Get the free certificate of sole proprietorship

Show details

Certificate of Sole Proprietorship SPC Instructions: Use this form to indicate the authorized signer for a sole proprietorship business account. Please also attach a copy of your valid business license.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of sole proprietorship

Edit your certificate of sole proprietorship form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of sole proprietorship form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of sole proprietorship online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit certificate of sole proprietorship. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of sole proprietorship

How to fill out certificate of sole proprietorship?

01

Obtain the necessary form or template for the certificate of sole proprietorship. This can usually be found on the website of your state's government or business registration agency.

02

Fill in the required information accurately and completely. This typically includes your full legal name, business name (if different), address, contact information, and social security number or employer identification number (EIN).

03

Provide details about your business activities, such as the nature of your business, products or services offered, and estimated annual revenue. Be specific and concise in your descriptions.

04

If applicable, indicate if you have any employees or if you plan to hire employees in the future. This may require additional documentation or registration with the appropriate government agencies.

05

Review the completed certificate of sole proprietorship form for any errors or omissions. Make sure all information is accurate and up to date.

06

Sign the form using your full legal name and date it. Some jurisdictions may require notarization or witness signatures, so check the requirements of your specific state or country.

07

Submit the completed certificate of sole proprietorship to the appropriate government agency or business registration office. This may involve mailing the form, submitting it online, or visiting an office in person.

Who needs a certificate of sole proprietorship?

01

Individuals who operate a business as a sole proprietor, meaning they are the sole owner and do not have partners or shareholders, typically need a certificate of sole proprietorship.

02

It is often required to establish the legal identity of the business and to comply with state or local registration and licensing requirements.

03

It may be needed for various purposes, such as opening a business bank account, obtaining business loans or credit, entering into contracts, or filing taxes as a self-employed individual.

04

The specific need for a certificate of sole proprietorship may vary depending on the jurisdiction and industry in which the business operates. It is advisable to consult with a local business attorney or an expert in business registration to determine the exact requirements for your situation.

Fill

form

: Try Risk Free

People Also Ask about

What forms does a sole proprietor need?

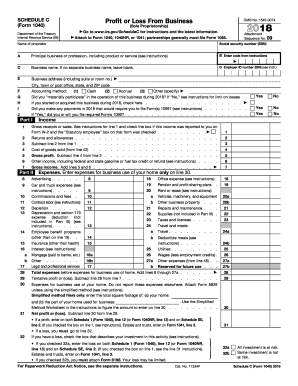

The profits of the company in a sole proprietorship belong to the owner. To file taxes on your sole proprietorship income, you must keep track of a few IRS forms like Form 1040, Schedule C, Form 940, Form 941, Form 944, etc.

How do I register as a sole proprietor in Florida?

Unlike other business entities, you don't need to file anything or take any formal actions to form a sole proprietorship. It's the default business structure for any new entity in Florida. That said, you'll still need to obtain the necessary permits and licenses required by your jurisdiction and industry.

Do I need to register a sole proprietorship in New York?

You don't have to register your Sole Proprietorship with the New York Department of State. It simply exists once you decide to start a business and engage in business activities.

Does sole proprietorship need to be registered?

No, Sole Proprietorship Registration is not mandatory. It is optional on whether a person intends to register his sole proprietorship or not. Although, banks insist on getting sole proprietorship registered if you intent to open a bank account in the name of your business, but as per law – it is not mandatory.

What are the rules of sole proprietorship?

There is no separate law to govern it. The only license is required to carry out the desired business and it allows for ease of doing business with minimum hassles. The owner is the only risk bearer in a sole proprietorship. Also, he is the one who enjoys all the profits with any other stakeholders.

How do you prove you are a sole proprietor?

Proof of Sole Proprietorship Ownership It is possible that the business is under a different name than the individual, often known as a doing business as (DBA) name. Proof of sole proprietorship ownership can be accomplished with: A copy of the owner's tax return with the Schedule C included.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit certificate of sole proprietorship on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign certificate of sole proprietorship on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete certificate of sole proprietorship on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your certificate of sole proprietorship. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out certificate of sole proprietorship on an Android device?

Use the pdfFiller mobile app and complete your certificate of sole proprietorship and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is certificate of sole proprietorship?

A certificate of sole proprietorship is a legal document that registers a sole proprietorship, confirming its existence and allowing the owner to operate under a business name.

Who is required to file certificate of sole proprietorship?

Individuals who wish to operate a business as a sole proprietor under a name other than their legal name are required to file a certificate of sole proprietorship.

How to fill out certificate of sole proprietorship?

To fill out a certificate of sole proprietorship, provide your legal name, the business name, business address, and any required additional information as requested by the local government authority.

What is the purpose of certificate of sole proprietorship?

The purpose of a certificate of sole proprietorship is to officially register the business, provide legal recognition, and protect the business name from being used by others.

What information must be reported on certificate of sole proprietorship?

Information reported on a certificate of sole proprietorship typically includes the owner's name, business name, business address, nature of the business, and the date of establishment.

Fill out your certificate of sole proprietorship online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Sole Proprietorship is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.