Thrivent 28E 2020 free printable template

Show details

Beneficiary Claim StatementThrivent.com 8008474836Guide to completing your claim It is always recommended to work with a financial professional to guide you (the Claimant) through the claim process.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Thrivent 28E

Edit your Thrivent 28E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Thrivent 28E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Thrivent 28E online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Thrivent 28E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Thrivent 28E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Thrivent 28E

How to fill out Thrivent 28E

01

Obtain the Thrivent 28E form from the Thrivent website or your local Thrivent representative.

02

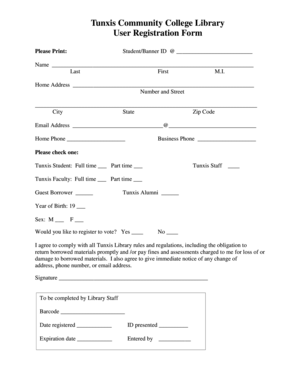

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Indicate the purpose of the form by selecting the appropriate option provided.

04

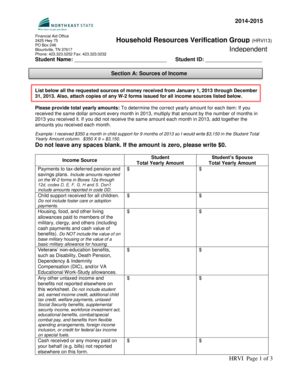

Complete the financial information section by accurately providing relevant figures.

05

Review the eligibility criteria and ensure you meet the requirements specified in the form.

06

Sign and date the form at the bottom to validate your submission.

07

Submit the completed form as directed on the form, either by mail or electronically.

Who needs Thrivent 28E?

01

Individuals or organizations seeking financial assistance or support for charitable causes.

02

Members of Thrivent Financial who wish to apply for grant funding.

03

Nonprofits or community organizations that partner with Thrivent for funding opportunities.

Fill

form

: Try Risk Free

People Also Ask about

Why adding beneficiary is important?

The small but important step of naming a beneficiary on your accounts can save time and money and prevent confusion after your death. Naming beneficiaries makes the probate process simpler and ensures assets are distributed ing to your wishes.

Who is considered a beneficiary?

A beneficiary is the person or entity you name in a life insurance policy to receive the death benefit. You can name: One person. Two or more people.

What is a beneficiary statement?

A beneficiary statement is a disclosure from the lender of record. It notes the unpaid balance remaining on a mortgage loan as of a certain date, including the interest rate. Lenders charge to deliver a beneficiary statement on request.

What is a beneficiary statement for life insurance?

A beneficiary is the person or entity that you legally designate to receive the benefits from your financial products. For life insurance coverage, that is the death benefit your policy will pay if you die. For retirement or investment accounts, that is the balance of your assets in those accounts.

What information do you need to add a beneficiary?

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

What is the meaning of beneficiary details?

Definition: In life insurance, the beneficiary is the person or entity entitled to receive the claim amount and other benefits upon the death of the benefactor or on the maturity of the policy. Description: Generally, a beneficiary is a person who receives benefit from a particular entity (say trust) or a person.

What are the types of beneficiaries?

Primary and contingent beneficiaries There are two types of beneficiaries: primary and contingent. A primary beneficiary is the person (or persons) first in line to receive the death benefit from your life insurance policy — typically your spouse, children or other family members.

What is an example of a beneficiary?

A primary beneficiary is the person (or persons) first in line to receive the death benefit from your life insurance policy — typically your spouse, children or other family members.

How do you write a beneficiary statement?

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write “children” on one of the lines; instead write the full names of each of your children on separate lines.

What should be included in a beneficiary information?

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

What is a claimant statement?

A claimant is the person or entity claiming the death benefit under a policy. Each beneficiary must complete a separate Claimant's Statement. Q.

What do you write in a beneficiary type?

The person to whom the payment is to be made needs to be added as a 'beneficiary' and his bank account details provided in order to transfer the funds. These include the name of the beneficiary account holder, account number, bank and branch name, and the IFSC code of the beneficiary bank branch.

Can you have 3 primary beneficiaries?

Yes, you can have more than one primary beneficiary. Also called co-beneficiaries, these multiple primary beneficiaries will share your death benefit equally or receive the sum based on a predetermined percentage.

What percentage should I put for beneficiary?

Make sure your percentage designations total 100% under Employee's Primary Beneficiary(ies), AND 100% under Employee's Contingent Beneficiary(ies) (if applicable). Do not combine totals for Primary and Contingent to equal 100%.

What is the purpose of a beneficiary?

A beneficiary is the person or entity that you legally designate to receive the benefits from your financial products. For life insurance coverage, that is the death benefit your policy will pay if you die.

Why is it important to have a beneficiary?

By having a current beneficiary on all your accounts, you leave no doubt as to what you wish to be done with your hard-earned money or insurance proceeds. 2. It saves time. If you die and have not named a beneficiary, this will delay the transfer of whatever funds are in those accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Thrivent 28E directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Thrivent 28E and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send Thrivent 28E to be eSigned by others?

Thrivent 28E is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in Thrivent 28E?

With pdfFiller, the editing process is straightforward. Open your Thrivent 28E in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is Thrivent 28E?

Thrivent 28E is a filing form related to the reporting of certain financial data for organizations affiliated with Thrivent Financial, typically used for tax-exempt status clarifications.

Who is required to file Thrivent 28E?

Organizations that are tax-exempt and that receive contributions from Thrivent Financial are typically required to file Thrivent 28E.

How to fill out Thrivent 28E?

To fill out Thrivent 28E, organizations need to provide details such as their contact information, purpose, the amount of contributions received, and how these funds were used, ensuring all sections are complete and accurate.

What is the purpose of Thrivent 28E?

The purpose of Thrivent 28E is to report financial information to ensure compliance with IRS regulations and to maintain the tax-exempt status of the affiliated organizations.

What information must be reported on Thrivent 28E?

The information that must be reported includes the organization's name, address, EIN, the total contributions received from Thrivent, the use of those funds, and other pertinent financial details.

Fill out your Thrivent 28E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Thrivent 28e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.