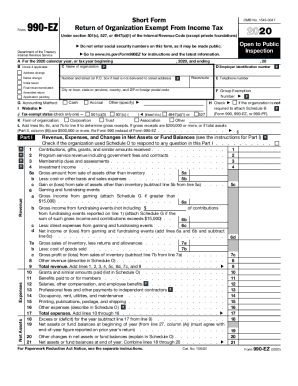

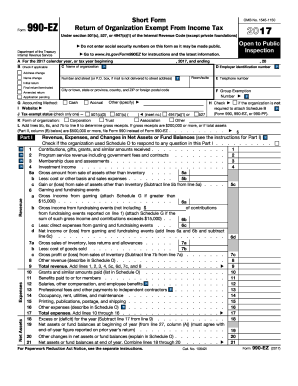

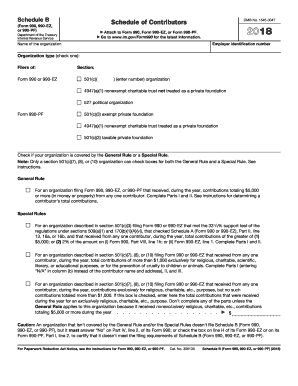

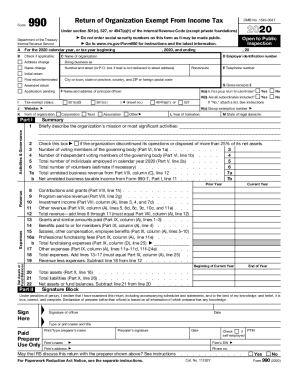

IRS 990 or 990-EZ - Schedule L 2020 free printable template

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

How to fill out IRS 990 or 990-EZ - Schedule

About IRS 990 or 990-EZ - Schedule 2020 previous version

What is IRS 990 or 990-EZ - Schedule?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 or 990-EZ - Schedule

What should I do if I realize I made a mistake after submitting the 990 interested form?

If you discover an error after filing your 990 interested form, you can submit an amended form to correct the mistake. Ensure that you clearly indicate that it is an amendment and reference the original form to avoid confusion. Always keep a copy of both the original and amended submissions for your records.

How can I track the status of my 990 interested form after submission?

To verify the status of your submitted 990 interested form, you should check with the IRS or the online portal where you filed the form. Typically, you'll need the submission date and your identification details. If you encounter issues or delays, contact the IRS for assistance and clarification.

What should I do if my 990 interested form is rejected upon e-filing?

If your submission of the 990 interested form is rejected, review the rejection notice for specific codes detailing the reason. Correct any issues identified and resubmit the form promptly. Be aware that some errors may require special handling or additional documentation, so read the guidelines carefully.

Can I use an e-signature for filing the 990 interested form?

Yes, you can use an e-signature for the 990 interested form if the filing method allows it. Ensure that your e-signature adheres to the IRS standards for electronic submissions. Maintaining adequate documentation that supports the use of an e-signature can be important for your records.

What are common errors to avoid when submitting the 990 interested form?

Common errors when filing the 990 interested form include incorrect information about the entity, missing signatures, and math errors throughout the document. Double-checking your entries and ensuring all required fields are filled can significantly reduce the risk of submission issues.