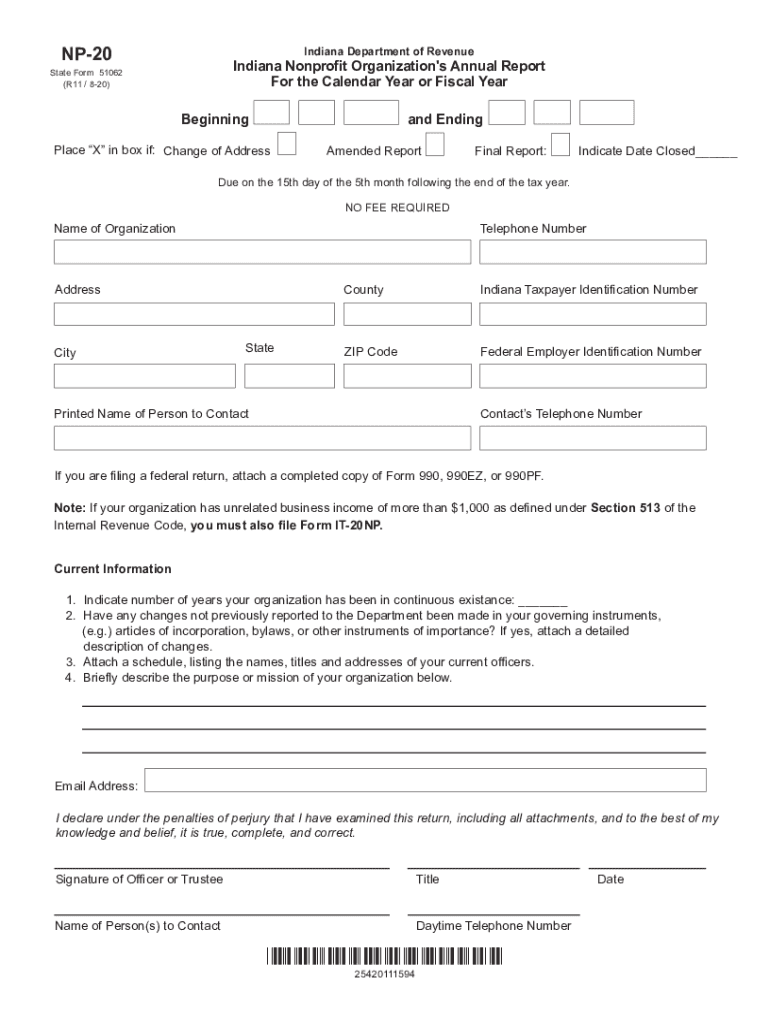

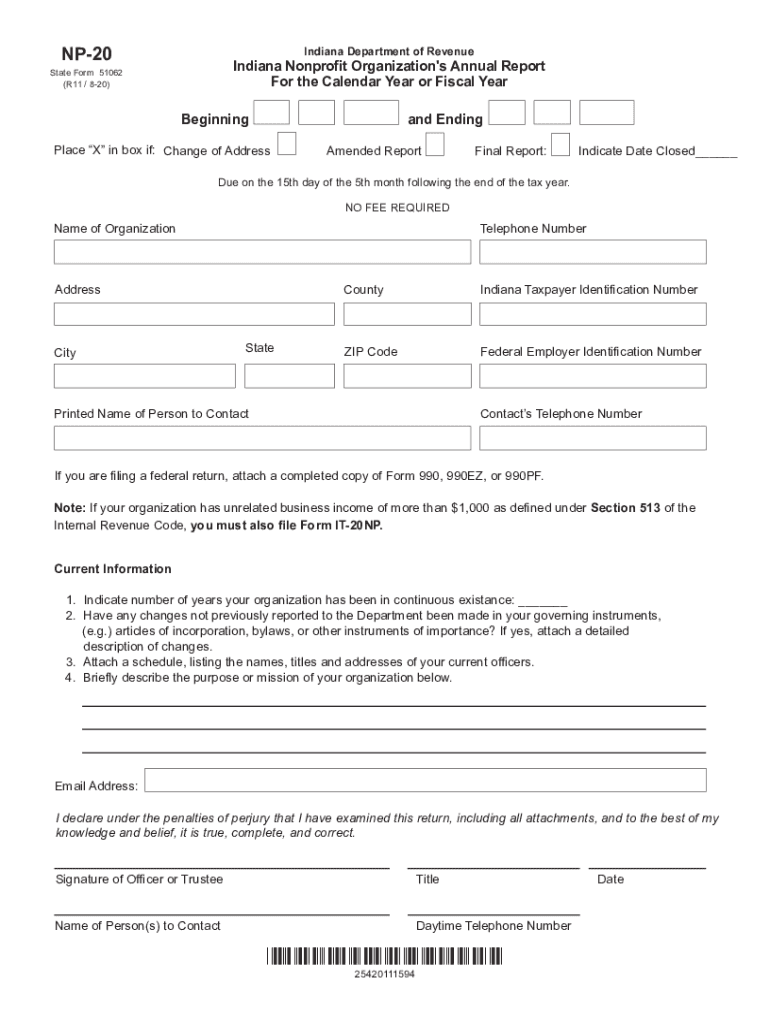

IN DoR NP-20 2020 free printable template

Get, Create, Make and Sign IN DoR NP-20

Editing IN DoR NP-20 online

Uncompromising security for your PDF editing and eSignature needs

IN DoR NP-20 Form Versions

How to fill out IN DoR NP-20

How to fill out IN DoR NP-20

Who needs IN DoR NP-20?

