Get the free INSTALLMENT LOAN AND SECURITY AGREEMENT 12167 bb

Show details

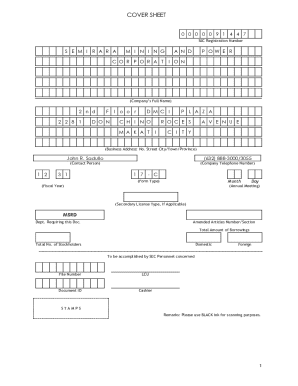

INSTALLMENT LOAN AND SECURITY AGREEMENT Loan No: TL102 Loan Date: 9/25/2014 Lender : Maturity Date: 10/25/2014 Borrower: Alpha Omega Calvin Brazier 1111 11th Ave. South, Nashville, TN 11111 This Installment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign installment loan and security

Edit your installment loan and security form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your installment loan and security form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit installment loan and security online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit installment loan and security. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out installment loan and security

How to fill out an installment loan and security:

01

Start by gathering all the necessary documents and information. This may include identification documents, proof of income, proof of residence, and details about the loan amount and terms.

02

Begin by filling out the loan application form. This typically asks for personal information such as your name, address, contact details, and social security number. Provide accurate and up-to-date information to avoid any delays or complications during the approval process.

03

Provide information about the purpose of the loan. Whether it is for purchasing a house, a car, or any other specific need, clearly state the reason for taking out the loan.

04

Indicate the loan amount and the desired repayment term. Calculate how much you can comfortably afford to repay each month and choose a term that aligns with your financial situation.

05

Include details about any collateral or security that you are offering for the loan. This could be an asset such as a car or house that can be used as collateral in case of default. Provide accurate information about the value of the collateral.

06

Carefully review the terms and conditions of the loan, including the interest rate, fees, and penalties. Understand the repayment schedule and any additional costs associated with late or missed payments.

07

Before submitting the application, double-check all the information provided to ensure accuracy and completeness. Mistakes or missing information can lead to delays in the approval process.

Who needs an installment loan and security:

01

Individuals who need a larger amount of money for a specific purpose that cannot be immediately afforded from their own savings may consider an installment loan. This allows them to borrow the necessary funds and repay them over time in fixed installments.

02

Businesses or entrepreneurs who require capital to expand their operations or invest in new ventures may also opt for installment loans. These loans can help finance equipment purchases, inventory, or other business-related expenses.

03

Individuals with lower credit scores or a limited credit history may find it difficult to obtain traditional loans. In such cases, installment loans can be an alternative option, as they may have more flexible eligibility criteria and requirements.

04

People who have valuable assets that can be used as collateral may choose to secure their loans with these assets. This can potentially result in lower interest rates or higher borrowing limits.

Overall, installment loans and security are relevant for anyone who needs additional funds in a structured repayment plan and is willing to provide collateral to secure the loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get installment loan and security?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific installment loan and security and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my installment loan and security in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your installment loan and security and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out installment loan and security on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your installment loan and security, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is installment loan and security?

An installment loan is a type of loan that is repaid over time with a set number of scheduled payments. Security refers to the collateral or assets that a borrower pledges to secure the loan.

Who is required to file installment loan and security?

Individuals or businesses that are taking out an installment loan and pledging security are required to file installment loan and security.

How to fill out installment loan and security?

To fill out installment loan and security, the borrower must provide information about the loan amount, repayment schedule, and details of the pledged security.

What is the purpose of installment loan and security?

The purpose of installment loan and security is to provide a structured repayment plan for borrowers and to protect lenders in case of default.

What information must be reported on installment loan and security?

Information such as loan amount, interest rate, repayment schedule, and details of the pledged security must be reported on installment loan and security.

Fill out your installment loan and security online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Installment Loan And Security is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.