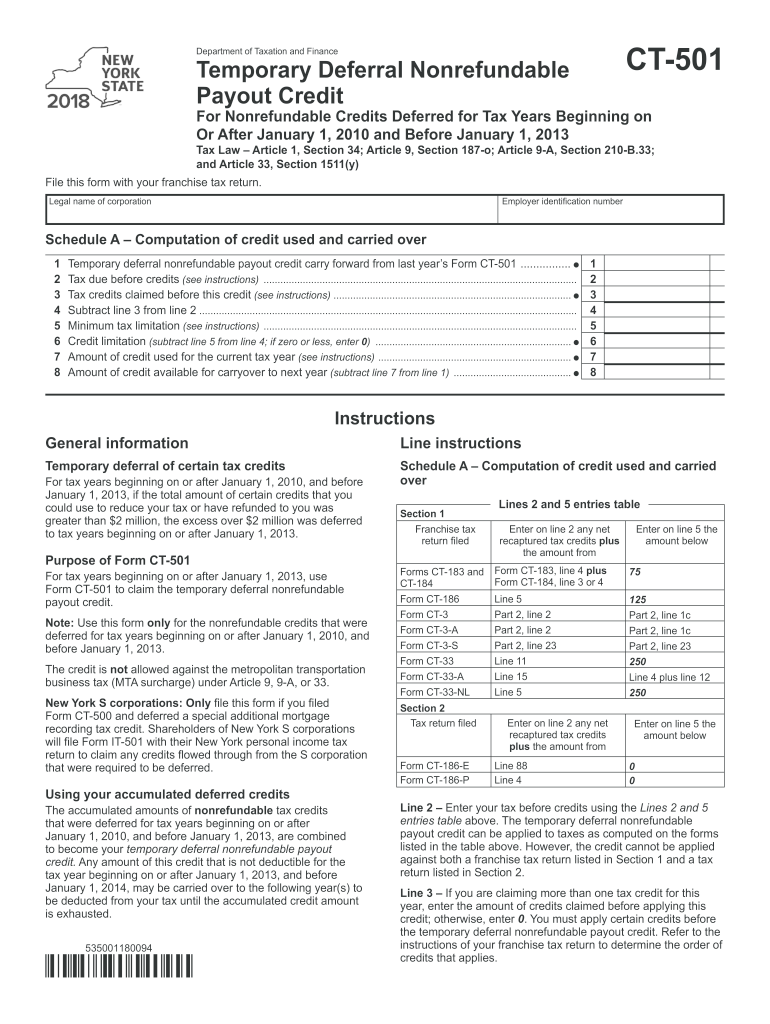

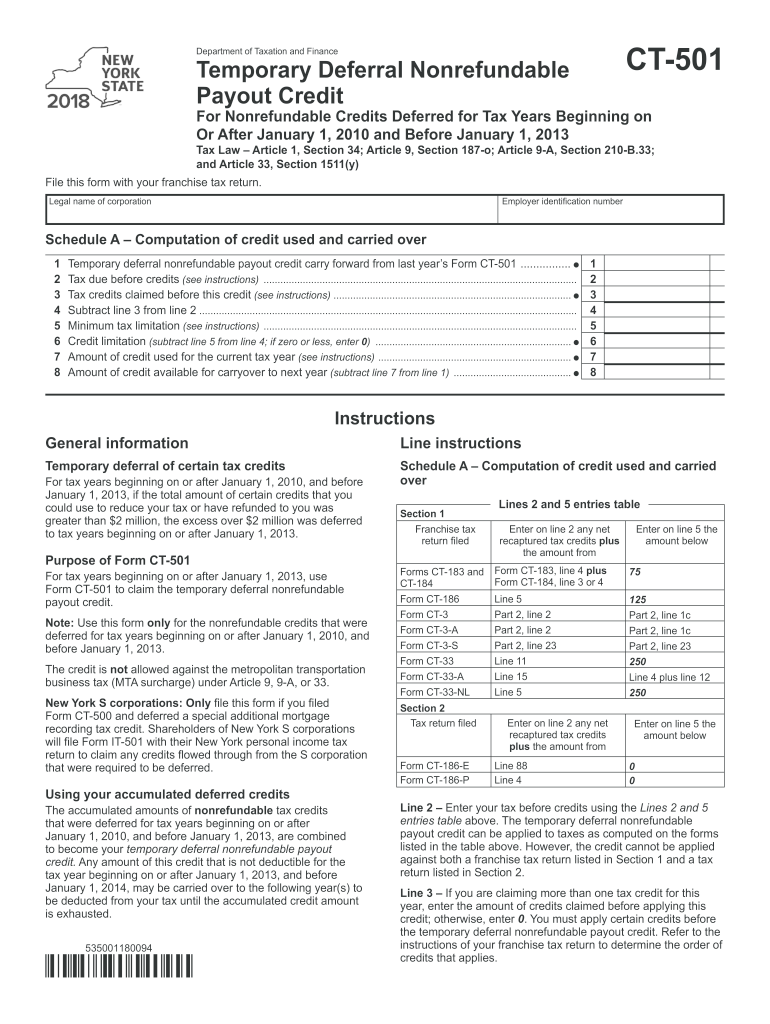

CT501Department of Taxation and FinanceTemporary Deferral Nonrefundable Payout Creditor Nonrefundable Credits Deferred for Tax Years Beginning on Or After January 1, 2010, and Before January 1, 2013Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form ct-5012018temporary deferral

