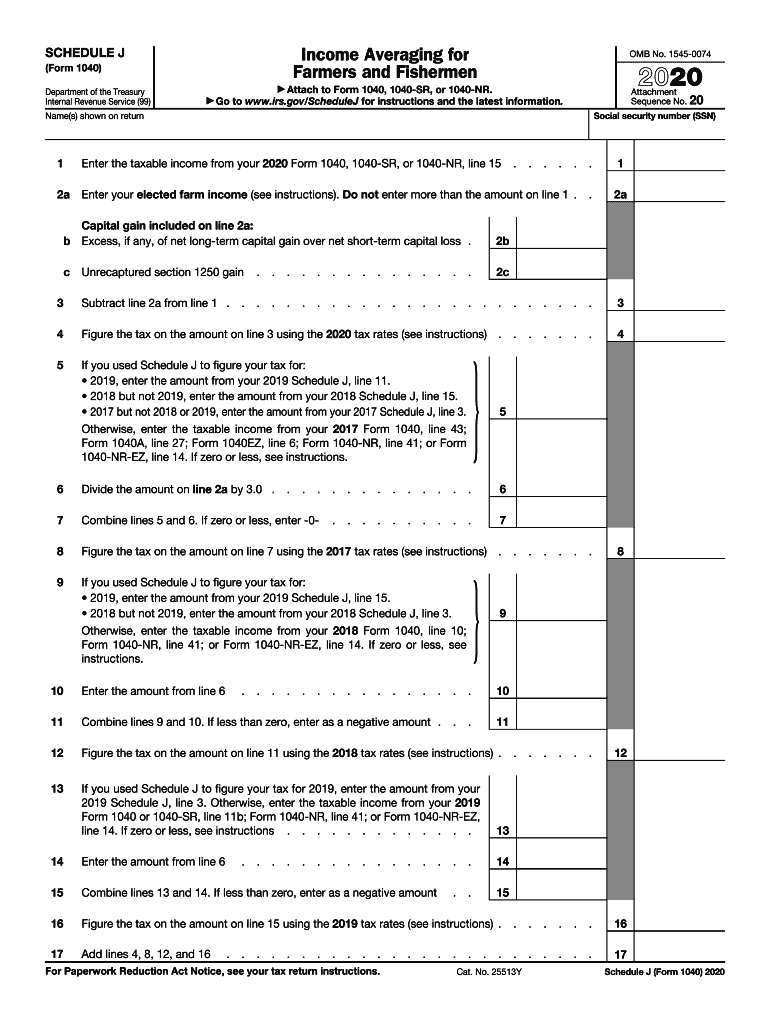

IRS 1040 Schedule J 2020 free printable template

Show details

Cat. No. 25513Y Schedule J Form 1040 2018 Page 2 Amount from line 17. line 16. from your 2017 Schedule J line 4. 2016 but not 2017 enter the amount from your 2016 Schedule J line 15. 2015 but not 2016 or 2017 enter the amount from your 2015 Schedule J line 3. Otherwise enter the taxable income from your 2015 Form 1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. Otherwise enter the taxable income from your 2015 Form 1040 line 43 Form 1040A line 27...Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. If zero or less see instructions. Divide the amount on line 2a by 3. 0Combine lines 5 and 6. If zero or less enter -0- Enter the amount from line 6 amount from your 2017 Schedule J line 3. If zero or less see instructions. Divide the amount on line 2a by 3. 0Combine lines 5 and 6. If zero or less enter -0- Enter the amount from line 6 amount from your 2017 Schedule J line 3. Otherwise enter the taxable income from your 2017 Form...1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. Income Averaging for Farmers and Fishermen SCHEDULE J Form 1040 Department of the Treasury Internal Revenue Service 99 Go OMB No. 1545-0074 Attach to Form 1040 or Form 1040NR. to www.irs.gov/ScheduleJ for instructions and the latest information. Attachment Sequence No. 20 Social security number SSN Name s shown on return Enter the taxable income from your 2018 Form 1040 line 10 or Form 1040NR line...41 2a Enter your elected farm income see instructions. Do not enter more than the amount on line 1. Capital gain included on line 2a b Excess if any of net long-term capital gain over net short-term capital loss. 2b c 2c Unrecaptured section 1250 gain Subtract line 2a from line 1. Figure the tax on the amount on line 3 using the 2018 tax rates see instructions. If you used Schedule J to figure your tax for 2017 enter the amount from your 2017 Schedule J line 11. 2016 but not 2017 enter the...amount from your 2016 Schedule J line 15. 2015 but not 2016 or 2017 enter the amount from your 2015 Schedule J line 3. Otherwise enter the taxable income from your 2015 Form 1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. If zero or less see instructions. Divide the amount on line 2a by 3. 0Combine lines 5 and 6. If zero or less enter -0- Enter the amount from line 6 amount from your 2017 Schedule J line 3. Otherwise enter the taxable income from...your 2017 Form 1040 line 43 Form 1040A line 27 Form 1040EZ line 6 Form 1040NR line 41 or Form 1040NR-EZ line 14. If zero or less see instructions. Add lines 4 8 12 and 16 For Paperwork Reduction Act Notice see your tax return instructions. Otherwise enter the tax from your 2017 Form 1040 line 44 Form 1040A line 28 Form 1040EZ line 10 Form 1040NR line 42 or Form 1040NR-EZ line 15. Only include tax reported on this line that is imposed by section 1 of the Internal Revenue Code see instructions. Do...not include alternative minimum tax from Form 1040A. Add lines 19 through 21. Tax. Subtract line 22 from line 18.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 Schedule J

