KS Homestead or Property Tax Refund for Homeowners 2020 free printable template

Show details

2020Homestead or

Property Tax

Refund for

Homeowners

For a fast refund,

file electronically!

See back cover for details.ks revenue. General INFORMATION

Filing a Claim

Homestead refunds

are not available

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS Homestead or Property Tax Refund

Edit your KS Homestead or Property Tax Refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS Homestead or Property Tax Refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

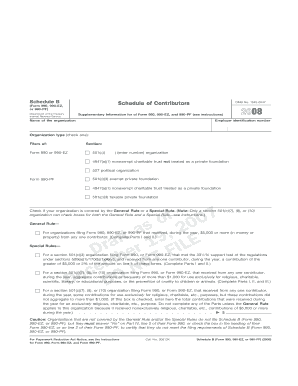

Editing KS Homestead or Property Tax Refund online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KS Homestead or Property Tax Refund. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS Homestead or Property Tax Refund for Homeowners Form Versions

Version

Form Popularity

Fillable & printabley

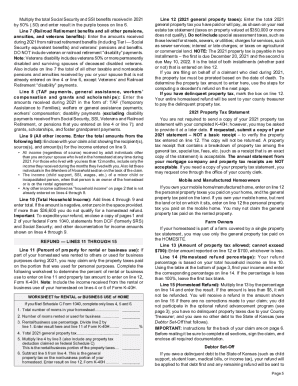

How to fill out KS Homestead or Property Tax Refund

How to fill out KS Homestead or Property Tax Refund for Homeowners

01

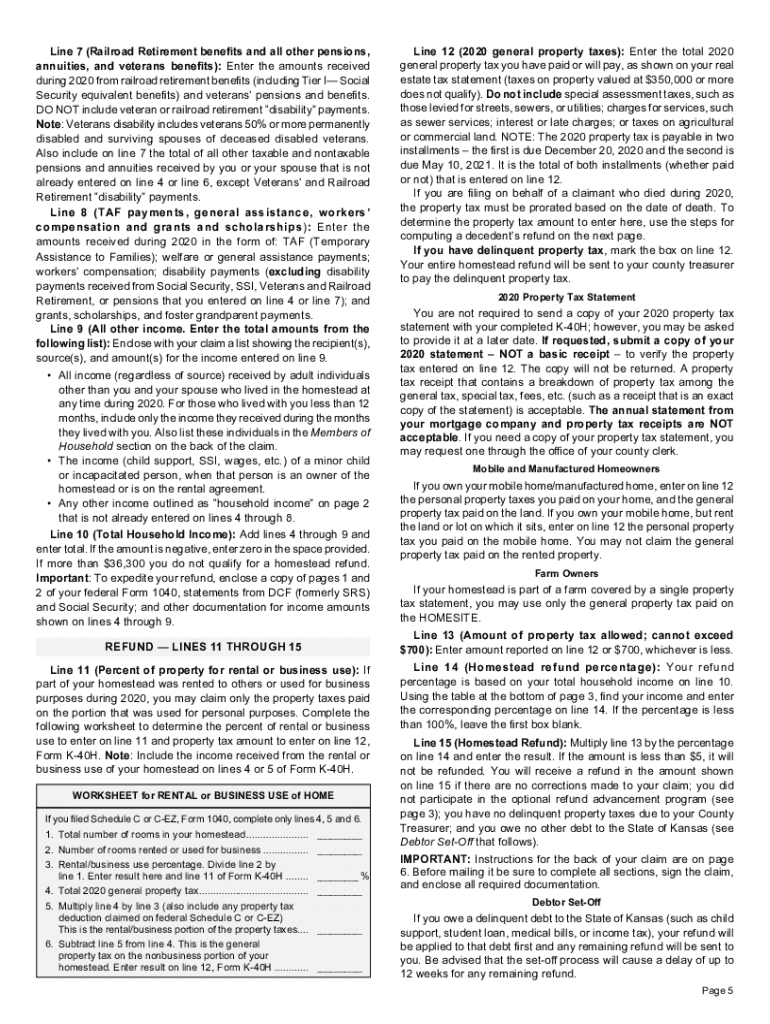

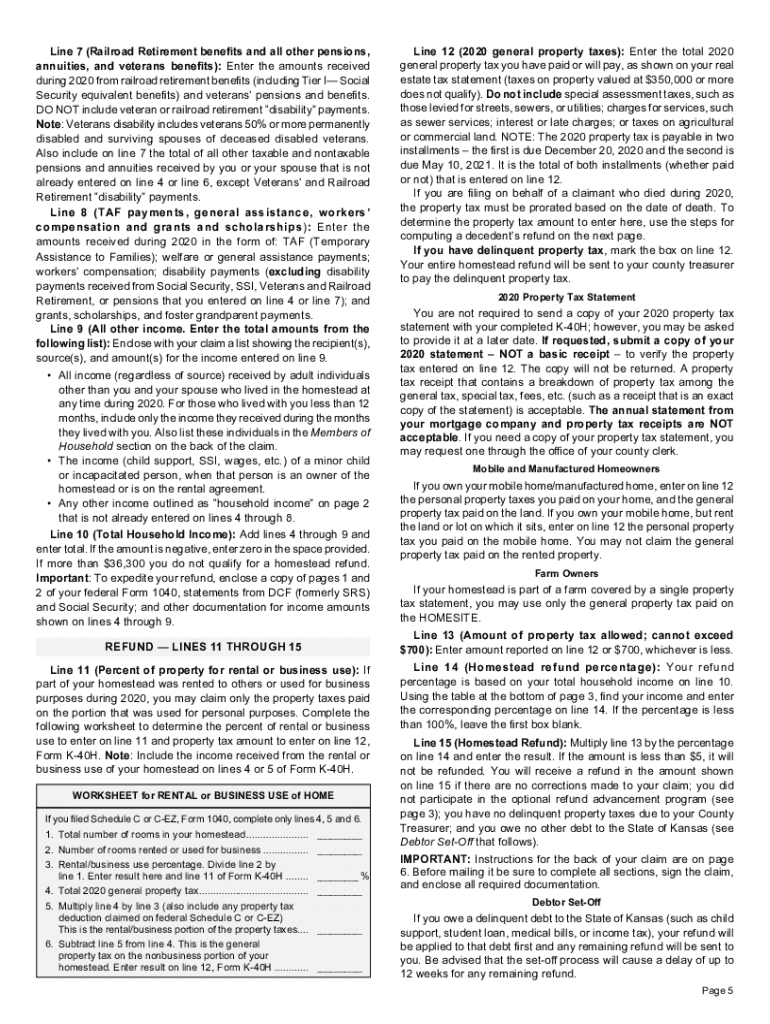

Gather necessary documents such as your 2022 income tax return, property tax statement, and proof of homestead status.

02

Visit the Kansas Department of Revenue's website to download the KS Homestead or Property Tax Refund application form.

03

Complete the application form with accurate information, including your personal details, income, and property information.

04

Calculate your total household income and ensure it falls within the qualifying limits for the refund.

05

Attach any required documentation to your application, such as copies of your tax return and property tax statements.

06

Review the application for accuracy and completeness before submission.