Edit your form ct-5012018temporary deferral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ct-5012018temporary deferral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ct-5012018temporary deferral online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form ct-5012018temporary deferral. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form ct-5012018temporary deferral

How to fill out form ct-5012018temporary deferral

01

Start by obtaining a copy of form CT-5012018temporary deferral. This form can usually be found on the official website of the organization or institution requesting the deferral.

02

Read the instructions provided with the form carefully. Make sure you understand the purpose of the deferral and the specific requirements for eligibility.

03

Gather all the necessary information and documents required to complete the form. This may include personal information, financial information, and any supporting documentation requested.

04

Begin filling out the form by entering your personal information. This may include your name, address, contact information, and any identification numbers or codes provided by the organization.

05

Follow the instructions on the form to complete each section accurately. Pay attention to any specific guidance or notes provided for certain fields.

06

Provide all the requested information and double-check for accuracy before proceeding to the next section. Incomplete or incorrect information may delay the processing of your deferral application.

07

If there are any sections that are not applicable to your situation, mark them as 'N/A' or 'Not Applicable' as instructed.

08

Once you have filled out all the required information, review the form again to ensure everything is correct and complete. Make any necessary corrections before finalizing the form.

09

Sign and date the form as required. Some forms may require additional signatures from authorized individuals or witnesses. Follow the instructions provided to ensure proper completion.

10

Make a copy of the completed form and any supporting documentation for your records. This will help if there are any issues or inquiries regarding your deferral application.

11

Submit the completed form and any required attachments or documents to the designated address or contact provided. Follow any additional instructions for submission, such as including a cover letter or using a specific method of delivery.

12

Keep track of the submission date and any confirmation or reference numbers provided. This will help you monitor the status of your deferral application and address any concerns or inquiries.

13

Wait for a response from the organization regarding your deferral request. This may include an approval notification, a request for additional information, or a denial. Follow any further instructions provided to comply with the decision.

14

If approved, adhere to the terms and conditions of the deferral as outlined by the organization. This may include making regular payments, providing periodic updates, or fulfilling any other obligations specified in the agreement.

15

If denied, consult the organization or institution for further guidance. They may be able to provide clarification on the reason for the denial or suggest alternative options to address your needs.

16

Keep copies of all correspondence and documentation related to the deferral process. This includes approval letters, payment receipts, and any communication with the organization or institution. These records will be valuable for future reference or potential disputes.

17

Review the deferral agreement periodically to ensure you remain in compliance with the terms. Make any necessary adjustments or updates as required by the organization.

18

If any changes occur in your circumstances that may affect the deferral or your eligibility, notify the organization promptly. This may include changes in income, employment, or personal information.

19

Maintain open communication with the organization or institution throughout the deferral period. Address any questions or concerns promptly to avoid any potential issues or misunderstandings.

20

Once the deferral period has ended, fulfill any remaining obligations or conditions specified in the agreement. This may include making final payments, submitting reports, or providing final documentation.

21

Review your deferral experience and consider providing feedback to the organization or institution. This can help them improve their processes and assist future applicants.

Who needs form ct-5012018temporary deferral?

01

Form CT-5012018temporary deferral is needed by individuals or entities who are seeking a temporary deferral on certain financial obligations. The specific eligibility criteria and purpose of the deferral will be outlined by the organization or institution requiring the form. It is important to consult the relevant guidelines or instructions provided by the organization to determine if you meet the requirements for a temporary deferral.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form ct-5012018temporary deferral in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form ct-5012018temporary deferral.

Can I edit form ct-5012018temporary deferral on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign form ct-5012018temporary deferral right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit form ct-5012018temporary deferral on an Android device?

You can make any changes to PDF files, like form ct-5012018temporary deferral, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is form ct-501temporary deferral?

Form CT-501 is used to request a temporary deferral of payment for certain taxes owed in Connecticut.

Who is required to file form ct-501temporary deferral?

Businesses and individuals who are facing financial difficulties and need to defer tax payments may be required to file Form CT-501.

How to fill out form ct-501temporary deferral?

To fill out Form CT-501, provide your personal and business information, indicate the type of tax for which you are requesting deferral, specify the reason for the deferral, and include any required financial documentation.

What is the purpose of form ct-501temporary deferral?

The purpose of Form CT-501 is to allow taxpayers to temporarily defer payment of taxes due to financial hardship, providing relief during challenging economic times.

What information must be reported on form ct-501temporary deferral?

Information required on Form CT-501 includes taxpayer identification details, tax type, amount owed, reason for deferral, and any supporting financial documents.

Fill out your form ct-5012018temporary deferral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct-5012018temporary Deferral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.