Get the free dividend warrant sample form

Show details

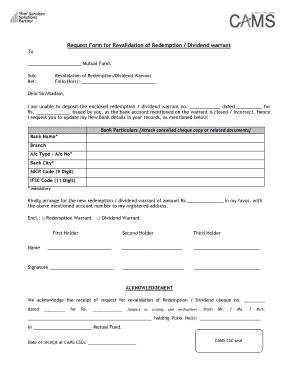

Request Form for Revalidation of Redemption / Dividend warrant To Mutual Fund. Sub: Ref: Revalidation of Redemption/Dividend Warrant Folio No(s): Dear Sir/Madam, I am unable to deposit the enclosed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dividend warrant sample form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dividend warrant sample form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dividend warrant sample online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit dividend warrant example form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out dividend warrant sample form

How to fill out a dividend warrant sample:

01

Obtain a dividend warrant sample form from your financial institution or company issuing the dividends. This form may also be available online.

02

Fill in your personal information accurately, including your full name, address, and contact details. This will ensure that the dividend payment reaches you correctly.

03

Provide your shareholder or investor identification number, if applicable. This number helps to identify you as a shareholder and ensures that the dividend payment is allocated to the correct account.

04

Indicate the dividend payment period for which you are requesting the warrant. This is usually a specific period of time, such as a quarter or fiscal year.

05

Specify the number of shares you own for which you are entitled to receive dividends. This information can usually be found on your shareholder or investment account statement.

06

Calculate the total amount of dividend payment due to you based on the number of shares owned and the dividend per share. This calculation may already be provided on the sample form, or you may need to perform it manually.

07

Sign and date the dividend warrant form to validate your request for payment. Make sure to read any additional instructions or disclaimers on the form before signing.

08

Submit the filled-out dividend warrant form to the appropriate department or address indicated on the form. This may involve mailing it back, dropping it off in person, or submitting it electronically, depending on the instructions provided.

Who needs a dividend warrant sample?

01

Shareholders or investors who are entitled to receive dividend payments from their investments need a dividend warrant sample. This sample form serves as a template to fill out and request the payment of dividends.

02

Financial institutions or companies that issue dividends to their shareholders may also use a dividend warrant sample as a standard form for their shareholders to fill out. This ensures that the necessary information is provided for accurate and timely dividend payments.

03

Individuals or organizations responsible for managing shareholder or investor accounts may use dividend warrant samples as a reference or tool to assist their clients in correctly filling out the necessary forms. This helps streamline the dividend payment process and avoids potential errors or delays.

Fill prepare specimen dividend warrant interest warrant 12th hsc project : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file dividend warrant format?

Dividend warrants are usually issued by companies or other entities that have issued dividends to shareholders. The entity responsible for issuing the dividend warrants is typically listed on the company’s financial statements or in its dividend announcement.

When is the deadline to file dividend warrant format in 2023?

The deadline to file dividend warrant format in 2023 is typically set by the company depending on the timeline of the dividend payout. Companies typically announce these dates in advance.

What is the purpose of dividend warrant format?

A dividend warrant is a document issued by a company to its shareholders as evidence of their right to receive a dividend payment. It outlines the amount of the dividend, the payment date, and the payment method. The purpose of a dividend warrant is to provide proof to shareholders that they are entitled to receive a payment from the company for their shares. It also serves to remind shareholders of their rights and to ensure that the company pays dividends on time.

What information must be reported on dividend warrant format?

A dividend warrant should include the following information:

1. Company name

2. Date of issue

3. Shareholder's name

4. Shareholder's address

5. Number of shares held

6. Amount of dividend declared

7. Payment method (e.g. check or direct deposit)

8. Bank details (if applicable)

9. Signature of authorized person

10. Date of payment

What is dividend warrant format?

A dividend warrant format is a standardized template or structure used to issue dividends to shareholders of a company. It typically includes the following information:

1. Company name and logo: The name of the company issuing the dividend along with its logo.

2. Dividend warrant number: A unique identification number given to each dividend warrant. This helps in tracking and record-keeping.

3. Shareholder name and address: The name and address of the shareholder who is entitled to receive the dividend payment.

4. Dividend payment date: The date on which the dividend is being issued to the shareholder.

5. Dividend amount: The total amount of dividend being paid to the shareholder.

6. Dividend payment method: Specifies how the dividend will be paid, such as through a check, bank transfer, or electronic payment.

7. Bank details: In case the dividend is being paid through bank transfer, the shareholder's bank account details may be included, including the bank name, branch, account number, and routing number.

8. Dividend declaration and approval: A section stating the declaration and approval of the dividend by the company's management or board of directors.

9. Signatures: The authorized signatures of the company officials responsible for issuing the dividend.

The dividend warrant format may vary slightly depending on the company and the country's regulations governing dividend payments.

How to fill out dividend warrant format?

To fill out a dividend warrant format, follow these steps:

1. Start by entering the name and address of the company issuing the dividend warrant at the top left corner of the form.

2. On the right side of the form, enter the name and address of the shareholder who is receiving the dividend.

3. Below the shareholder's information, enter the dividend warrant number and the dividend payment date.

4. In the "Amount" section, state the amount of dividend being paid to the shareholder. This can be in figures as well as in words to avoid any confusion.

5. Provide a space for the shareholder's signature and date on the form.

6. Below the signature space, add a space for the company's authorized signatory to sign and date the warrant.

7. You may also include a section for any remarks or additional information related to the dividend warrant.

8. Finally, make sure to include the company's bank account details, such as the bank name, branch, and account number, where the shareholder can deposit the warrant for redemption.

9. Review the completed form for accuracy and make copies of the dividend warrant for the company's records.

Note: It is important to consult with legal and financial professionals or use pre-designed templates specific to your jurisdiction to ensure compliance with relevant laws and regulations.

How can I edit dividend warrant sample from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your dividend warrant example form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute dividend warrant format online?

With pdfFiller, you may easily complete and sign dividend warrant format in sri lanka online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in revalidation of dividend warrant letter format without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing transit warrant format pdf and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Fill out your dividend warrant sample form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dividend Warrant Format is not the form you're looking for?Search for another form here.

Keywords relevant to dividend cheque revalidation letter format

Related to sample letter for dividend payment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.