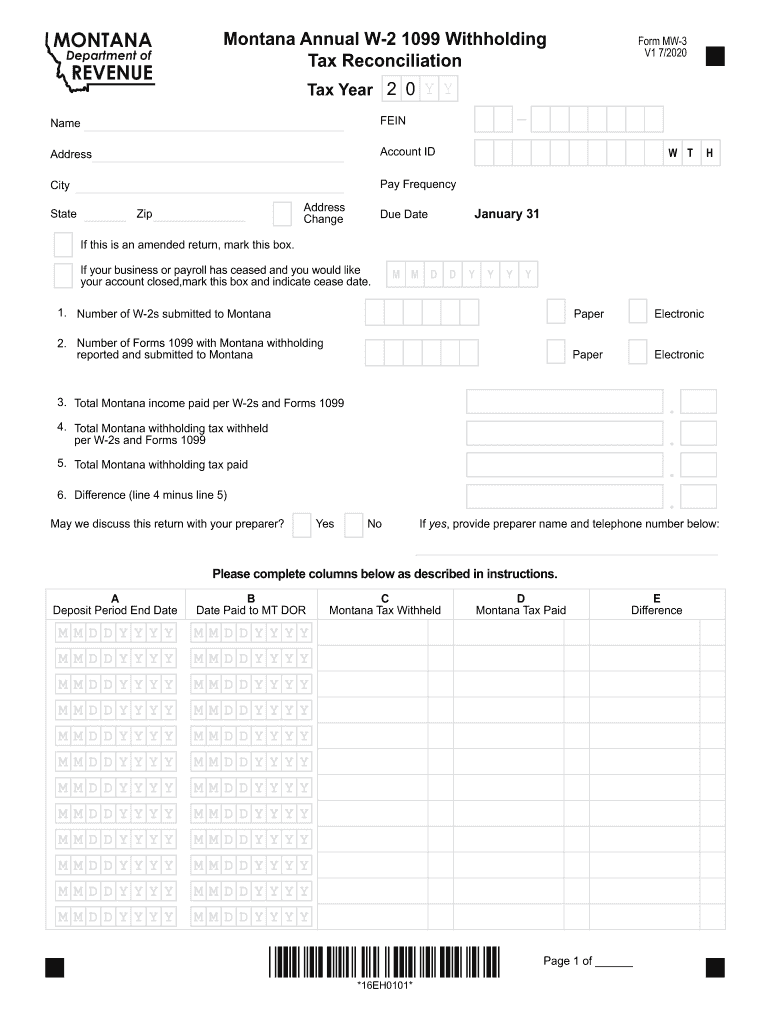

Who needs an MT Form MW-3?

This form is the State of Montana’s Annual W-2 1099 Withholding Tax Reconciliation MW-3 form that must be filed by employers in Montana as the Department of Revenue requires.

What is the purpose of the Form?

The Reconciliation Form MW-3 aims to reconcile taxes the employer withholds from their employees as it is indicated on forms W-2 and 1099 for the year.

Is the Form accompanied by any other documents?

The Department of Revenue obliges all employers registered in the State of Montana to attach all copies of Federal W-2 and 1099 forms delivered to all the employees and relevant W-2C forms to reflect the adjustments on the return if they were made.

When is the deadline for MT Form MW-3 filing?

The completed Montana Annual W-2 1099 Withholding Tax Reconciliation form must be completed and submitted by the end of the second month following the reported tax year. The due date often falls at the end of February.

How do I fill out the form?

The form is not difficult to complete as it includes instructions on the first sheet of the five-page document. Yet, a lot of calculations are required in order to complete the form properly

It is mandatory that the completed Annual Reconciliation of Income Tax Withheld form provides the following details:

- Business name and address of the employer;

- Federal Employer Identification Number;

- Account ID;

- Number of the submitted W-2 and 1099 forms;

- Total income, total tax paid and computation of their difference;

- Name of the form paid preparer if applicable.

- The next part of the form is a table that implies indicating the following data:

- End dates of deposit period;

- Dates of payment to MT Department of Revenue;

- Amount of State tax withheld;

- Amount of State tax paid;

- Difference of the two previous figures.

Where do I send the filled out form?

The completed form, the required attachments and a check or money order (if tax due) may be directed to the address indicated in the bottom right corner of the form’s first page (the instructions section).