CA PERS-BSD-369-D 2008 free printable template

Show details

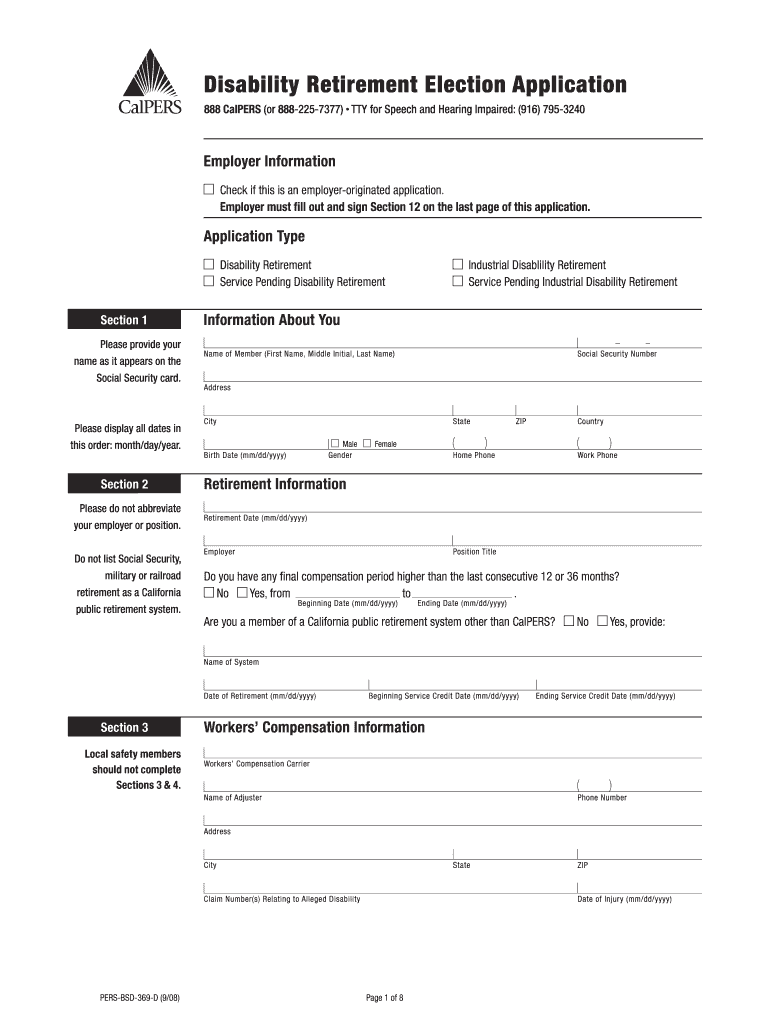

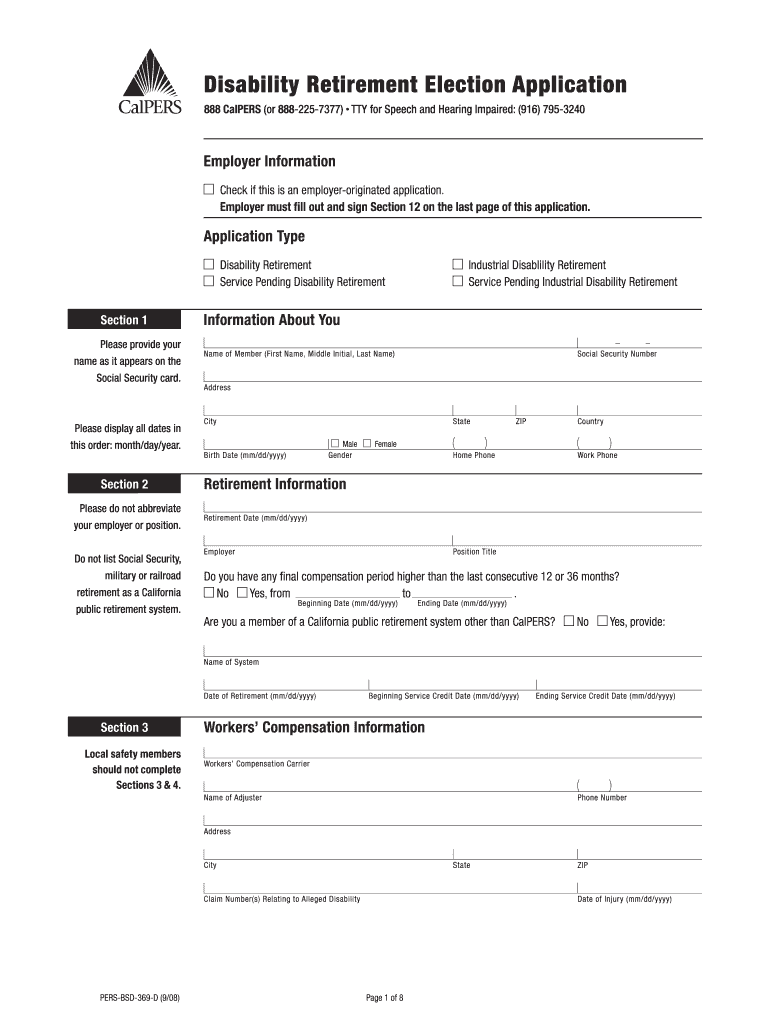

Disability Retirement Election Application 888 CalPERS or 888-225-7377 TTY for Speech and Hearing Impaired 916 795-3240 Employer Information Check if this is an employer-originated application. Employer must ll out and sign Section 12 on the last page of this application. Application Type Service Pending Disability Retirement Section 1 Industrial Disablility Retirement Information About You Social Security Number Please provide your name as it appears on the Name of Member First Name Middle...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA PERS-BSD-369-D

Edit your CA PERS-BSD-369-D form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA PERS-BSD-369-D form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA PERS-BSD-369-D online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA PERS-BSD-369-D. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA PERS-BSD-369-D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA PERS-BSD-369-D

How to fill out CA PERS-BSD-369-D

01

Gather necessary personal information, including your Social Security number, date of birth, and contact information.

02

Obtain the CA PERS-BSD-369-D form from the appropriate California PERS (Public Employees' Retirement System) website or office.

03

Complete the 'Member Information' section with your personal and employment details.

04

Fill out the 'Beneficiary Information' section, indicating your chosen beneficiaries for any applicable benefits.

05

Review the 'Service Information' section, detailing your employment history and any service credit you wish to claim.

06

Sign and date the form at the end, verifying that all information provided is accurate.

07

Submit the completed form either online, by mail, or in person to the appropriate PERS office, following the submission guidelines provided.

08

Keep a copy of the completed form for your records.

Who needs CA PERS-BSD-369-D?

01

Any California public employee or retiree who is applying for retirement benefits or needs to update beneficiary information.

02

Individuals planning to claim service credit or make adjustments related to their retirement plan.

03

Employees seeking to ensure their retirement documentation is current and accurate.

Fill

form

: Try Risk Free

People Also Ask about

Is disability pension more than regular pension?

Benefit Amount However, your disability benefit is never less than 85% of the normal retirement benefit you earn up to the effective date of your disability benefit. Your disability retirement benefit is calculated using only the basic employer contributions you earn up to your disability pension effective date.

What is the difference between disability retirement and regular retirement CalPERS?

CalPERS is a defined benefit plan. We provide monthly benefits based upon a member's years of service, age, and highest compensation. Disability retirement is a monthly retirement allowance payable to the member for life, or until recovery from the disabling injury or illness.

