Get the free Utility Sales Tax Exemption Application - IARA: State Forms ...

Show details

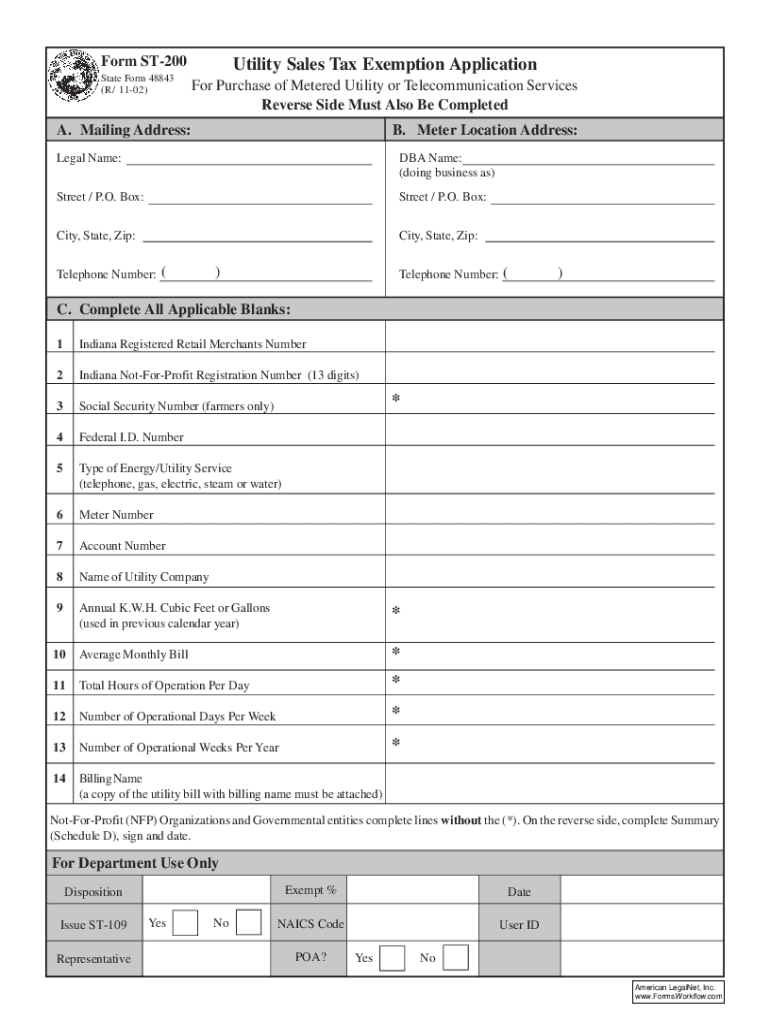

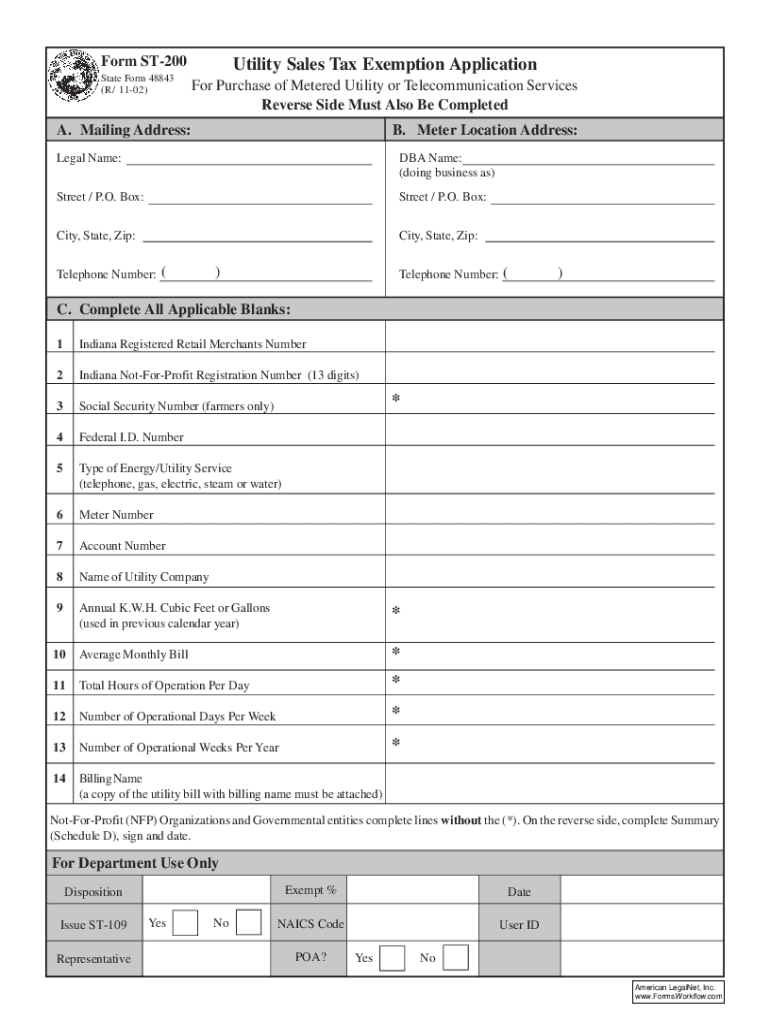

Form ST200

State Form 48843

(R/ 1102)Utility Sales Tax Exemption Application

For Purchase of Metered Utility or Telecommunication Services

Reverse Side Must Also Be Completed. Mailing Address:B. Meter

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign utility sales tax exemption

Edit your utility sales tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utility sales tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit utility sales tax exemption online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit utility sales tax exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out utility sales tax exemption

How to fill out utility sales tax exemption

01

Obtain the necessary forms: Find the utility sales tax exemption form specific to your state or jurisdiction. This form is usually available on the official website of the tax authority or can be obtained from their office.

02

Fill out your business information: Provide your company's name, address, and other required details on the form. Make sure the information is accurate and up to date.

03

Specify the utilities for exemption: Indicate which utilities you are seeking exemption for. This may include electricity, water, natural gas, or other qualifying services.

04

Justify the exemption: State the reasons or qualifications that make your business eligible for the utility sales tax exemption. For example, if your company operates in a specific industry or meets certain criteria outlined by the tax authority.

05

Attach supporting documents: Include any supporting documents required by the tax authority to verify your eligibility for the exemption. This may include proof of industry classification, certificates, or other relevant paperwork.

06

Review and submit: Double-check all the information provided on the form and ensure that it is complete. Sign and date the form where required, and submit it to the appropriate tax authority as instructed.

07

Follow up if necessary: Once you have submitted the form, keep track of its progress. If there are any further requirements or if the tax authority needs additional information, promptly provide them with the requested documents and communicate as needed.

08

Maintain compliance: If your business is granted the utility sales tax exemption, ensure ongoing compliance with any reporting or renewal requirements. Stay updated on any changes to the tax laws or regulations that may affect your eligibility for the exemption.

Who needs utility sales tax exemption?

01

