IN DoR NP-20 2012 free printable template

Show details

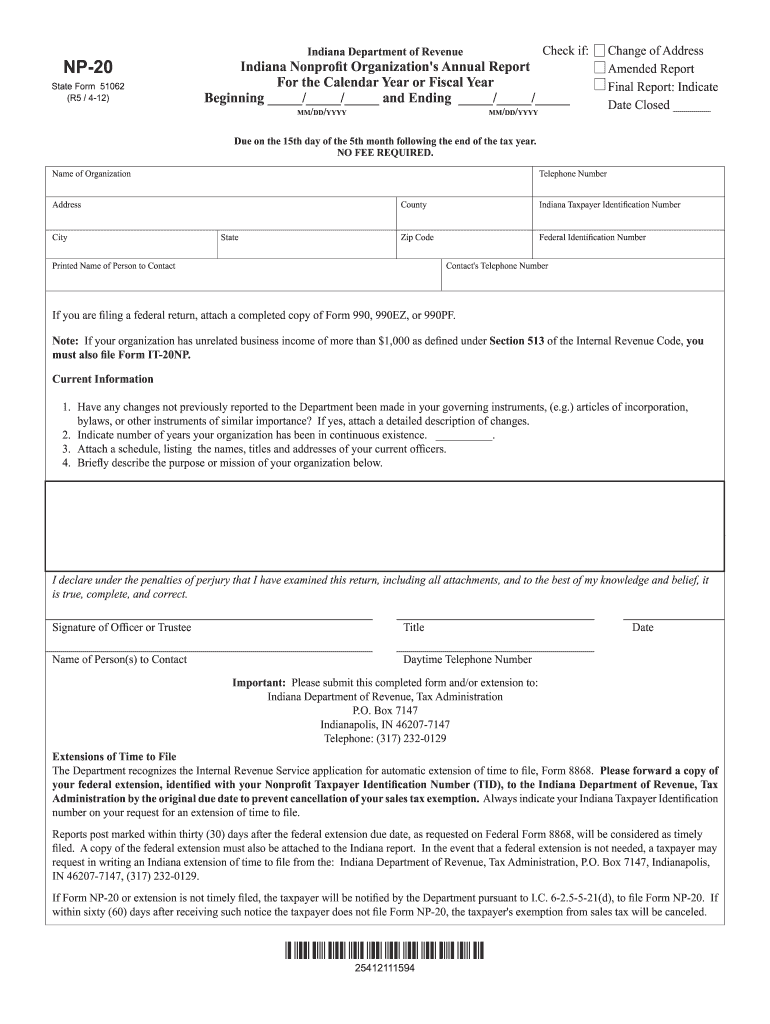

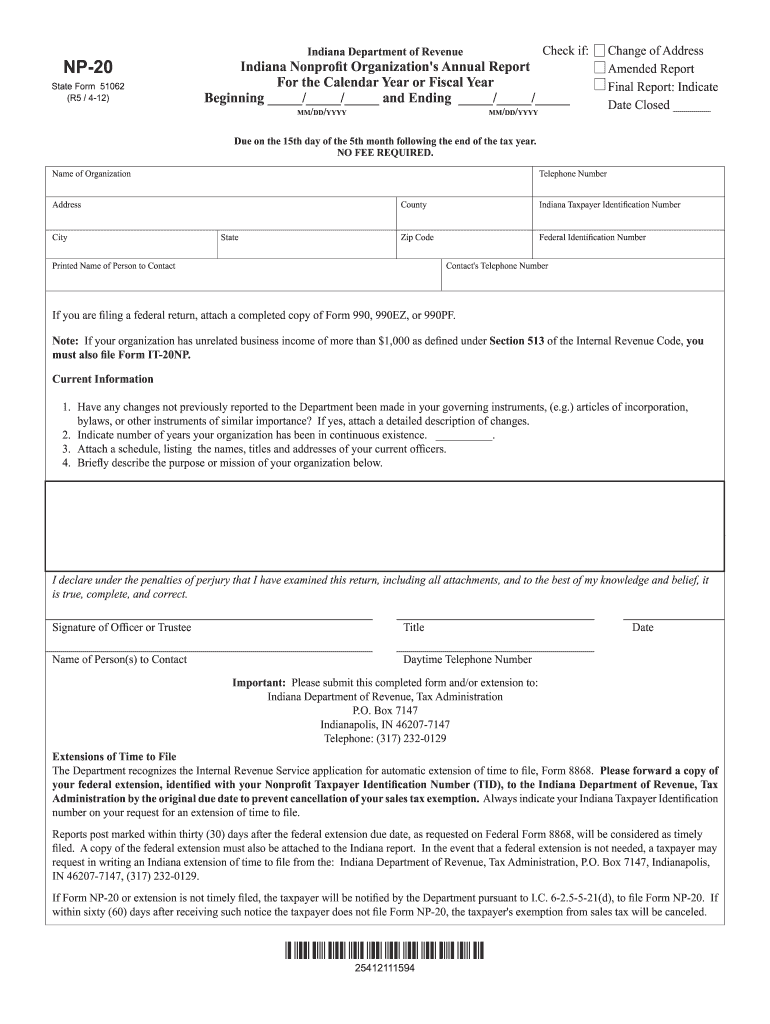

O. Box 7147 Indianapolis IN 46207-7147 317 232-0129. If Form NP-20 or extension is not timely filed the taxpayer will be notified by the Department pursuant to I. NP-20 State Form 51062 R5 / 4-12 Check if Indiana Department of Revenue Indiana Nonprofit Organization s Annual Report For the Calendar Year or Fiscal Year Beginning // and Ending // mm/dd/yyyy Change of Address Amended Report Final Report Indicate Date Closed Due on the 15th day of the 5th month following the end of the tax year....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN DoR NP-20

Edit your IN DoR NP-20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN DoR NP-20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN DoR NP-20 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IN DoR NP-20. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DoR NP-20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN DoR NP-20

How to fill out IN DoR NP-20

01

Obtain the IN DoR NP-20 form from the official Indiana Department of Revenue website or your local office.

02

Fill in your personal information in the designated fields, including your name, address, and taxpayer identification number.

03

Provide details about your income sources, ensuring to include any applicable deductions or credits.

04

Review the instructions provided on the form carefully to ensure all sections are completed accurately.

05

If applicable, attach any necessary supporting documents that corroborate your income and deductions.

06

Double-check all entries for accuracy and completeness before signing the form.

07

Submit the completed form to the Indiana Department of Revenue by the specified deadline, either online or via mail.

Who needs IN DoR NP-20?

01

Individuals or businesses who are required to report their income and taxes to the Indiana Department of Revenue.

02

Taxpayers seeking to file their income tax returns in the state of Indiana.

03

Any resident or non-resident earning income from Indiana sources.

Fill

form

: Try Risk Free

People Also Ask about

Is it Indiana or Indianapolis?

Indianapolis (/ˌɪndiəˈnæpəlɪs/), colloquially known as Indy, is the state capital and most populous city of the U.S. state of Indiana and the seat of Marion County.

Is Indiana is a state?

Indiana became a state on Dec. 11, 1816, when President James Madison signed the congressional resolution admitting Indiana to the Union. Indiana is the 19th state.

