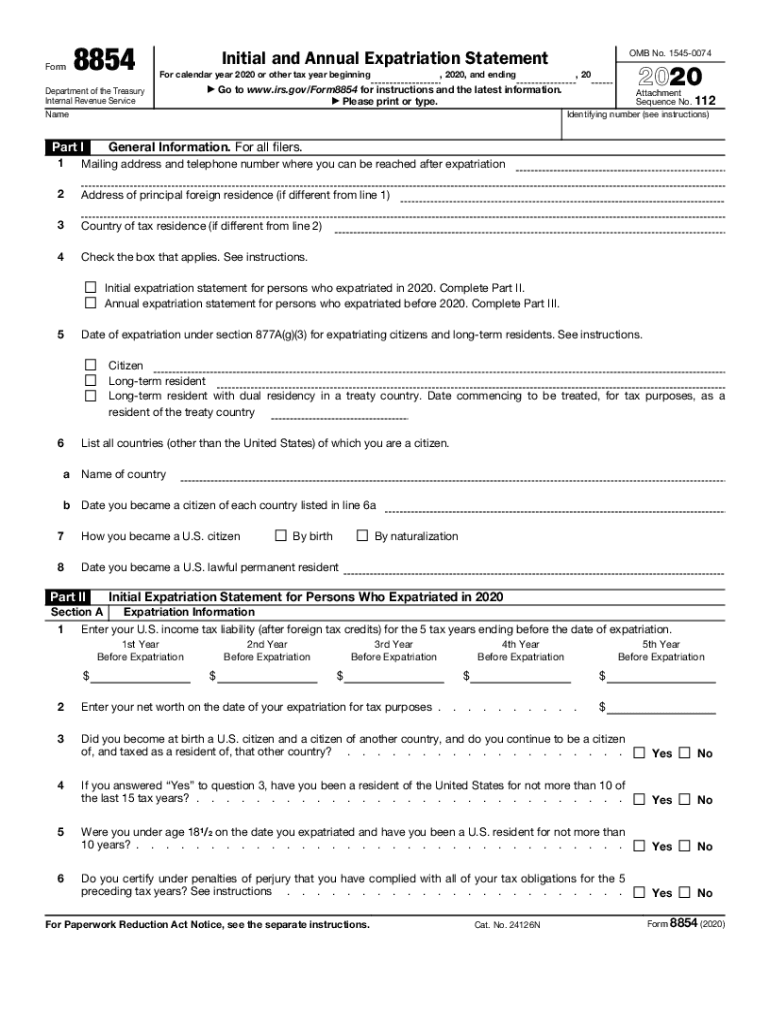

What is IRS 8854?

IRS Form 8854, known as the Initial and Annual Expatriation Statement, is a crucial document for U.S. citizens who expatriate. This form is required to report your expatriation and provide information about your tax status. Completing this form is necessary for compliance with U.S. tax laws and avoiding penalties related to expatriation taxes.

Who needs the form?

You need to file IRS Form 8854 if you have relinquished your U.S. citizenship or terminated your long-term resident status. Additionally, if your net worth exceeds $2 million or if you have an average annual tax liability of $162,000 for the five years preceding your expatriation, this form is required. It ensures that individuals with significant assets or tax obligations remain accountable to U.S. tax laws, even after leaving the country.

Components of the form

IRS Form 8854 consists of several components, including personal identification information, asset reporting, and tax election statements. The form typically requires declarative information about your foreign income, assets, and specific tax obligations associated with expatriation. Make sure to review each section carefully to provide complete and accurate details.

What information do you need when you file the form?

When you file IRS Form 8854, gather comprehensive information about your financial standing. Required details include your name, taxpayer identification number, the date of expatriation, foreign bank accounts, IRA accounts, and the balance of your foreign assets. Ensure that all data is accurate and complete to facilitate a smooth filing process.

Where do I send the form?

IRS Form 8854 should be submitted to the address specified in the IRS instructions for the form. If you are filing Form 8854 along with your annual tax return, send it to the same address as your return. If you're filing separately, ensure you check for the most current mailing designation provided by the IRS to avoid delays.

What is the purpose of this form?

The purpose of IRS Form 8854 is to inform the IRS about your status as an expatriate and to report your global income and asset information. This form helps the IRS determine if you meet certain tax obligations upon leaving U.S. citizenship. It's essential for expatriates to file this form to properly calculate any exit taxes that may apply and to fulfill their reporting responsibilities.

When am I exempt from filling out this form?

Exemptions from filing IRS Form 8854 exist for certain individuals. If you are a dual citizen born outside the United States and did not choose to be a U.S. citizen, you may be exempt. Additionally, if your average net tax liability for the five years preceding your expatriation is below $162,000, or if your net worth is under $2 million, you may not need to file this form.

What are the penalties for not issuing the form?

Failing to file IRS Form 8854 can result in significant penalties. The IRS may impose a penalty of $10,000 for not filing the form, along with additional fines if inaccuracies are found in your reported tax obligations. Moreover, not submitting this form can complicate your tax situation and hinder your ability to return to the U.S. without scrutiny.

Is the form accompanied by other forms?

Filing IRS Form 8854 may require accompanying forms, depending on your situation. Commonly, it is filed along with Form 1040 for the year you expatriate, as well as other relevant forms that pertain to your foreign income and assets. Review IRS guidelines to confirm which forms are necessary for your specific circumstances.