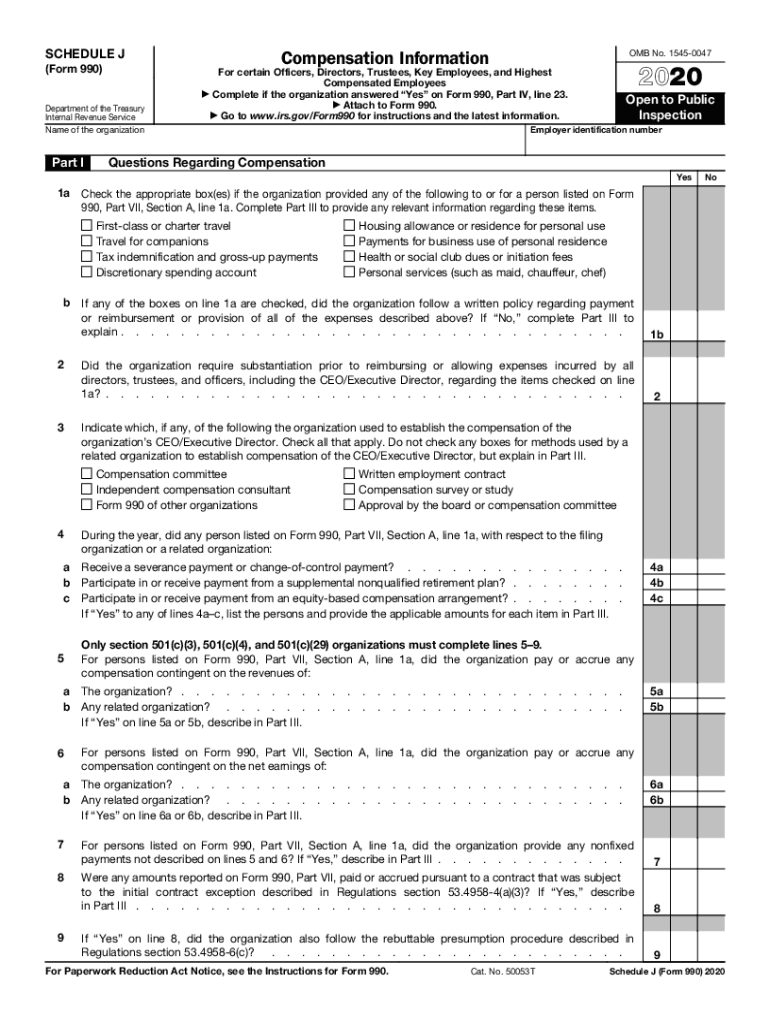

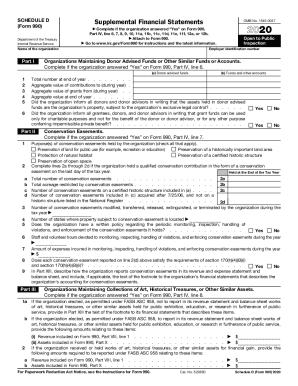

IRS 990 - Schedule J 2020 free printable template

Get, Create, Make and Sign IRS 990 - Schedule J

How to edit IRS 990 - Schedule J online

Uncompromising security for your PDF editing and eSignature needs

IRS 990 - Schedule J Form Versions

How to fill out IRS 990 - Schedule J

How to fill out IRS 990 - Schedule J

Who needs IRS 990 - Schedule J?

