TX AP-228-1 2020 free printable template

Show details

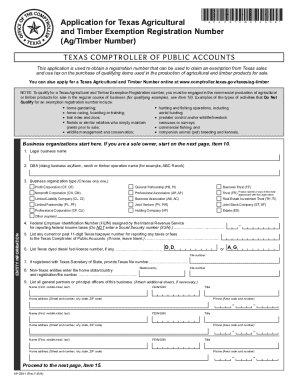

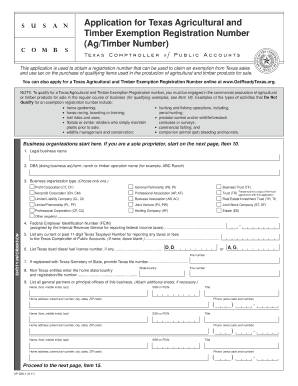

Physical location - This address is for the primary physical location where business is conducted and/or where agricultural or timber products are grown or raised for sale. You can also apply for a Texas Agricultural and Timber Number online at www. comptroller. texas. gov/taxes/ag-timber/ NOTE To qualify for a Texas Agricultural and Timber Exemption Registration number you must be engaged in the commercial production of agricultural or timber products for sale in the regular course of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX AP-228-1

Edit your TX AP-228-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX AP-228-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX AP-228-1 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX AP-228-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX AP-228-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX AP-228-1

How to fill out TX AP-228-1

01

Obtain the TX AP-228-1 form from the Texas Comptroller's website or local office.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide the specific details related to the property or transaction that the form addresses.

04

Review the instructions on the form for any specific requirements or additional information needed.

05

Sign and date the form where indicated.

06

Submit the completed form via the recommended submission method (mail, online, etc.) to the appropriate authority.

Who needs TX AP-228-1?

01

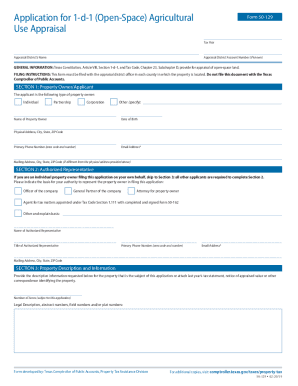

Individuals or businesses involved in property transactions in Texas.

02

Real estate professionals facilitating property sales.

03

Taxpayers applying for certain exemptions related to property assessments.

Fill

form

: Try Risk Free

People Also Ask about

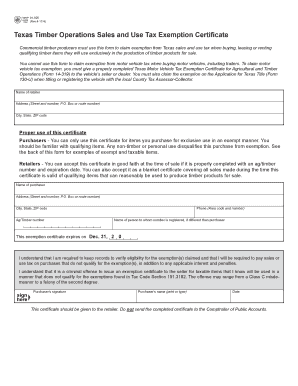

How long are tax exempt forms good for in Texas?

A seller is required to keep exemption certificates for a minimum of four years from the date on which the sale is made and throughout any period in which any tax, penalty, or interest may be assessed, collected, or refunded by the comptroller or in which an administrative hearing or judicial proceeding is pending.

How do I renew my Texas AG and timber number?

Ag/Timber Numbers must be renewed every four years, regardless of when the number was first issued. Renewed and new Ag/Timber Numbers expire Dec. 31, 2023. You must enter the expiration date on the exemption certificate you give to retailers on your qualifying purchases.

How do I renew my Texas tax exempt certificate?

There are three options for renewing your exemption certificate: online, by phone or by mail. Online renewal is the fastest option, as you will receive your confirmation number immediately. If you apply by phone, expect to get your confirmation letter by mail in five to seven days.

Do Texas tax exempt certificates expire?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

How many acres do you need for timber exemption in Texas?

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

How do I get a Texas ag exemption number?

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in TX AP-228-1 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your TX AP-228-1, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the TX AP-228-1 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your TX AP-228-1 in seconds.

How can I fill out TX AP-228-1 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your TX AP-228-1. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is TX AP-228-1?

TX AP-228-1 is a form used in Texas for reporting specific tax-related information, often related to sales and use tax.

Who is required to file TX AP-228-1?

Businesses and individuals who are engaged in activities subject to Texas sales and use tax and meet certain reporting criteria are required to file TX AP-228-1.

How to fill out TX AP-228-1?

To fill out TX AP-228-1, you need to provide detailed information about taxable sales, deductions, and exemptions, along with identification information for the filing entity.

What is the purpose of TX AP-228-1?

The purpose of TX AP-228-1 is to ensure accurate reporting and compliance with Texas tax laws regarding sales and use tax.

What information must be reported on TX AP-228-1?

TX AP-228-1 requires reporting information such as total sales, exemptions claimed, tax rates applied, and any other relevant deductions or adjustments.

Fill out your TX AP-228-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX AP-228-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.