Instructions and Help about IN DoR NP-20

TEST TEST TEST TEST TEST CAPTIONING PERFORMED BY VITAC THE COMMITTEE WILL COME TO ORDER GOOD MORNING EVERYONE THIS IS THE SEVENTH IN A SERIES OF PUBLIC HEARINGS THE COMMITTEE WILL BE HOLDING AS PART OF THE HOUSE OF REPRESENTATIVES IMPEACHMENT INQUIRY WITHOUT OBJECTION THE CHAIR IS AUTHORIZED TO DECLARE A RECESS OF THE COMMITTEE AT ANY TIME WE WILL PROCEED TODAY IN THE SAME FASHION AS OUR OTHER HEARINGS I'LL MAKE AN OPENING STATEMENT AND THEN RANKING MEMBER NUNES WILL HAVE AN OPPORTUNITY TO MAKE A STATEMENT AND WE WILL TURN TO OUR WITNESSES FOR THEIR OPENING STATEMENTS AND TO QUESTIONS FOR AUDIENCE MEMBERS WE WELCOME YOU AND RESPECT YOUR INTEREST IN BEING HERE IT IS THE INTENTION OF THE COMMITTEE TO PROCEED WITHOUT DISRUPTIONS I'LL TAKE ALL NECESSARY AND APPROPRIATE STEPS TO MAINTAIN ORDER AND ENSURE THAT THE COMMITTEE IS RUN IN ACCORDANCE WITH HOUSE RULES I RECOGNIZE MYSELF TO GIVE AN OPENING STATEMENT IN THE IMPEACHMENT INQUIRY INTO DONALD J TRUMP THE 45th PRESIDENT OF THE UNITED STATES YESTERDAY MORNING THE COMMITTEE HEARD FROM AMBASSADOR GORDON SONDLAND THE AMERICAN AMBASSADOR TO THE EUROPEAN UNION THE DE FACTO LEADER OF THE THREE AMIGOS WHO HAD REGULAR ACCESS TO PRESIDENT DONALD TRUMP AND PRESSED THE NEW UKRAINIAN PRESIDENT FOR TWO INVESTIGATIONS TRUMP BELIEVED WOULD HELP HIS RE-ELECTION CAMPAIGN THE FIRST INVESTIGATION WAS OF A DISCREDITED CONSPIRACY THEORY THAT UKRAINE AND NOT RUSSIA WAS RESPONSIBLE FOR INTERFERING IN OUR 2016 ELECTION THE SECOND INVESTIGATION WAS INTO THE POLITICAL RIVAL TRUMP APPARENTLY FEARED MOST JOE BIDEN TRUMP SOUGHT TO WEAKEN BIDEN AND REFUTE THE FACT THAT HIS OWN ELECTION HAD BEEN HELPED BY A RUSSIAN HACKING AND DUMPING INITIATIVE TRUMP SCHEME'S STOOD IN AND SET BACK ANTI-CORRUPTION EFFORTS IN UKRAINE IN CONDITIONING A MEETING WITH ZELENSKY AND MILITARY AID AND SECURING AN INVESTIGATION OF HIS RIVAL