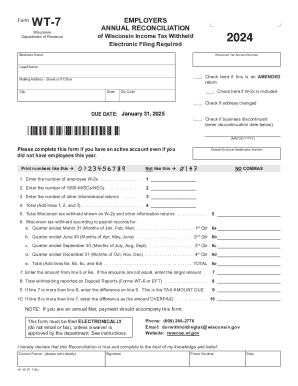

WI DoR WT-7 2020 free printable template

Get, Create, Make and Sign wisconsin wt 7

How to edit wisconsin wt 7 online

Uncompromising security for your PDF editing and eSignature needs

WI DoR WT-7 Form Versions

How to fill out wisconsin wt 7

How to fill out WI DoR WT-7

Who needs WI DoR WT-7?

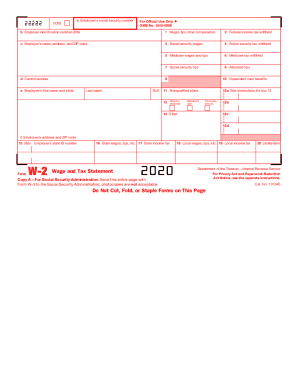

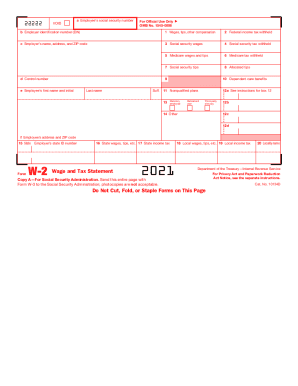

Instructions and Help about wisconsin wt 7

Let's get started with filing and paying withholding tax First choose your withholding tax account The form WT-6 deposit reports and form WT-7annual reconciliations are shown on separate tabs Annual filers do not need to file a form WT-6 To file form WT-6 select 'File'for the period We recommend paying by direct debit from checking or savings account It's the easiest most secure way to pay Click File-slash-Pay and choose your preferred payment option Your previous payment sources if saved Willie listed on the payment screen Select the account you want to use or enter anew payment source You can save this bank information as your default for future payments Today's date is entered as the payment date You can change the payment date to any future date up to the due date for the report Enter the tax withheld from employees forth selected filing period The tax amount is automatically entered Ashe payment amount Confirm the amount and submit the payment After you submit and agree the information you reported is correct you'll see a confirmation page To file a Zero Report or to file with nonpayment select File Zero Report or Pay Later If you don't have withholding for the period check the File Zero Report box and click 'Submit' If you need to make a payment after filing your report select File for the period Select Pay Only then choose your payment method To file form WT-7 click the WT-7 Reconciliation tab and select File WT7 If you are a business with an annual filing frequency for withholding tax this is the only withholding return you will file forth year Enter the number of wage statements and information returns for the year then choose how you will file them If you select the My Tax Account option you must manually enter the information for each statement If your business generates a textile through your software or a PDF on the Social Security Administration's website select File Transfer and follow the link provided in the help bubble Wage statements and information returns may only be mailed to the department if there are fewer than 10 This limit applies to wage statements and information returns separately For example if you have 10 W-2's and 9 1099'you must electronically file the W-2s However you would not be subject to penalties if you mailed the 1099s Enter the total amount of tax withheld then the quarterly amounts The 'Total withholding reported' line shows any differences between the quarterly amounts of withholding reported to the department and what you entered on the WT-7 After you submit and agree the information you reported is correct you'll see a confirmation page If there was tax due you can make a payment from the Confirmation page If there is an overpayment we will refund it after verifying the wage statements and information returns Please note — if you file form WT-6 and formWT-7 reconciliation on the same day you may see an amount due on the WT-7 until the payments withdrawn from your bank account Continue to video 5 to...

People Also Ask about

What is the Wisconsin withholding form?

Who is exempt from Wisconsin withholding?

What is a Wisconsin WT 6 form for?

What is Wisconsin tax form WT 7?

Are tax rates changing in 2023?

What is the income tax rate for 2023?

What are the tax rates for Wisconsin 2023?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the wisconsin wt 7 in Gmail?

Can I edit wisconsin wt 7 on an iOS device?

How do I complete wisconsin wt 7 on an Android device?

What is WI DoR WT-7?

Who is required to file WI DoR WT-7?

How to fill out WI DoR WT-7?

What is the purpose of WI DoR WT-7?

What information must be reported on WI DoR WT-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.