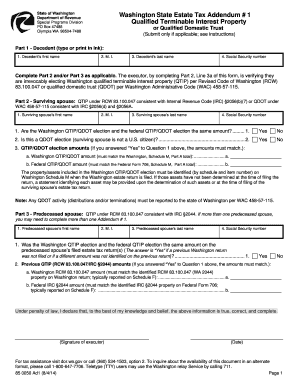

UK SA103F 2020 free printable template

Show details

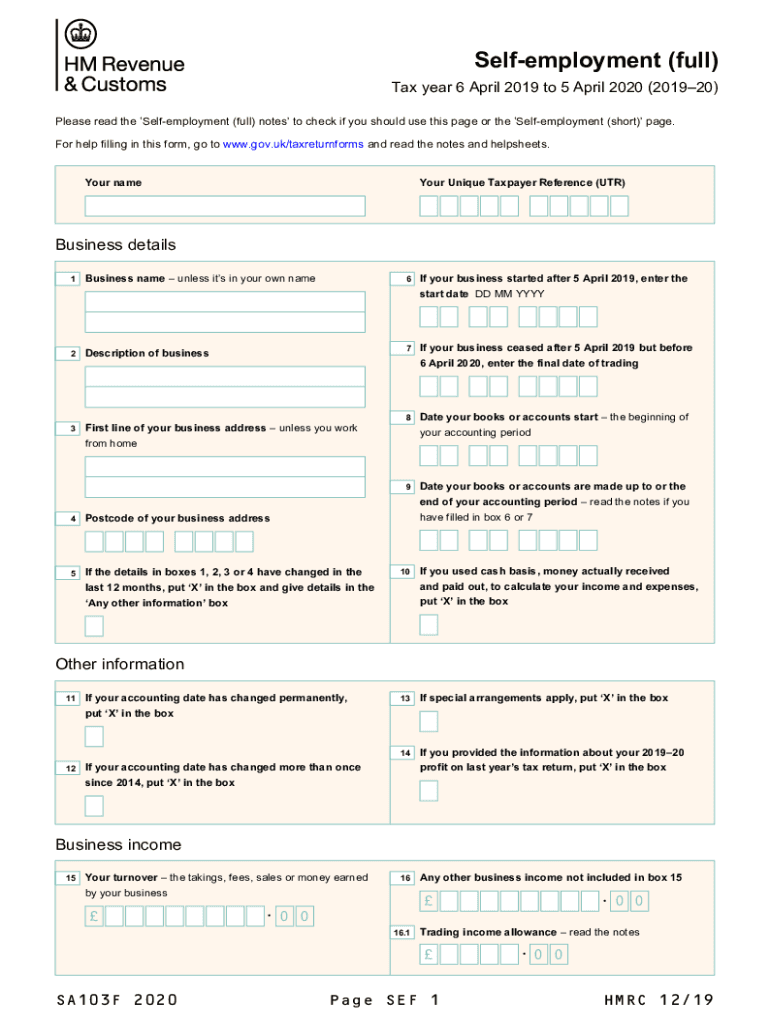

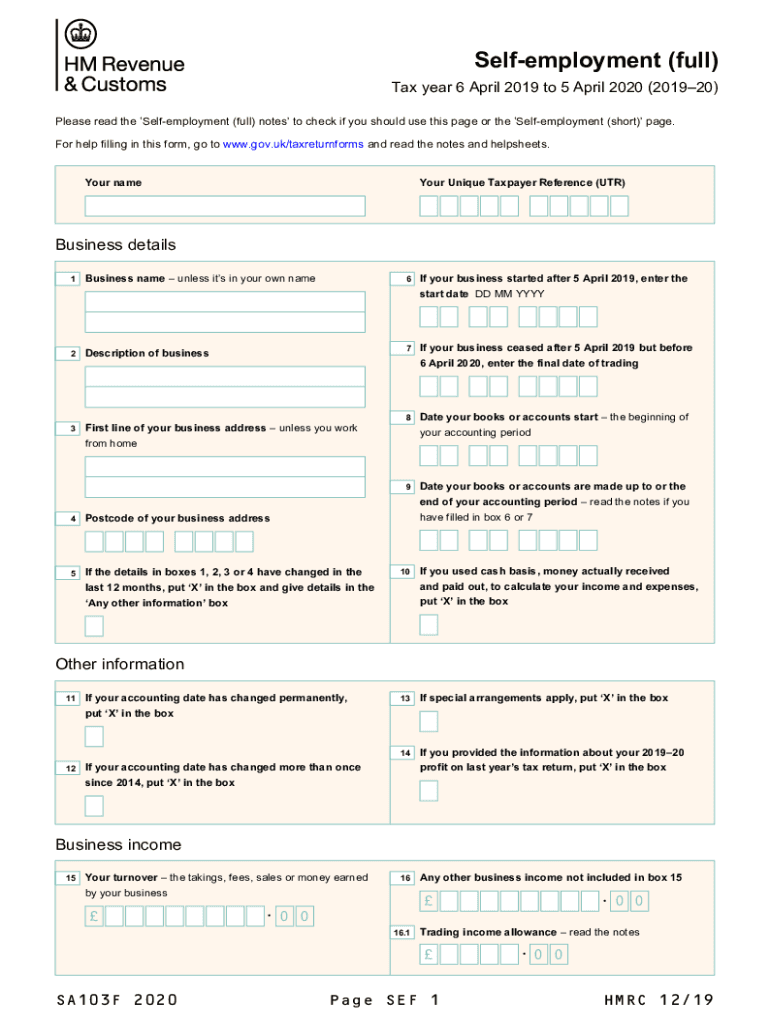

Self-employment (full) Tax year 6 April 2019 to 5 April 2020 (201920) Please read the Self employment (full) notes to check if you should use this page or the Self employment (short) page. For help

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK SA103F

Edit your UK SA103F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK SA103F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK SA103F online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK SA103F. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK SA103F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK SA103F

How to fill out UK SA103F

01

Gather your financial records, including income, expenses, and any relevant documents.

02

Start by filling out your personal information such as your name, address, and National Insurance number.

03

Provide details regarding your self-employment, including business name and type of business.

04

Fill in your income details, including sales, other income, and any compensation received.

05

Enter all your allowable business expenses, ensuring to categorize them correctly (e.g., travel, office supplies).

06

Calculate your total profit by subtracting total expenses from total income.

07

Complete the 'Additional Information' section if necessary, providing any other relevant financial details.

08

Review everything thoroughly to ensure accuracy and completeness.

09

Submit the form by the deadline set by HM Revenue and Customs (HMRC).

Who needs UK SA103F?

01

Self-employed individuals in the UK who earn income from a business and need to report their earnings for tax purposes.

02

Freelancers and contractors who do not fall under the PAYE (Pay As You Earn) tax system.

03

Individuals whose self-employment income exceeds the tax-free personal allowance.

Fill

form

: Try Risk Free

People Also Ask about

What is SA103?

Form TypesSelf Assessment. The SA103 Form is a supplementary page you may need to use if you submit a paper version of the Self Assessment tax return and need to report any self-employment income to HMRC.

How can I avoid self-employment tax?

Self-employment tax of 15.3% is generally owed on any self-employment income. Self-employed taxpayers can reduce the amount of SE taxes they pay by taking allowable deductions to reduce business net income. They can also use retirement plan and health savings account contributions to reduce income subject to SE tax.

What is SA 103f?

The SA103 forms are supplementary tax return forms filling out details about your self-employment on your Self Assessment.