Instructions and Help about IRS 990 - Schedule J

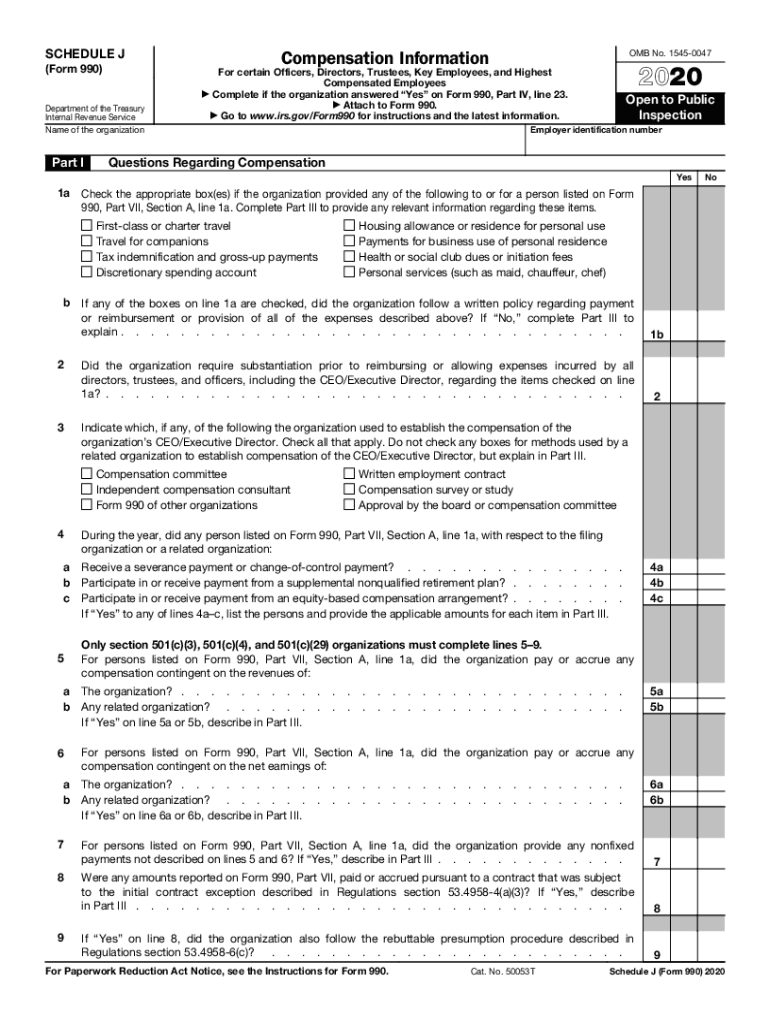

So there are a couple places on the form 990 that these questions are asked so what Justin is talking about with compensation studies are very relevant so the first place that that happens is on part six question 15 here they ask about the process for determining compensation for a couple of individuals, so first you have your CEO your head of school your president of the school, and then they ask about other officers and key employees of the organization, and then they ask you to describe the process, so they really want you to talk about what you did to determine that compensation back in schedule oh, so we encourage clients that even if they don't have that full process that they go ahead and put that description back in schedule just so that the reader and the IRS know that you are doing some kind of process to determine that compensation and then the other important piece i would say there is they also ask you about the date that it was last reviewed so that last polling question is really relevant because that is part of that process here and then in schedule j part...

People Also Ask about

What does J schedule mean?

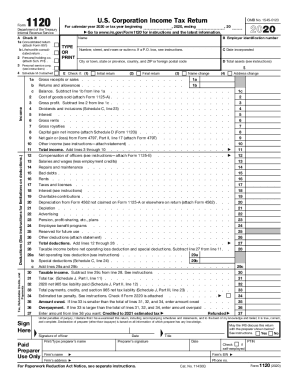

What is the form 5471 for 2017?

What is Schedule 1 on IRS 1040?

What is a Schedule 1 for taxes?

What is a Schedule 1?

What does Schedule 1 mean?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 990 - Schedule J directly from Gmail?

How do I complete IRS 990 - Schedule J online?

How do I edit IRS 990 - Schedule J in Chrome?

What is IRS 990 - Schedule J?

Who is required to file IRS 990 - Schedule J?

How to fill out IRS 990 - Schedule J?

What is the purpose of IRS 990 - Schedule J?

What information must be reported on IRS 990 - Schedule J?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.