Get the free CGA Fee Schedule - 2014 - the Canadian Gelbvieh Association - gelbvieh

Show details

Canadian Gelbvieh Association 5160 Skyline Way NE, Calgary, Alberta T2E 6V1 Phone: 403-250-8640, Fax: 403-291-5624 Email: Gelbvieh.ca Website: www.gelbvieh.ca 2014 Fee Schedule Make checks payable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cga fee schedule

Edit your cga fee schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cga fee schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cga fee schedule online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cga fee schedule. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cga fee schedule

How to fill out CGA fee schedule:

01

Gather all necessary information: Before starting to fill out the CGA fee schedule, make sure you have all the relevant information at hand. This may include details about the project or service being provided, the rates or fees involved, and any additional expenses that need to be accounted for.

02

Provide accurate contact details: Start by filling out the required contact information in the CGA fee schedule form. This typically includes your name or the name of your organization, address, phone number, and email address. These details are crucial for communications and ensuring you can be contacted regarding the fees.

03

Specify the services rendered: Clearly state the services that are being provided in the appropriate section of the fee schedule. This could be specific tasks, projects, or services that you offer as a CGA. Provide a detailed description and any relevant specifications or requirements for each service.

04

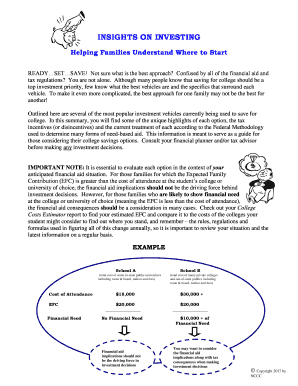

Outline the fee structure: Next, outline the fee structure for each service provided. This may include hourly rates, fixed fees, or any other agreed-upon pricing structure. Be sure to specify the currency and indicate whether any taxes or additional charges are applicable.

05

Include any additional expenses: If there are any additional expenses that need to be factored into the fee schedule, such as travel costs or material expenses, make sure to include them as separate line items. Clearly state the nature of each expense and provide an estimated or fixed cost for each.

06

Break down the payment schedule: Specify the payment terms and schedule in the fee schedule. This includes indicating the payment due dates, any deposit or down payment required, and any consequences for late payments. It's important to communicate the expectations for payment clearly.

07

Provide signature and date: Once you have completed the fee schedule, make sure to sign and date the document. This signifies your agreement with the terms and conditions outlined in the fee schedule.

Who needs CGA fee schedule?

01

Business owners: CGA fee schedules are particularly important for business owners who require the services of a Certified General Accountant (CGA). It helps them understand the cost breakdown and payment structure when availing accounting services.

02

Self-employed individuals: Freelancers, consultants, and self-employed professionals who work with a CGA may also need a CGA fee schedule. It ensures clarity on the services provided and the associated fees.

03

Non-profit organizations: Non-profit organizations often require the assistance of CGAs for financial management and reporting. They need a CGA fee schedule to understand the costs involved in these services and budget accordingly.

04

Individuals seeking tax or financial planning services: Individuals who require tax planning, financial consulting, or general accounting services can benefit from a CGA fee schedule. It allows them to understand the cost implications before engaging a CGA's services.

05

Organizations requiring audit or assurance services: Companies or organizations that require audit or assurance services, such as verifying financial statements or compliance with regulations, will need a CGA fee schedule to understand the fees associated with these services.

Overall, anyone seeking the services of a CGA or engaging in financial transactions that require CGA assistance will benefit from having a CGA fee schedule. It ensures transparency and serves as a mutual agreement between the CGA and the client.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cga fee schedule from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including cga fee schedule, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit cga fee schedule in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your cga fee schedule, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out cga fee schedule on an Android device?

Use the pdfFiller mobile app to complete your cga fee schedule on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is cga fee schedule?

The cga fee schedule is a list of fees charged by the Certified General Accountant (CGA) organization for their services.

Who is required to file cga fee schedule?

CGAs, accounting firms, or individuals who offer accounting services are required to file the cga fee schedule.

How to fill out cga fee schedule?

To fill out the cga fee schedule, one must provide the details of the services offered, along with the corresponding fees.

What is the purpose of cga fee schedule?

The purpose of the cga fee schedule is to provide transparency to clients regarding the fees associated with accounting services.

What information must be reported on cga fee schedule?

The cga fee schedule must include a detailed breakdown of services offered, along with the corresponding fees.

Fill out your cga fee schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cga Fee Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.