Utility sales tax exemption is typically needed by businesses or organizations that qualify for specific tax incentives or have been granted certain exemptions by the tax authority.

02

Some common entities that may require utility sales tax exemption include:

03

- Non-profit organizations or charities

04

- Manufacturers or industrial businesses

05

- Government entities

06

- Educational institutions

07

- Agricultural enterprises

08

- Renewable energy producers

09

It is important to consult with a tax professional or the relevant tax authority in your jurisdiction to determine if your business or organization qualifies for utility sales tax exemption.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit utility sales tax exemption in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your utility sales tax exemption, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the utility sales tax exemption in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your utility sales tax exemption in seconds.

Can I edit utility sales tax exemption on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign utility sales tax exemption on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is utility sales tax exemption?

Utility sales tax exemption is a tax relief that allows eligible businesses or organizations to avoid paying sales tax on utility services, typically used in manufacturing, agriculture, or other qualifying industries.

Who is required to file utility sales tax exemption?

Businesses or organizations that qualify for the exemption and wish to claim it must file for the utility sales tax exemption. This typically includes manufacturers, certain agricultural entities, and non-profit organizations.

How to fill out utility sales tax exemption?

To fill out a utility sales tax exemption form, an entity must provide its name, address, type of business, the reason for exemption, and any relevant identification numbers. It's important to follow state-specific guidelines when completing the form.

What is the purpose of utility sales tax exemption?

The purpose of utility sales tax exemption is to reduce the operational costs for eligible businesses, stimulate growth in specific industries, and promote economic development by making essential utility services more affordable.

What information must be reported on utility sales tax exemption?

Information required usually includes the business's name, address, type of business, tax identification number, the nature of the utility use, and the specific utility services being exempted.

Fill out your utility sales tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utility Sales Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.