Get the free Can Zakat Be Used to Pay Debts?Zakat Foundation of America

Show details

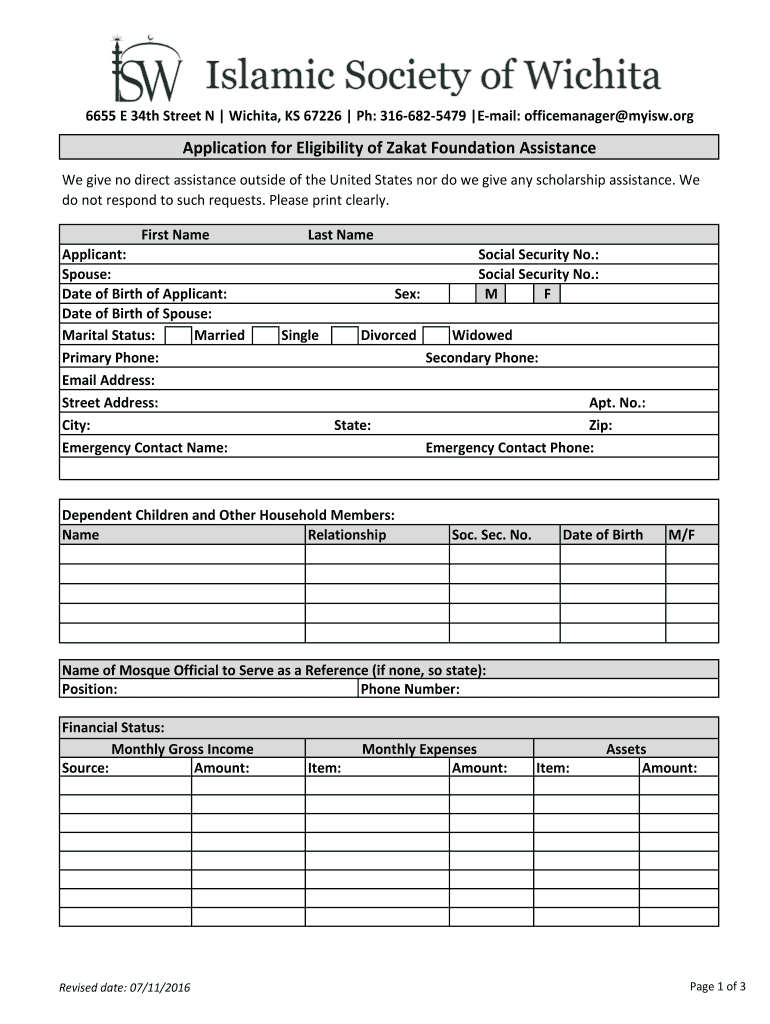

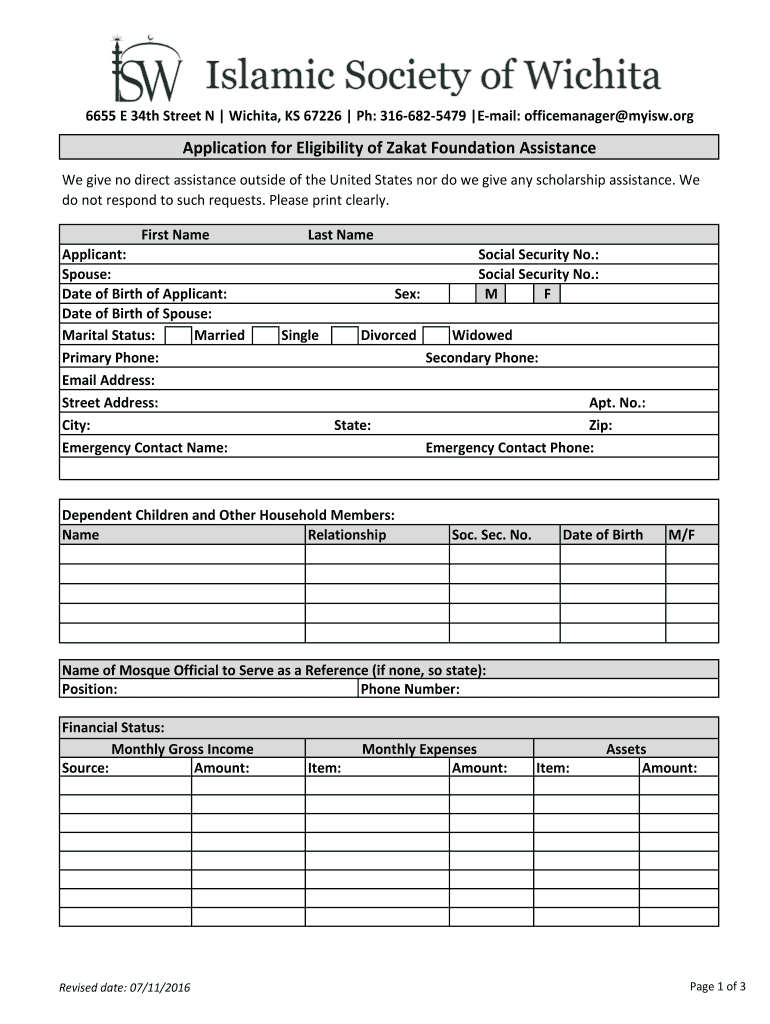

6655 E 34th Street N Wichita, KS 67226 pH: 3166825479 Email: office manager moist. Reapplication for Eligibility of Aka Foundation Assistance We give no direct assistance outside the United States

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign can zakat be used

Edit your can zakat be used form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your can zakat be used form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing can zakat be used online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit can zakat be used. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out can zakat be used

How to fill out can zakat be used

01

To fill out can zakat, follow these steps:

02

Determine your zakat eligibility: Check if you meet the criteria for paying zakat, which include being a Muslim, owning wealth above the nisab (minimum threshold), and meeting the lunar year requirement.

03

Calculate your zakat amount: Determine the value of your zakatable assets, such as cash, gold, silver, investments, and business goods. Deduct any outstanding debts. Apply the zakat rate (usually 2.5%) to the net zakatable assets to calculate your zakat obligation.

04

Choose a worthy recipient: Identify individuals or groups eligible to receive zakat, such as the poor, the needy, debtors, new Muslims, those in financial hardship, or organizations providing social welfare.

05

Distribute your zakat: Give the determined zakat amount to the chosen recipients. It is recommended to distribute zakat evenly or prioritize those most in need.

06

Keep records: Maintain proper documentation of your zakat calculation, recipients, and distribution for future reference and accountability.

07

Remember that zakat is both an obligation and a means of purifying wealth, helping those in need, and attaining spiritual growth.

Who needs can zakat be used?

01

Can zakat can be used by those who are eligible to receive it according to Islamic principles.

02

Eligible recipients include:

03

- The poor: Those who do not possess enough wealth to meet their basic needs.

