Get the free Executive Long-Term Disability Insurance Policy dated ... - SEC.gov

Show details

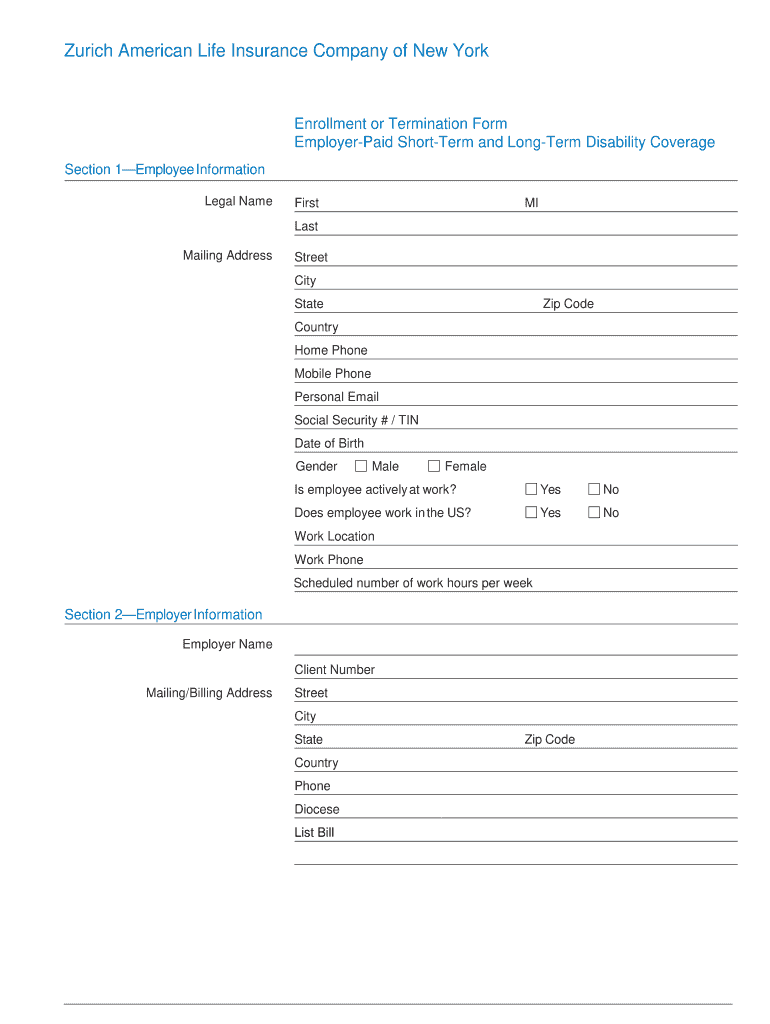

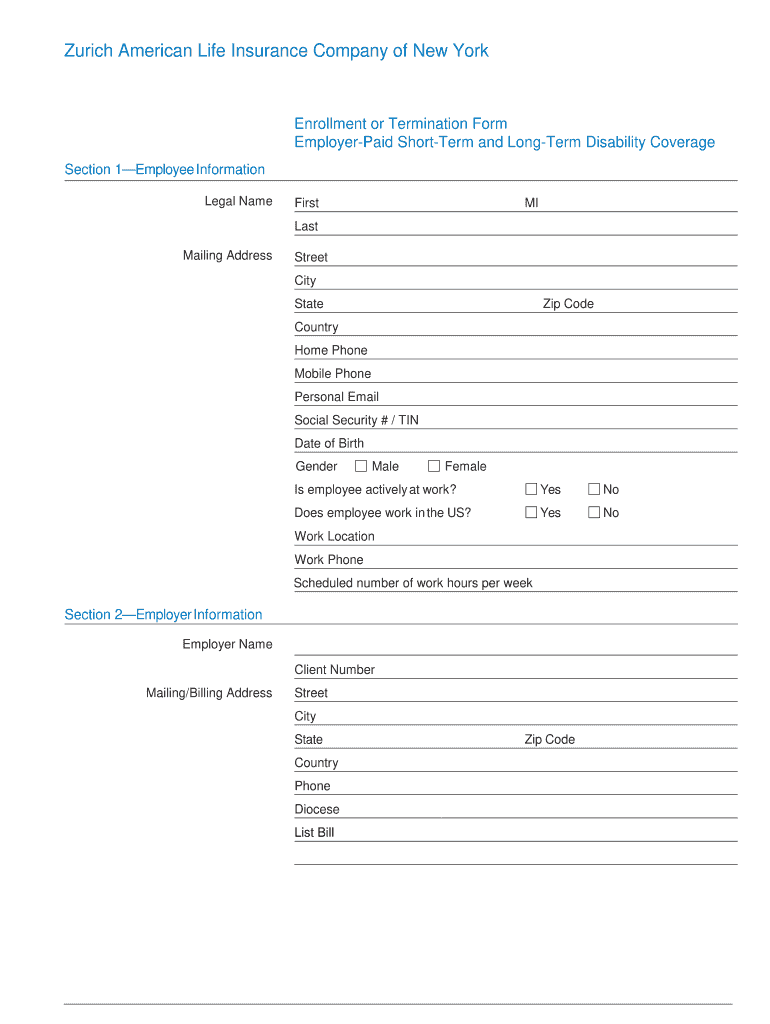

Zurich American Life Insurance Company of New YorkEnrollment or Termination Form

EmployerPaid Shorter and Longer Disability Coverage

Section 1Employee Information

Legal NameFirstMILast

Mailing AddressStreet

City

State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign executive long-term disability insurance

Edit your executive long-term disability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your executive long-term disability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit executive long-term disability insurance online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit executive long-term disability insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out executive long-term disability insurance

How to fill out executive long-term disability insurance

01

Step 1: Begin by gathering all necessary information, including personal details such as name, address, and contact information.

02

Step 2: Next, provide information about your current occupation, job title, and employer.

03

Step 3: Specify the desired coverage amount and duration for your executive long-term disability insurance.

04

Step 4: Disclose any pre-existing medical conditions or previous disabilities that may affect your eligibility or coverage.

05

Step 5: Review the terms and conditions of the insurance policy carefully, including the exclusions and limitations.

06

Step 6: Complete the application form accurately and truthfully.

07

Step 7: Submit the filled-out application along with any required documentation or proof of income.

08

Step 8: Wait for the insurance provider to review your application and make a decision.

09

Step 9: If approved, carefully review the policy terms and contact the provider for any clarification or additional information.

10

Step 10: Make sure to pay the premiums on time to ensure continuous coverage.

Who needs executive long-term disability insurance?

01

Executives or high-income individuals who heavily rely on their income and would face financial hardship in the event of a long-term disability.

02

Individuals whose employers do not provide comprehensive long-term disability insurance coverage.

03

Professionals in physically demanding or high-risk occupations where the likelihood of disability is relatively higher.

04

Those who have financial dependents and want to ensure their loved ones are financially protected in case of disability.

05

