Get the free irs schedule f

Instructions and Help about IRS 990 - Schedule F

How to edit IRS 990 - Schedule F

How to fill out IRS 990 - Schedule F

About IRS 990 - Schedule F 2020 previous version

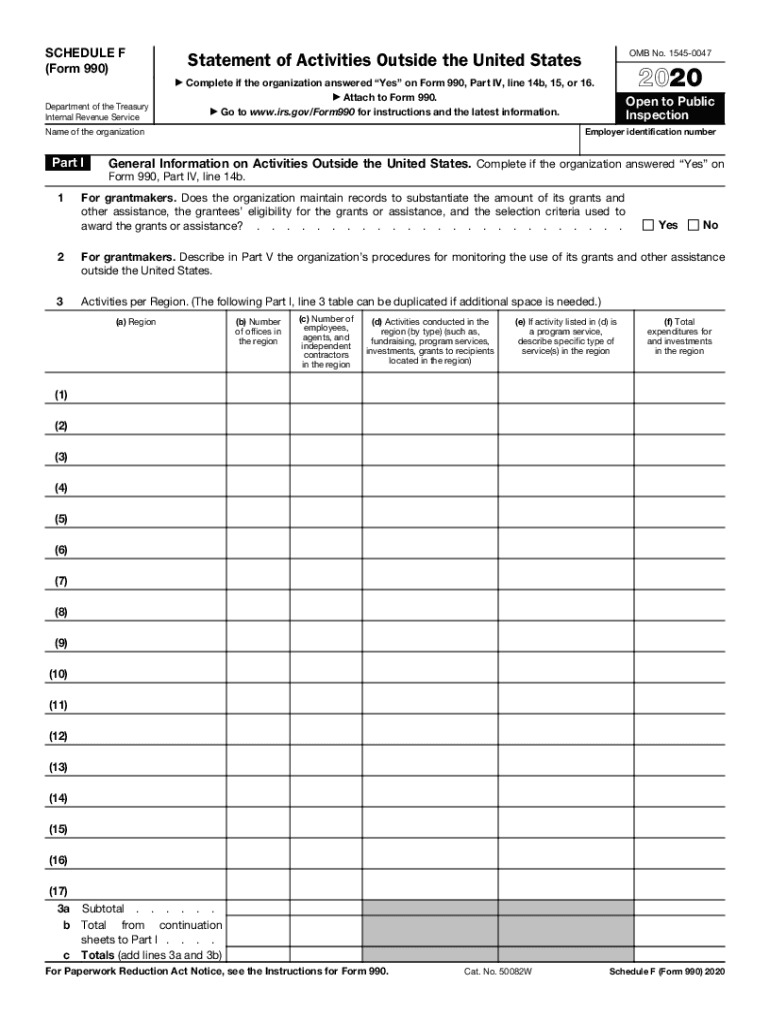

What is IRS 990 - Schedule F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about irs schedule f

What should I do if I discovered an error on my submitted IRS 990 - Schedule F?

If you find an error after submitting your IRS 990 - Schedule F, you can file an amended return to correct the mistakes. Ensure that your amended form clearly indicates which line items are being changed. Keeping documentation of the corrections is crucial in case of future inquiries.

How can I verify if my IRS 990 - Schedule F was received by the IRS?

To verify the receipt of your IRS 990 - Schedule F, you can use the IRS e-file status tool available on their website. This tool allows you to check the processing status and identify any potential rejections that might have occurred.

Are e-signatures accepted when filing IRS 990 - Schedule F electronically?

Yes, e-signatures are accepted for electronically filed IRS 990 - Schedule F. Make sure to follow the specific guidelines provided by the IRS regarding e-signature methods to ensure compliance.

What common errors should I avoid when filing IRS 990 - Schedule F?

Common errors when filing the IRS 990 - Schedule F include mismatched figures and incomplete documentation. Ensure all relevant payments and purchases are reported correctly and cross-check your entries against financial records to minimize mistakes.

What should I do if I receive an audit notice related to IRS 990 - Schedule F?

If you receive an audit notice regarding your IRS 990 - Schedule F, gather all pertinent documentation related to the filing, including receipts and supporting records. It's advisable to consult with a tax professional to prepare an appropriate response and address the IRS's inquiries effectively.