IRS Instruction 2441 2020 free printable template

Show details

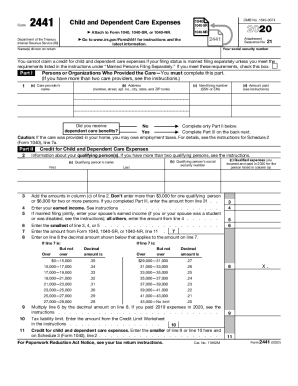

Form2441Child and Dependent Care Expenses OMB No. 1545007410401040SR.......... Department of the Treasury

Internal Revenue Service (99)20201040NRAttach to Form 1040, 1040SR, or 1040NR.2441Go to www.irs.gov/Form2441

pdfFiller is not affiliated with IRS

Instructions and Help about IRS Instruction 2441

How to edit IRS Instruction 2441

How to fill out IRS Instruction 2441

Instructions and Help about IRS Instruction 2441

How to edit IRS Instruction 2441

To edit IRS Instruction 2441, utilize tools that allow you to fill out forms electronically. It’s essential to ensure all information is accurately represented before submission. You can use pdfFiller to access editing tools that simplify this process, enabling you to complete, sign, and store the document efficiently.

How to fill out IRS Instruction 2441

Filling out IRS Instruction 2441 involves gathering necessary documentation and providing accurate details pertaining to child and dependent care expenses. Ensure you have the Social Security numbers (SSNs) of the individuals cared for and your care providers. The step-by-step process includes:

01

Gathering personal and dependent information.

02

Documenting care expenses and providers’ information.

03

Calculating the allowable credit based on your expenses and income.

04

Submitting the form along with your tax return.

About IRS Instruction 2 previous version

What is IRS Instruction 2441?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS Instruction 2 previous version

What is IRS Instruction 2441?

IRS Instruction 2441 is a guideline for taxpayers to claim the Child and Dependent Care Credit. This credit allows taxpayers to reduce their tax liability based on expenses incurred when caring for qualifying children and dependents while they work or look for work. Understanding this form ensures you can maximize eligible benefits and comply with tax regulations.

What is the purpose of this form?

The purpose of IRS Instruction 2441 is to facilitate the calculation and proper reporting of expenses related to child and dependent care. It allows eligible filers to claim a credit for a portion of their care costs, thereby reducing their overall tax burden. Ensuring that you are familiar with the purpose of this form helps in accurately capturing these expenses for potential credit.

Who needs the form?

Taxpayers who pay for child or dependent care services in order to work or look for work need to fill out IRS Instruction 2441. This includes anyone with children under 13, or dependents who are physically or mentally incapable of self-care. Understanding your eligibility ensures proper use of the form and potential benefits.

When am I exempt from filling out this form?

You may be exempt from filling out IRS Instruction 2441 if you did not pay for child or dependent care expenses during the tax year. Additionally, if your dependent care expenses do not qualify for the credit or if you do not meet the necessary income thresholds, you would not need to submit this form. Knowing the exemptions helps streamline your filing process.

Components of the form

The components of IRS Instruction 2441 include sections for personal information, details of the care provider(s), and expenses incurred. Each segment requires precise data to ensure accurate computation of your potential tax credit. Familiarity with these components allows for efficient form completion.

What are the penalties for not issuing the form?

Failing to complete or accurately submit IRS Instruction 2441 may result in penalties, which can include disallowance of the credit claimed, leading to increased tax liability. Additionally, inaccuracies may draw scrutiny from the IRS, resulting in further inquiries or audits. Being aware of these penalties underscores the importance of compliance.

What information do you need when you file the form?

When filing IRS Instruction 2441, you need several pieces of information: your Social Security number, the SSNs of your dependents, and details of the care providers, including their Taxpayer Identification Number (TIN) or SSN. Accurate documentation of your child and dependent care expenses is also vital for proper claim processing.

Is the form accompanied by other forms?

IRS Instruction 2441 is typically accompanied by Form 1040 or Form 1040-SR when claiming the Child and Dependent Care Credit. Ensuring that all necessary forms are filed together supports a comprehensive tax return, reducing processing delays and potential errors.

Where do I send the form?

Once completed, IRS Instruction 2441 should be mailed along with your tax return to the address specified in the IRS directions for Form 1040. Ensure you verify which office to send it to, as mailing addresses can vary based on your state of residence and whether you are filing electronically or on paper.

See what our users say