07

Submit your application by mail or online as instructed on the form, ensuring you meet the submission deadline.

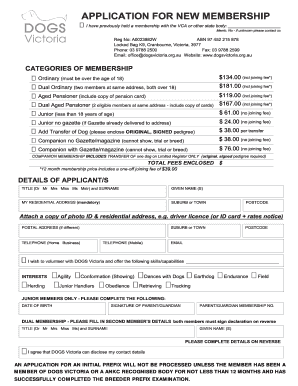

Who needs KS Homestead or Property Tax Refund for Homeowners?

01

Homeowners in Kansas who have a low to moderate income and have paid property taxes on their homestead.

02

Those who meet the eligibility requirements based on income and property ownership.

03

Senior citizens, disabled individuals, or any qualifying homeowners who may benefit from property tax assistance.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for homestead in Kansas?

The Homestead Refund Program is for homeowners who were residents of Kansas ALL of 2021. As a Kansas resident the entire year, you are eligible if your total household income is $36,600 or less and you: Were born before January 1, 1966, or. Were blind or totally and permanently disabled all of 2021, or.

Who is exempt from Kansas income tax?

If your federal adjusted gross income is $75,000 or less, regardless of your filing status, your social security benefits are exempt from Kansas income tax.

How long does it take for Kansas tax refund?

Generally, if the return was completed correctly. taxpayers expecting refunds that filed electronically can expect a deposit within 10 to 14 business days. Taxpayers expecting a refund that filed using a paper form should allow at least 16 to 20 weeks to receive a refund back by mail.

Does Kansas offer homestead exemption?

To claim a Homestead refund you must have been a Kansas resident all of 2021 and had an income of $36,600 or less. You must also meet one of the following three requirements: You were born before January 1, 1966; OR. You must have been blind or totally and permanently disabled all of 2021, regardless of your age; OR.

How do you file for homestead in Kansas?