Self-employed individuals or business owners who want to safeguard their income stream in case they become disabled.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get executive long-term disability insurance?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the executive long-term disability insurance in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the executive long-term disability insurance in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your executive long-term disability insurance right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out executive long-term disability insurance on an Android device?

Complete your executive long-term disability insurance and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is executive long-term disability insurance?

Executive long-term disability insurance is a type of insurance that provides financial protection to executives and high-level employees who become unable to work due to a covered illness or injury for an extended period. This insurance typically offers a higher benefit amount compared to standard disability insurance.

Who is required to file executive long-term disability insurance?

Generally, organizations and companies that offer executive long-term disability plans are responsible for filing the necessary documentation. Individual executives may not be required to file anything themselves unless they are claiming benefits.

How to fill out executive long-term disability insurance?

To fill out executive long-term disability insurance, you typically need to complete an application form provided by the insurance company. This form may require personal information, details about the disabling condition, employment history, and any other relevant documentation.

What is the purpose of executive long-term disability insurance?

The purpose of executive long-term disability insurance is to provide financial security to executives who are unable to work for an extended period due to a serious illness or injury, ensuring they receive a portion of their income during their recovery and maintaining their standard of living.

What information must be reported on executive long-term disability insurance?

Information that must be reported typically includes personal identification details, employment information, medical history related to the disability, a description of the disabling condition, and any supporting medical documentation from healthcare providers.

Fill out your executive long-term disability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Executive Long-Term Disability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.