What percentage of disability retirement do you get from CalPERS?

If your employer has an agreement for the improved disability retirement (Government Code section 21427), your Unmodified Allowance will be 30 percent of your final compensation for the first five years of service credit, plus 1 percent for each additional year, to a maximum of 50 percent .

Is CalPERS disability retirement taxable income?

Are CalPERS disability retirement benefits taxable? CalPERS reports all non-industrial disability retirement as ordinary income, meaning that it is generally going to be subject to both Federal (IRS) and State (California) income Tax.

What is the CalPERS disability and survivor benefits division?

The Disability & Survivor Benefits Division (DSBD) administers the processing of survivor and disability benefits for CalPERS members, which includes adjudicating disability retirement and industrial disability retirement benefit claims and appeals, overseeing the recruitment and screening of Independent Medical

Does CalPERS have disability benefits?

We provide monthly benefits based upon a member's years of service, age, and highest compensation. Disability retirement is a monthly retirement allowance payable to the member for life, or until recovery from the disabling injury or illness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA PERS-BSD-369-D directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your CA PERS-BSD-369-D and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in CA PERS-BSD-369-D?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your CA PERS-BSD-369-D to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the CA PERS-BSD-369-D form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CA PERS-BSD-369-D and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CA PERS-BSD-369-D?

CA PERS-BSD-369-D is a form used by the California Public Employees' Retirement System (CalPERS) to provide specific employment and retirement information regarding members.

Who is required to file CA PERS-BSD-369-D?

Employers participating in the CalPERS retirement system are required to file CA PERS-BSD-369-D for their employees who are members of the system.

How to fill out CA PERS-BSD-369-D?

To fill out CA PERS-BSD-369-D, one must provide accurate employment details, member information, and any necessary supplemental documentation as required by CalPERS.

What is the purpose of CA PERS-BSD-369-D?

The purpose of CA PERS-BSD-369-D is to collect and report important data about CalPERS members' employment status and contributions to ensure accurate retirement benefits.

What information must be reported on CA PERS-BSD-369-D?

Information that must be reported includes the member's personal details, employment history, retirement plan participation, and any other relevant data required by CalPERS.

Fill out your CA PERS-BSD-369-D online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA PERS-BSD-369-D is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.