Kansas Homestead claims (K-40H) and Kansas Property Tax Relief claims (K-40PT) can be filed using our electronic Webfile system. This filing method is safe and secure and you could get your refund faster if you use the direct deposit option! Only one claim can be filed per Household.

How to file Kansas homestead tax return?

The Homestead Claim (K-40H) and the Property Tax Relief Claim for Low Income Seniors (K-40PT) may be filed electronically through Kansas WebFile or IRS e-File. Both filing methods are safe and secure and you will get your refund faster if you use the direct deposit option!

What is homestead refund in Kansas?

The Homestead Refund is a rebate of a portion of the property taxes paid on a Kansas resident's homestead. Your refund percentage is based on your total household income. The refund is a percentage of your general property tax excluding specials. Tax on property valued at more than $350,000 does not qualify.

What is considered a homestead in Kansas?

What is Homestead Property? Your homestead in Kansas can be any real and personal property, including your home, manufactured home, or mobile home. Kansas has no property value maximum that can be designated homestead.

Who qualifies for Kansas Homestead refund?

The refund is based on a portion of the property tax paid on a Kansas resident's home. The maximum refund is $700. To qualify you must be a Kansas resident, living in Kansas the entire year. Your total household income must be $36,600 or less.

How do I claim homestead in Kansas?

Kansas Homestead claims (K-40H) and Kansas Property Tax Relief claims (K-40PT) can be filed using our electronic Webfile system. This filing method is safe and secure and you could get your refund faster if you use the direct deposit option! Only one claim can be filed per Household.

How much is homestead refund in Kansas?

The refund is 75% of the 2021 general property tax paid or to be paid - as shown on the 2021 real estate tax statement for the residence in which the claimant lived in 2021. The 2021 property tax consists of the 1st half which is due December 20, 2021 and the 2nd half which is due May 10, 2022.

How long does Kansas Homestead refund?

Normal processing time for a refund is 20 to 24 weeks. You may check on the status of your current year Homestead refund claim at Kansas Department of Revenue - Home page and click Check My Refund. You may also visit the refund status application directly by clicking here.

Do seniors get a property tax break in Kansas?

The SAFESR property tax relief claim (K-40PT) allows a refund of property tax for low income senior citizens that own their home. The refund is 75% of the property taxes actually and timely paid on real or personal property used as their principal residence.

What does homestead mean in Kansas?

What is Homestead Property? Your homestead in Kansas can be any real and personal property, including your home, manufactured home, or mobile home. Maximum Property Value That Can Be Designated Homestead. Kansas has no property value maximum that can be designated homestead.

At what age do you stop paying property taxes in Kansas?

Senior Citizens and Disabled Individuals For example, Kansas has a Safe Senior property tax exemption, which provides tax relief to homeowners who are at least 65 years old and meet income qualifications. Some homeowners may also be granted relief if they can prove that they have a disability.

How long can you go without paying property taxes in Kansas?

Delinquent real estate taxes not paid within 3 years are referred to the Legal Department for foreclosure action, thus putting the property in jeopardy of being sold at auction.

Who qualifies for homestead exemption in Kansas?

To qualify you must be a Kansas resident, living in Kansas the entire year. Your total household income must be $36,600 or less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in KS Homestead or Property Tax Refund without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit KS Homestead or Property Tax Refund and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit KS Homestead or Property Tax Refund on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign KS Homestead or Property Tax Refund right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit KS Homestead or Property Tax Refund on an Android device?

You can make any changes to PDF files, like KS Homestead or Property Tax Refund, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is KS Homestead or Property Tax Refund for Homeowners?

The KS Homestead or Property Tax Refund for Homeowners is a program in Kansas that provides financial assistance to eligible homeowners to help reduce the burden of property taxes.

Who is required to file KS Homestead or Property Tax Refund for Homeowners?

Homeowners in Kansas who meet certain income and residency requirements are required to file for the KS Homestead or Property Tax Refund.

How to fill out KS Homestead or Property Tax Refund for Homeowners?

To fill out the KS Homestead or Property Tax Refund, homeowners need to complete the appropriate application form and provide documentation on their income, property taxes paid, and residency status.

What is the purpose of KS Homestead or Property Tax Refund for Homeowners?

The purpose of the KS Homestead or Property Tax Refund for Homeowners is to provide financial relief to eligible homeowners by refunding a portion of the property taxes they have paid.

What information must be reported on KS Homestead or Property Tax Refund for Homeowners?

Homeowners must report their total income, the amount of property taxes paid, and their residency status when filing for the KS Homestead or Property Tax Refund.

Fill out your KS Homestead or Property Tax Refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS Homestead Or Property Tax Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.