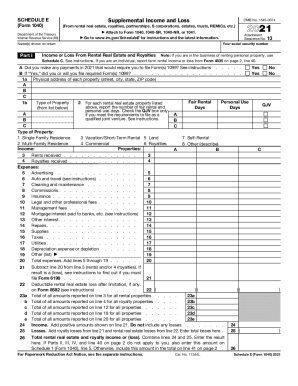

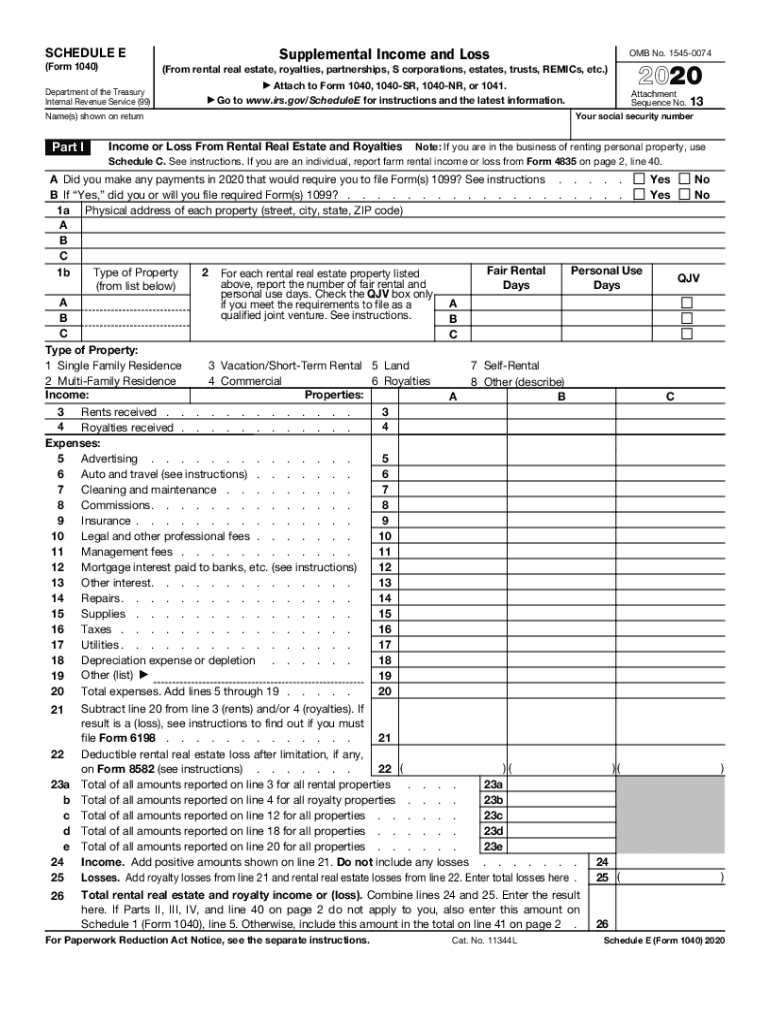

IRS 1040 - Schedule E 2020 free printable template

FAQ about IRS 1040 - Schedule E

What should I do if I find an error on my submitted IRS 1040 - Schedule E?

If you discover an error on your submitted IRS 1040 - Schedule E, you must file an amended return using IRS Form 1040X. This form allows you to correct mistakes and should include any adjustments to your original filing. Ensure that you check the IRS instructions for specific guidance on submitting your amended form.

How can I verify the status of my IRS 1040 - Schedule E filing?

To verify the status of your IRS 1040 - Schedule E filing, you can use the IRS 'Where's My Refund?' tool if you are receiving a refund, or call the IRS directly for inquiries. It’s essential to have your information handy, such as your Social Security number, filing status, and the exact whole dollar amount of your refund to check the status.

What should I do if I receive an audit notice for my IRS 1040 - Schedule E?

If you receive an audit notice related to your IRS 1040 - Schedule E, first review the notice carefully to understand what areas are being questioned. Gather relevant documentation to support your entries and consider consulting a tax professional for guidance. Respond to the IRS by the deadlines provided in the notice and ensure your responses are clear and well-documented.

What are common mistakes to avoid when filing IRS 1040 - Schedule E?

Some common mistakes to avoid while filing your IRS 1040 - Schedule E include misreporting rental income, overlooking deductions for repairs and maintenance, and not properly classifying passive activities. Double-check all entries for accuracy and ensure that you keep thorough records to support your claims in case of an audit.

Are there specific technical requirements I should be aware of for e-filing IRS 1040 - Schedule E?

When e-filing your IRS 1040 - Schedule E, ensure that you meet the technical requirements set by the IRS, which may include using compatible software, maintaining an internet connection, and adhering to browser privacy settings. Some services offer mobile compatibility, which can streamline the process, but it’s essential to verify that your chosen software supports IRS e-filing.

See what our users say