Cost Of Goods Sold Analysis free printable template

Show details

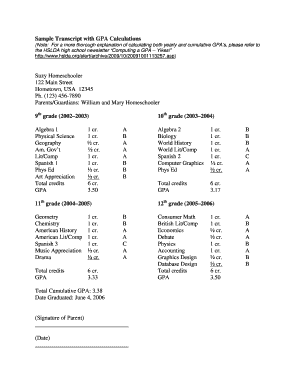

Company Name Inventory/Cost of Goods Sold Analysis Date Dark gray cells will be calculated for you. You do not need to enter anything into them. Product A Inventory unit analysis: Number of units

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Cost Of Goods Sold Analysis

Edit your Cost Of Goods Sold Analysis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Cost Of Goods Sold Analysis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Cost Of Goods Sold Analysis online

Use the instructions below to start using our professional PDF editor:

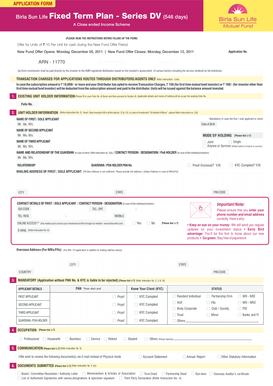

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Cost Of Goods Sold Analysis. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Cost Of Goods Sold Analysis

How to fill out Cost Of Goods Sold Analysis

01

Gather data on beginning inventory at the start of the period.

02

Add purchases made during the period to the beginning inventory.

03

Subtract ending inventory at the end of the period from the total obtained in the previous step.

04

Calculate the Cost of Goods Sold (COGS) using the formula: COGS = Beginning Inventory + Purchases - Ending Inventory.

05

Review and analyze the calculated COGS in relation to sales and revenue.

Who needs Cost Of Goods Sold Analysis?

01

Businesses that manufacture or sell physical products.

02

Accountants and financial analysts for financial reporting.

03

Management teams for financial planning and analysis.

04

Investors and stakeholders for assessing business performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Cost Of Goods Sold Analysis to be eSigned by others?

Once your Cost Of Goods Sold Analysis is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the Cost Of Goods Sold Analysis electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your Cost Of Goods Sold Analysis.

How do I edit Cost Of Goods Sold Analysis on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Cost Of Goods Sold Analysis on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Cost Of Goods Sold Analysis?

Cost of Goods Sold Analysis (COGS Analysis) is the process of evaluating and understanding the direct costs attributable to the production of goods sold by a company. This analysis helps in determining the profitability of a business by providing insights into production efficiency and cost management.

Who is required to file Cost Of Goods Sold Analysis?

Businesses that sell products are required to file a Cost of Goods Sold Analysis. This typically includes corporations, partnerships, and sole proprietorships that maintain inventory or sell identifiable products in the course of their business operations.

How to fill out Cost Of Goods Sold Analysis?

To fill out a Cost of Goods Sold Analysis, businesses must gather data on their inventory, including the beginning inventory, purchases during the year, and ending inventory. The formula to calculate COGS typically follows: COGS = Beginning Inventory + Purchases - Ending Inventory. This calculated figure is then reported in the financial statements.

What is the purpose of Cost Of Goods Sold Analysis?

The purpose of Cost of Goods Sold Analysis is to calculate the total cost incurred by a company to produce the goods that it sells. Understanding COGS is crucial for determining gross profit, pricing strategies, and overall financial performance.

What information must be reported on Cost Of Goods Sold Analysis?

The information that must be reported in a Cost of Goods Sold Analysis includes the value of beginning inventory, total purchases during the accounting period, and the value of ending inventory. Additionally, it is important to disclose the costs associated with producing or acquiring inventory.

Fill out your Cost Of Goods Sold Analysis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Of Goods Sold Analysis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.