KS Homestead or Property Tax Refund for Homeowners 2024-2025 free printable template

Show details

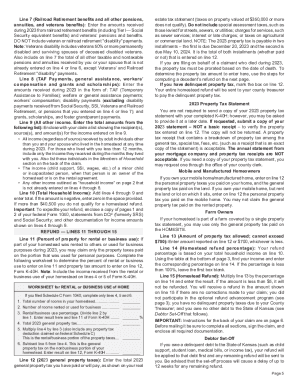

The K-40H form allows Kansas homeowners to apply for a rebate on property taxes paid on their homestead. To qualify, claimants must have been residents of Kansas for the entire year of 2024, and meet specific income and age criteria. The form outlines the necessary instructions for filing, eligibility requirements, and provides information about other related claims for property tax relief.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign kansas homestead tax refund form

Edit your 2024 ks homestead form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2024 kansas homestead form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas homestead refund online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ks homestead tax refund form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS Homestead or Property Tax Refund for Homeowners Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2024 homestead form printable

How to fill out KS Homestead or Property Tax Refund for Homeowners

01

Gather necessary documents: Collect proof of income, property tax statements, and identification.

02

Determine eligibility: Ensure you meet the income limits and residence requirements.

03

Obtain the application form: Download the KS Homestead or Property Tax Refund application from the state website or visit a local office.

04

Complete the application: Fill out the form with required personal information, including your name, address, and income details.

05

Provide supporting documents: Attach any required documentation, such as income verification and property tax receipts.

06

Review your application: Double-check all information for accuracy and completeness.

07

Submit the application: Send your completed application and documents to the appropriate state agency by the deadline.

Who needs KS Homestead or Property Tax Refund for Homeowners?

01

Homeowners in Kansas who meet specific income and residency requirements may need the KS Homestead or Property Tax Refund.

02

Individuals with low to moderate income who pay property taxes may benefit from this refund program.

03

Senior citizens, disabled homeowners, and certain veterans also qualify for the homestead refund.

Fill

ks homestead refund

: Try Risk Free

People Also Ask about 2024 kansas homestead pdf

How do you qualify for homestead in Kansas?

You must have been a resident of Kansas the entire year of 2022 and own your home and had an income of $50,000 or less. Age 65 or over for the entire year. A disabled veteran for the entire year. The surviving spouse of a claimant who was either a disabled veteran or person 65 years of age or older for the entire year.

What is a Kansas homestead refund?

The Homestead Refund is a rebate program for the property taxes paid by homeowners. The refund is based on a portion of the property tax paid on a Kansas resident's home. The maximum refund is $700. To qualify you must be a Kansas resident, living in Kansas the entire year.

What is Form K 40PT?

K-40PT Property Tax Relief Claim for Low Income Seniors Rev. 7-20.

What is the homestead exemption in Kansas?

The Kansas homestead exemption allows homeowners to protect an unlimited amount of value in their homes if they file for bankruptcy. Most people want to know whether they can keep valuable property before filing for bankruptcy—especially a home.

Who qualifies for homestead refund in Kansas?

The refund is based on a portion of the property tax paid on a Kansas resident's home. The maximum refund is $700. To qualify you must be a Kansas resident, living in Kansas the entire year. Your total household income must be $37,750 or less.

What is the Kansas Homestead Act?

The Homestead Act was one way settlers acquired land in Kansas and other parts of the west. It was signed into law by President Abraham Lincoln on May 20, 1862. Under the provisions of the Homestead Act, settlers could claim 160 acres of public land.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024 ks homestead form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your homestead tax credit kansas along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I sign the 2024 kansas homestead online electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your ks refund homeowners in minutes.

How do I edit 2024 homestead form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 2024 homestead tax form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is KS Homestead or Property Tax Refund for Homeowners?

The KS Homestead or Property Tax Refund for Homeowners is a financial program in Kansas that provides property tax refunds to eligible homeowners based on their property taxes paid and income levels.

Who is required to file KS Homestead or Property Tax Refund for Homeowners?

Homeowners in Kansas who meet certain income and residency requirements, including those who paid property taxes on their homestead, are required to file for the KS Homestead or Property Tax Refund.

How to fill out KS Homestead or Property Tax Refund for Homeowners?

To fill out the KS Homestead or Property Tax Refund application, homeowners need to gather required documents, complete the application form with accurate personal and property information, and submit it to the appropriate state agency by the deadline.

What is the purpose of KS Homestead or Property Tax Refund for Homeowners?

The purpose of the KS Homestead or Property Tax Refund for Homeowners is to provide financial relief to eligible homeowners by refunding a portion of their property taxes, particularly to assist low-income residents.

What information must be reported on KS Homestead or Property Tax Refund for Homeowners?

Homeowners must report their personal information, including name, address, Social Security number, as well as income, and details of the property taxes paid. Additional information regarding dependents and previous refunds may also be required.

Fill out your kansas homestead refund form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2024 Kansas Homestead Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.