How to edit IRS 1040 Schedule J

How to fill out IRS 1040 Schedule J

Instructions and Help about IRS 1040 Schedule J

How to edit IRS 1040 Schedule J

To edit the IRS 1040 Schedule J, ensure that you have a digital version of the form. Utilize tools available on platforms like pdfFiller, which allow you to fill out fields, correct errors, and save your progress. Always double-check your edits for accuracy before submission.

How to fill out IRS 1040 Schedule J

To correctly fill out the IRS 1040 Schedule J, follow these steps:

01

Obtain the latest version of the form from the IRS website.

02

Read the instructions carefully to understand all relevant components.

03

Input your income details for each applicable year as guided on the form.

04

Ensure that all entries are accurate and match your financial records.

05

Review the completed form before submission for any errors.

About IRS 1040 Schedule J 2020 previous version

What is IRS 1040 Schedule J?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 Schedule J 2020 previous version

What is IRS 1040 Schedule J?

IRS 1040 Schedule J is a form used for reporting income and tax liabilities for farmers and fishermen. It allows for the averaging of income over a three-year period, which may help those with fluctuating incomes to reduce their overall tax liability. This form is particularly valuable for ensuring that the tax burden reflects the average earnings over multiple years instead of just one.

What is the purpose of this form?

The purpose of IRS 1040 Schedule J is to provide farmers and fishermen a method to average their income, enabling them to smooth out income spikes and drops resulting from market fluctuations and weather conditions. By using Schedule J, taxpayers can potentially lower their tax burden, decreasing the chance of a large tax payment in a year of high income.

Who needs the form?

Farmers and fishermen who wish to average their income for tax purposes may need to file IRS 1040 Schedule J. This applies primarily to those who receive significant income that varies significantly from year to year. Individuals in these professions who expect their average income to exceed $2,500 must consider this form.

When am I exempt from filling out this form?

You might be exempt from filling out IRS 1040 Schedule J if your average income is $2,500 or less over the past three years. If you do not earn your income primarily from farming or fishing, you would also generally not need to file this schedule. Additionally, certain filing statuses and income levels might provide exemptions.

Components of the form

IRS 1040 Schedule J consists of several sections where you will report your income. Key components include reporting income from farming, fishing, and any other applicable sources, as well as calculating your average income over the specified years. The form also includes methods for calculating taxes based on those averages.

What are the penalties for not issuing the form?

Failing to file IRS 1040 Schedule J or not accurately reporting income may result in penalties. The IRS can impose a failure-to-file penalty, which is generally 5% of the unpaid tax for each month your return is late, up to a maximum of 25%. Additionally, you may face interest on any unpaid taxes.

What information do you need when you file the form?

When filing IRS 1040 Schedule J, gather essential documents such as tax returns for the past three years, income statements from farming or fishing operations, and records of any deductible expenses. Having this information readily available will facilitate accurate completion and ensure compliance with IRS requirements.

Is the form accompanied by other forms?

IRS 1040 Schedule J is typically submitted alongside the main Form 1040. If applicable, other schedules and forms related to farming or fishing income (such as Schedule F for Profit or Loss from Farming) may also need to be included depending on your specific income situation.

Where do I send the form?

After completing IRS 1040 Schedule J, mail it along with your Form 1040 to the designated address provided in the IRS instructions. The correct mailing address may depend on your state and whether you are enclosing a payment. Always check the current IRS guidelines to confirm the appropriate submission location.

See what our users say