CT DRS CT-588 2017 free printable template

Show details

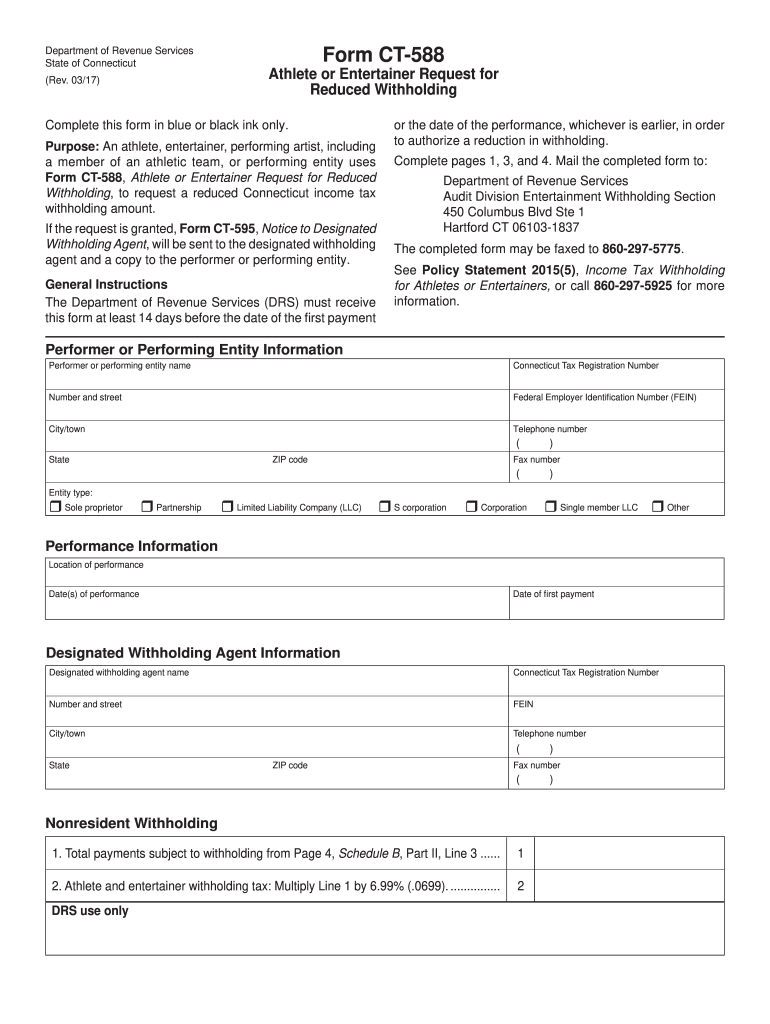

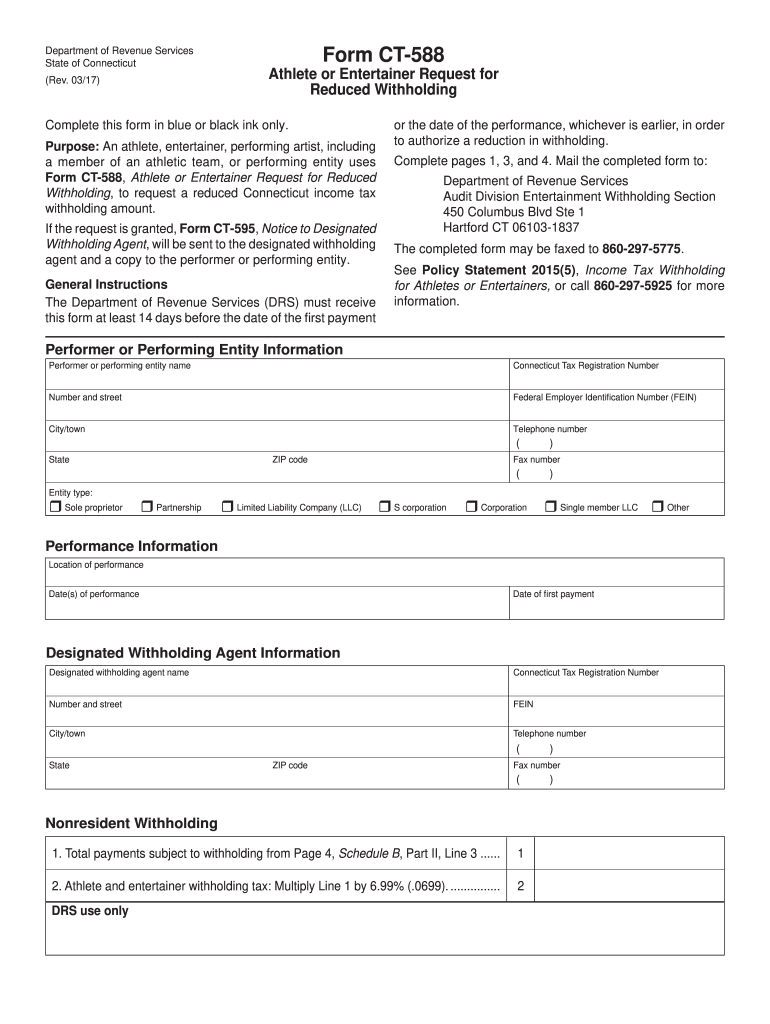

Total payments subject to withholding from Page 4 Schedule B Part II Line 3. 2. Athlete and entertainer withholding tax Multiply Line 1 by 6. Page 2 of 4 Schedule A - Connecticut Athlete and Entertainer Withholding Tax Schedule of Income and Expenses Location Income Amount Received for 1. Department of Revenue Services State of Connecticut Rev. 03/17 Form CT-588 Athlete or Entertainer Request for Reduced Withholding Complete this form in blue or black ink only. Refer to Form CT-590 Athlete or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-588

Edit your CT DRS CT-588 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-588 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-588 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT DRS CT-588. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-588 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-588

How to fill out CT DRS CT-588

01

Obtain the CT DRS CT-588 form from the Connecticut Department of Revenue Services website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Provide details on the type of income you are reporting, ensuring it aligns with the categories specified on the form.

04

Enter the amounts in the designated spaces, making sure to follow the instructions for each line carefully.

05

Double-check all entries for accuracy and completeness before submitting the form.

06

Sign and date the form at the bottom as required.

07

Submit the completed form to the Connecticut Department of Revenue Services either by mail or electronically, as indicated in the submission guidelines.

Who needs CT DRS CT-588?

01

Anyone who is claiming a credit for a contribution made to a qualifying scholarship organization in Connecticut.

02

Taxpayers seeking to report information for tax credits associated with educational funding.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a CT nonresident return?

You must file a Connecticut income tax return if your gross income for the 2022 taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or. $24,000 and you are married filing jointly or qualifying surviving spouse.

What is the CT employee tax withholding form?

