CT DRS CT-588 2011 free printable template

Show details

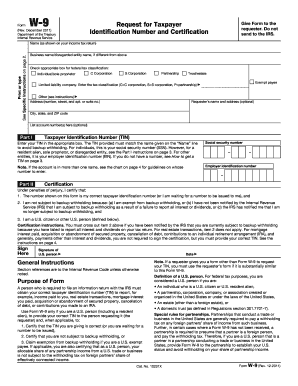

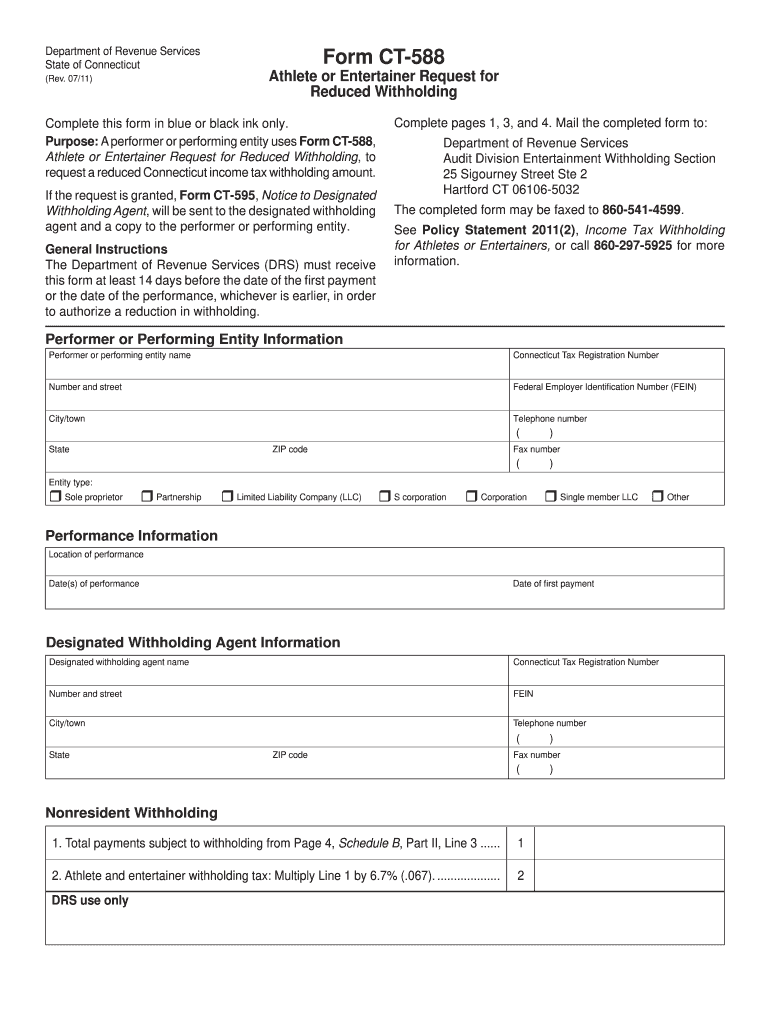

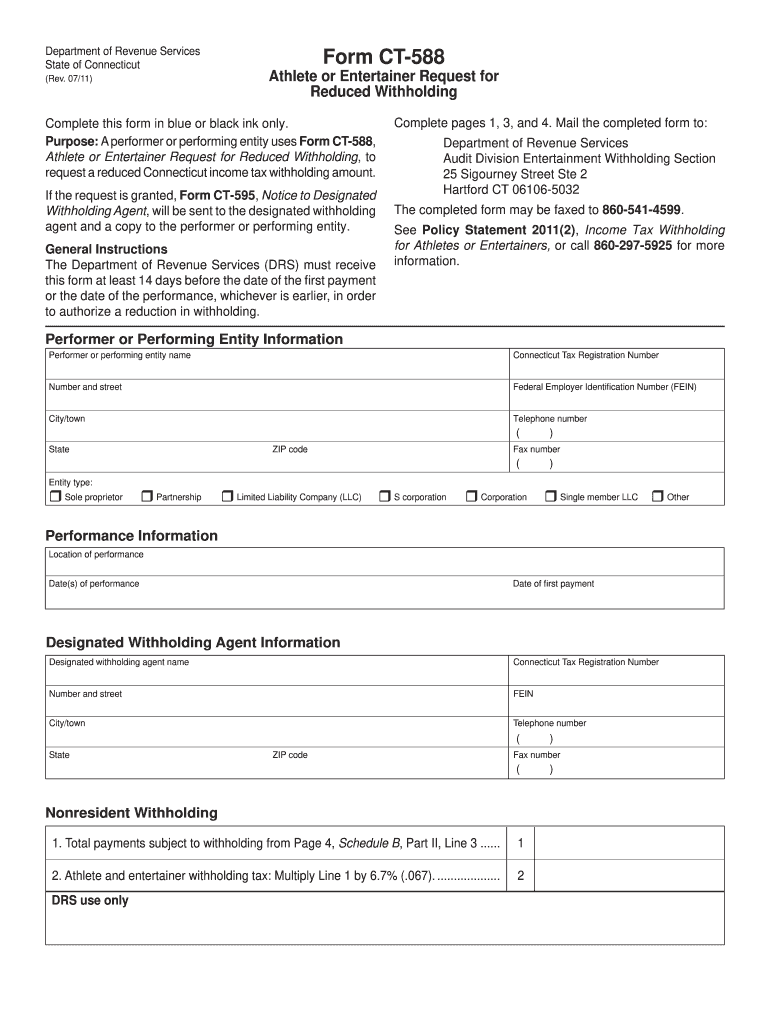

Purpose A performer or performing entity uses Form CT-588 request a reduced Connecticut income tax withholding amount. Form CT-588 Rev. 07/11 List the amounts received directly or indirectly by each athlete entertainer or service provider. Where a performing entity submits Form CT-588 because one or more performers or subcontracted entities have requested a waiver of withholding on Form CT-590 the performing entity must attach all Forms CT-590 to its completed Form CT-588. Department of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-588

Edit your CT DRS CT-588 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-588 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-588 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CT DRS CT-588. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-588 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-588

How to fill out CT DRS CT-588

01

Obtain the CT DRS CT-588 form from the Connecticut Department of Revenue Services website or office.

02

Fill in your name and address in the designated fields at the top of the form.

03

Indicate your Connecticut Tax Identification Number (TID) or Social Security Number (SSN).

04

Complete the section related to the type of credit or adjustment you are claiming.

05

Provide any additional information or documentation required to support your claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form either by mail or electronically as per the instructions provided.

Who needs CT DRS CT-588?

01

Individuals or businesses eligible for tax credits or adjustments in Connecticut.

02

Taxpayers who have received a notice from the Connecticut Department of Revenue Services regarding the need to file CT-588.

03

Those who have experienced changes in their tax situation requiring an adjustment to previously filed tax returns.

Instructions and Help about CT DRS CT-588

Fill

form

: Try Risk Free

People Also Ask about

Who must file a CT nonresident return?

You must file a Connecticut income tax return if your gross income for the 2022 taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or. $24,000 and you are married filing jointly or qualifying surviving spouse.

What is the CT employee tax withholding form?

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