Is Indiana a state or city?

When a visitor hailed a pioneer cabin in Indiana or knocked upon its door, the settler would respond, "Who's yere?" And from this frequent response Indiana became the "Who's yere" or Hoosier state. No one ever explained why this was more typical of Indiana than of Illinois or Ohio.

Is Indiana a state or a city?

Indiana was admitted to the Union on December 11, 1816, as the 19th state, with generally the same boundary as the present state.

What is the form of government of Indianapolis Indiana?

City government The city of Indianapolis utilizes a strong mayor and city council system. In this form of municipal government, the city council serves as the city's primary legislative body while the mayor serves as the city's chief executive.

What is the state of Indiana called?

In summary RankStateState revenue per capita34Nevada7,25135Indiana7,82836Florida7,11137New Mexico10,35739 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IN DoR NP-20 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your IN DoR NP-20 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send IN DoR NP-20 to be eSigned by others?

To distribute your IN DoR NP-20, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the IN DoR NP-20 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IN DoR NP-20 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is IN DoR NP-20?

IN DoR NP-20 is a tax form used for reporting income and financial transactions for non-profit organizations in India.

Who is required to file IN DoR NP-20?

Non-profit organizations, including charitable trusts and societies, that are registered under Indian law and have income above a certain threshold are required to file IN DoR NP-20.

How to fill out IN DoR NP-20?

To fill out IN DoR NP-20, organizations must provide details about their income, expenditures, and activities, including relevant financial statements and supporting documents.

What is the purpose of IN DoR NP-20?

The purpose of IN DoR NP-20 is to ensure transparency and accountability in the financial reporting of non-profit organizations, as well as to facilitate government oversight.

What information must be reported on IN DoR NP-20?

IN DoR NP-20 requires reporting of income sources, expenditure details, donations received, financial position, and activities undertaken by the organization during the reporting period.

Fill out your IN DoR NP-20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN DoR NP-20 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.