04

- The needy: Individuals or families who are in financial difficulty and require assistance.

05

- Debtors: People burdened with debt and unable to repay it.

06

- New Muslims: Recent converts who require support in adjusting to their new faith and community.

07

- Those in financial hardship: Individuals facing unexpected financial crises or disasters.

08

- Organizations providing social welfare: Institutions and charitable organizations working towards helping those in need.

09

Zakat aims to uplift the poor and provide them with financial relief, ensuring a more equitable distribution of wealth within the Muslim community.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit can zakat be used in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your can zakat be used, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit can zakat be used on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing can zakat be used.

How do I fill out can zakat be used using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign can zakat be used and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is can zakat be used?

Zakat can be used to assist the poor and needy, support community projects, fund educational initiatives, aid in disaster relief, and help individuals in debt.

Who is required to file can zakat be used?

Muslims who have reached the minimum wealth threshold (nisab) and possess assets for a lunar year are required to file zakat.

How to fill out can zakat be used?

To fill out zakat, individuals should calculate their total wealth, determine the zakat rate (usually 2.5%), and list eligible recipients or organizations for distribution.

What is the purpose of can zakat be used?

The purpose of zakat is to purify wealth, promote social justice, and assist those in need within the community.

What information must be reported on can zakat be used?

Individuals must report their total assets, liabilities, and calculate the zakat amount owed, as well as the recipients of the zakat.

Fill out your can zakat be used online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Can Zakat Be Used is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.