Is a non resident required to file income tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

Do I need extra withholding?

Any time your income goes up, your tax liability will likely go up too, requiring a new W-4. If your extra income comes from a side job that doesn't have any tax withholding, you could submit a new W-4 to adjust the withholdings at your main job to account for the increase in income.

Who must file a CT return?

If you are a part-year resident and you meet the requirements for Who Must File Form CT-1040NR/PY for the 2022 taxable year, you must file Form CT-1040NR/PY, Connecticut Nonresident and Part-Year Resident Income Tax Return.Connecticut Resident Income Tax Information. Gross Income$100,000Expenses($92,000)Net Income$8,000

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CT DRS CT-588 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign CT DRS CT-588 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in CT DRS CT-588?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your CT DRS CT-588 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my CT DRS CT-588 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your CT DRS CT-588 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is CT DRS CT-588?

CT DRS CT-588 is a form used by Connecticut taxpayers to report and pay any tax liabilities related to amusement or entertainment activities.

Who is required to file CT DRS CT-588?

Individuals and businesses that operate amusement or entertainment facilities in Connecticut and earn revenue from them are required to file CT DRS CT-588.

How to fill out CT DRS CT-588?

To fill out CT DRS CT-588, taxpayers should provide their identifying information, calculate their total taxable revenue from amusement or entertainment activities, and report the amount of tax owed according to the instructions provided with the form.

What is the purpose of CT DRS CT-588?

The purpose of CT DRS CT-588 is to ensure compliance with state tax laws related to the amusement and entertainment industry by allowing businesses to properly report their earnings and pay the associated taxes.

What information must be reported on CT DRS CT-588?

CT DRS CT-588 must report the taxpayer's name, address, federal employer identification number (if applicable), total gross revenue from amusement or entertainment activities, tax calculation, and any payments made during the reporting period.

Fill out your CT DRS CT-588 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-588 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.