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

Is a non resident required to file income tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

Do I need extra withholding?

Any time your income goes up, your tax liability will likely go up too, requiring a new W-4. If your extra income comes from a side job that doesn't have any tax withholding, you could submit a new W-4 to adjust the withholdings at your main job to account for the increase in income.

Who must file a CT return?

If you are a part-year resident and you meet the requirements for Who Must File Form CT-1040NR/PY for the 2022 taxable year, you must file Form CT-1040NR/PY, Connecticut Nonresident and Part-Year Resident Income Tax Return.Connecticut Resident Income Tax Information. Gross Income$100,000Expenses($92,000)Net Income$8,000

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CT DRS CT-588 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your CT DRS CT-588 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send CT DRS CT-588 for eSignature?

When you're ready to share your CT DRS CT-588, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the CT DRS CT-588 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your CT DRS CT-588 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is CT DRS CT-588?

CT DRS CT-588 is a form used in Connecticut for reporting and calculating the tax on certain sales and use tax transactions.

Who is required to file CT DRS CT-588?

Businesses and individuals who are liable for collecting and remitting sales and use tax in Connecticut are required to file CT DRS CT-588.

How to fill out CT DRS CT-588?

To fill out CT DRS CT-588, gather your sales and use tax transaction information, complete the form with the required financial details, and ensure to sign and date the submission.

What is the purpose of CT DRS CT-588?

The purpose of CT DRS CT-588 is to report sales and use tax liabilities, ensuring that businesses comply with state tax regulations.

What information must be reported on CT DRS CT-588?

CT DRS CT-588 requires reporting information such as gross sales, taxable sales, exempt sales, and applicable tax owed.

Fill out your CT DRS CT-588 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-588 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.