How does IRS verify self-employment income?

1099 Forms The payer is responsible for filling this out and sending it to the IRS, as well as a copy for you to use as reference when filling out your own tax return. So if you don't have your tax return on hand, you can use 1099 forms to prove your income.

How do I report self-employment income to the IRS?

Answer: Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

What tax form do I fill out for self-employed?

More In Forms and Instructions Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment.

How do I fill out a self-employment income?

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

How do you calculate self-employed income?

You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income you derived from your trade or business. You can be liable for paying self-employment tax even if you currently receive social security benefits.

What is an example of self-employed income?

Self-employment income is earned from executing a "trade or business" as a sole proprietor, an independent contractor, or some form of partnership. Freelancers and "gig workers" are also considered by the IRS to be self-employed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK SA103F in Gmail?

UK SA103F and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for signing my UK SA103F in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your UK SA103F right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit UK SA103F on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing UK SA103F, you can start right away.

What is UK SA103F?

UK SA103F is a supplementary form used by self-employed individuals in the UK to report their self-employment income and expenses as part of their Self Assessment tax return.

Who is required to file UK SA103F?

Individuals who are self-employed and have income from their business that exceeds the tax-free allowance are required to file UK SA103F.

How to fill out UK SA103F?

To fill out UK SA103F, you must provide details of your business income, allowable business expenses, and any other relevant financial information, ensuring that you maintain accurate records to support your claims.

What is the purpose of UK SA103F?

The purpose of UK SA103F is to provide HM Revenue and Customs (HMRC) with information about your self-employment income and expenses, enabling the calculation of your tax liability.

What information must be reported on UK SA103F?

UK SA103F requires reporting of various information including total business income, allowable business expenses, details of any capital allowances, and personal adjustments to profit.

Fill out your UK SA103F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK sa103f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.