IRS 15268 2020-2025 free printable template

Show details

Www.irs.gov/coronavirusReminder: Millions of Americans who don't usually file a tax return can use the Confiders tool until Nov. 21 to receive their Economic Impact Payment. The free Confiders tool

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 2020 irs form non

Edit your 2020 irs form non form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2020 irs form non form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2020 irs form non online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2020 irs form non. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2020 irs form non

How to fill out IRS 15268

01

Obtain Form 15268 from the IRS website or your local IRS office.

02

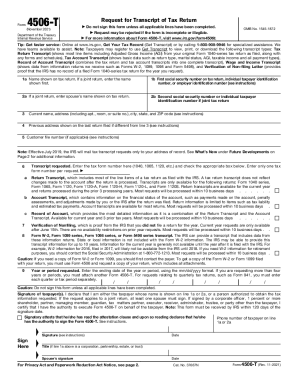

Enter your personal information in the required fields, including your name, address, and Social Security number.

03

Complete the section related to the tax year in question.

04

Provide details about the type of tax return you are filing and any relevant circumstances.

05

Review all information for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form as directed by the IRS, either electronically or by mail.

Who needs IRS 15268?

01

Individuals or businesses who are requesting a tax relief or identification number.

02

Taxpayers who are filing a return and need to disclose specific information for tax relief considerations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a non filers form?

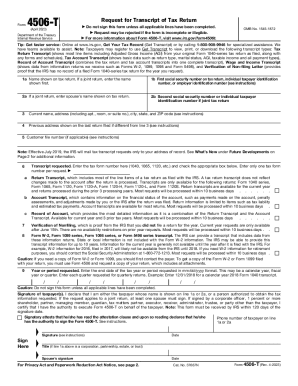

Mail or fax the completed IRS Form 4506-T to the address (or FAX number) provided on page 2 of Form 4506-T. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided on their request within 5 to 10 days.

Can I get a non-filing letter online?

Non-Filing letters are available online via the IRS website, but only if you have created an account prior.

How do I file a non-filer tax return for 2020?

If you cannot use these options, you'll get your payment as a paper check. Step 1: Visit the IRS website to access the Non-filer form. Step 2: Create an account. Step 3: Fill out filing status, claim dependents, and provide banking information. Step 4: Fill out income and personal identification information.

Can I print out a non filer form?

Non Tax filers can request an IRS Verification of Non-filing Letter, free of charge, from the IRS in one of three ways: Online Request: Use the Get Transcript Online tool on the IRS website to view, print, or download a copy of the Tax Return Transcript.

Where can I find my letter 6475?

A: If you did not receive your Letter 6475, you can check Your IRS Online Account to securely access your individual IRS account information. The amount of your third Economic Impact Payment is shown on the Tax Records tab/page under the section “Economic Impact Payment Information”.

Is it too late for non filers to get a stimulus check?

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you don't owe taxes, there is no penalty for filing late.

Can I still file non-filers stimulus check?

States with income tax codes required residents to send in a tax form or fill out an online form in order to claim this payment. Non-filers can use the federal Form 1040 to claim IRS stimulus checks; they can use state tax forms for their state in order to claim any state stimulus credits.

Can I still file as a non-filer for 2020?

Use the form if you are not planning to file a 2018 or 2019 federal tax return and have not received your stimulus payment. Note: On November 21, 2020, the IRS closed the non-filer tool. To claim your stimulus checks, you will need to file a Tax Year 2020 tax return (filed in 2021).

Can I print a non filers form?

Non Tax filers can request an IRS Verification of Non-filing Letter, free of charge, from the IRS in one of three ways: Online Request: Use the Get Transcript Online tool on the IRS website to view, print, or download a copy of the Tax Return Transcript.

Is there an IRS form for non-filers?

Fill out the IRS Non-filer tool if you are not planning to file a 2018 or 2019 federal tax return and have not received your stimulus payment. You are not a: Social Security, including Social Security Disability Insurance (SSDI), or Supplemental Security Insurance (SSI) recipient; OR.

Is there an IRS form for non filers?

USE the IRS Non-filer form if you: Are not required to file a 2020 tax return and are not planning to file one (Learn why you might want to file even if you aren't required to.) Have a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

How do I file 2020 taxes with no income to get stimulus?

Non-Filer, Zero Income: If you have zero or no income and are not normally required to file a tax return, you can file a 2021 Tax Return to claim the 2021 Recovery Rebate Credit plus the 2020 Credit for Stimulus 1 and 2.

Is the non filers form still available?

See Recovery Rebate Credit for more information. The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit.

Can you get a letter of non-filing online?

Non-Filing letters are available online via the IRS website, but only if you have created an account prior.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2020 irs form non without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 2020 irs form non into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in 2020 irs form non without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2020 irs form non and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the 2020 irs form non in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 2020 irs form non and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is IRS 15268?

IRS Form 15268 is a notice provided by the Internal Revenue Service (IRS) that assists taxpayers in obtaining a taxpayer identification number for their foreign entity.

Who is required to file IRS 15268?

Foreign entities applying for a taxpayer identification number that wish to engage in tax reporting or other transactions with the IRS are required to file IRS Form 15268.

How to fill out IRS 15268?

To fill out IRS Form 15268, taxpayers must provide information such as the entity's name, address, and the type of entity, as well as details about the reason for obtaining a taxpayer identification number.

What is the purpose of IRS 15268?

The purpose of IRS Form 15268 is to facilitate the process for foreign entities to apply for a taxpayer identification number in order to comply with U.S. tax requirements.

What information must be reported on IRS 15268?

IRS Form 15268 requires reporting of the entity's name, address, type, and relevant tax identification details, as well as the specific purpose for obtaining a taxpayer identification number.

Fill out your 2020 irs form non online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2020 Irs Form Non is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.