TRUMP PUT HIS PERSONAL AND POLITICAL INTERESTS ABOVE THE UNITED STATES AS AMBASSADOR SONDLAND WOULD LATER TELL DAVID HOLMES IMMEDIATELY AFTER SPEAKING TO THE PRESIDENT TRUMP DID NOT GIVE AN EXPLETIVE ABOUT UKRAINE HE CARES ABOUT BIG STUFF THAT BENEFITS HIM LIKE THE BIDEN INVESTIGATION THAT GIULIANI WAS PUSHING DAVID HOLMES IS HERE WITH US TODAY HE IS A FOREIGN SERVICE OFFICER CURRENTLY SERVING AS THE POLITICAL COUNSELOR AT THE US AMBASSADOR IN KIEV ALSO WITH US IS FIONA HILL DR HILL LEFT THE NS CLRKS IN JULY AFTER MORE THAN TWO YEARS IN THAT POSITION DR HILL AND MR HOLMES PROVIDE A UNIQUE PERSPECTIVE ON ISSUES RELATING TO UKRAINE DR HILL FROM WASHINGTON DC AND MR HOLMES FROM ON THE GROUND IN KYIV DR HILL BECAME CONCERNED ABOUT THE PRESENCE OF GIULIANI WHO WAS ASSERTING QUITE FRANKLY IN PUBLIC APPEARANCE THAT HE HAD BEEN GIVEN SOME AUTHORITY OVER MATTERS IN UKRAINE HER BOSS JOHN BOLTON WAS PAYING ATTENTION AS WELL AS HOLMES AT THE US EMBASSY IN KYIV BOLTON VIEWED GIULIANI HAS A HAND GRENADE THAT IS GOING TO BLOW EVERYBODY ELSE AND WAS POWERLESS TO...

People Also Ask about

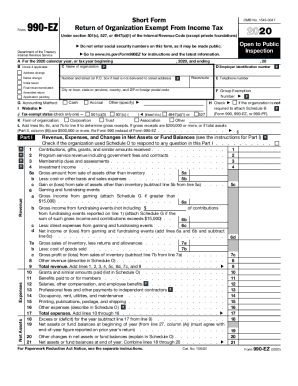

What is the ST 103 form Indiana?

What is a ST 105 form Indiana?

What is Indiana residency for tax purposes?

What states have no state income tax?

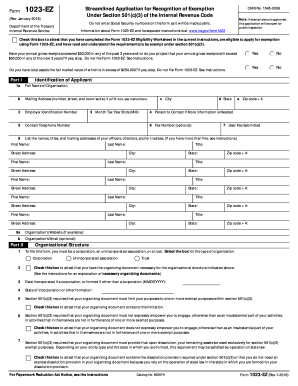

How do I get a tax exempt number in Indiana?

What is an NP-20 for in Indiana?

What is the state tax in Indiana?

How much tax is taken out of my paycheck Indiana?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IN DoR NP-20 online?

How do I fill out the IN DoR NP-20 form on my smartphone?

Can I edit IN DoR NP-20 on an Android device?

What is IN DoR NP-20?

Who is required to file IN DoR NP-20?

How to fill out IN DoR NP-20?

What is the purpose of IN DoR NP-20?

What information must be reported on IN DoR NP-20?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.