CT DRS CT-1041 2020 free printable template

Show details

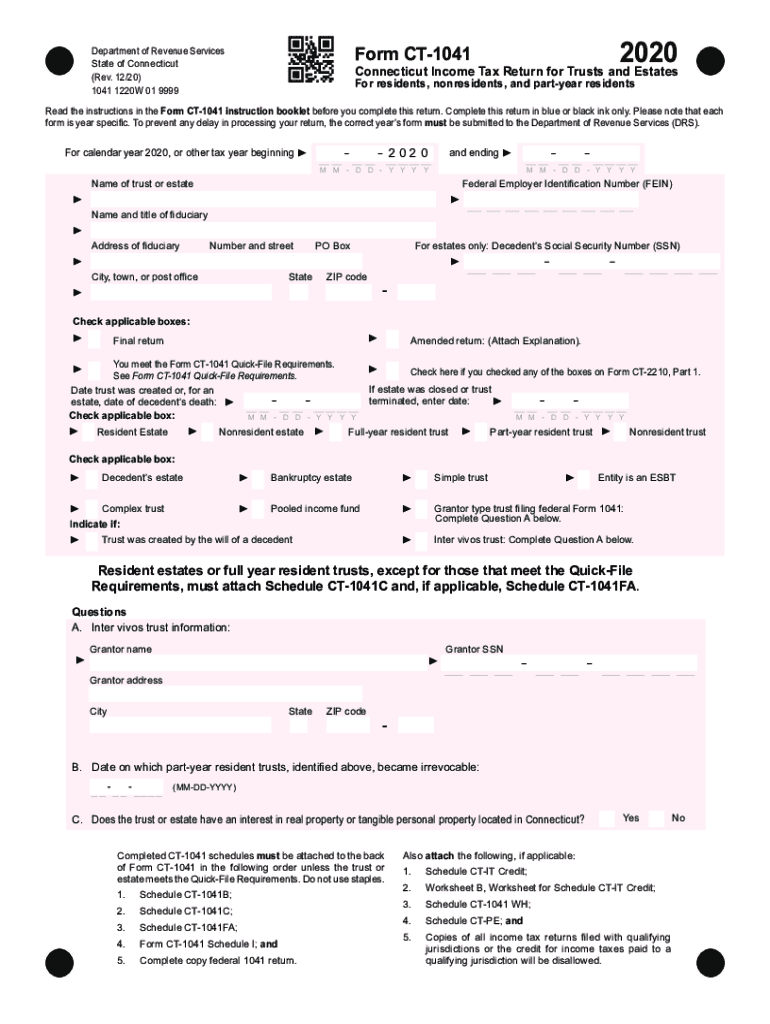

2020Form CT1041Department of Revenue Services

State of Connecticut

(Rev. 12/20)

1041 1220W 01 9999Connecticut Income Tax Return for Trusts and Estates

For residents, nonresidents, and part year residentsRead

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

To edit the CT DRS CT-1041 tax form, consider using pdfFiller, which provides a user-friendly platform for making necessary modifications. You can upload the existing form and utilize the editing tools to input your information accurately. After making changes, ensure to save your work before proceeding to print or submit the form.

How to fill out CT DRS CT-1041

Filling out the CT DRS CT-1041 involves several steps that must be followed to ensure accuracy and compliance. Begin by gathering all necessary information regarding the income, deductions, and credits applicable to your filing. Then, carefully complete each section of the form, ensuring that all data entered is correct and corresponds to supporting documents.

01

Read through the entire form to understand requirements.

02

Gather all pertinent financial documents, including W-2s and 1099s.

03

Input your information in the designated areas of the form.

04

Review all entries for accuracy before finalizing.

05

Save and print the completed form for submission.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

CT DRS CT-1041 is the Connecticut Income Tax Return for Estates and Trusts. This form is specifically designed for estates and trusts to report their income to the Connecticut Department of Revenue Services (DRS). It provides a structured format for declaring income, deductions, and credits applicable to estates and trusts operating in Connecticut.

What is the purpose of this form?

The primary purpose of the CT DRS CT-1041 is to ensure that estates and trusts report their income accurately to meet state tax obligations. Completing this form allows the Connecticut DRS to assess the taxable income generated by the estate or trust during the tax year. This is a crucial step in ensuring compliance with state tax laws, which vary from federal requirements.

Who needs the form?

Estates and trusts needing to file the CT DRS CT-1041 include those that have a gross income exceeding a set threshold. Typically, if the estate or trust generates income beyond $1,000 during the tax year, the fiduciary must file this form. Understanding the criteria for filing is essential to avoid penalties for non-compliance.

When am I exempt from filling out this form?

Filing the CT DRS CT-1041 is not necessary if the estate or trust does not earn any income that meets the state's filing thresholds. Additionally, if the estate was settled with no income generated during the tax year, exemption from filing can apply. It is important to evaluate the financial activities of the estate or trust to determine whether an exemption is applicable.

Components of the form

The CT DRS CT-1041 comprises several components, including sections for reporting income, deductions, and credits. Key sections include gross income calculations, deductions for administrative expenses, and a summary of the taxable income. Careful attention to each part is critical to accurately reflect the financial status of the estate or trust.

01

Gross income section: Report all qualifying income.

02

Deductions section: Include any allowable expenses.

03

Tax computation section: Calculate the tax liability based on net income.

What are the penalties for not issuing the form?

Failure to issue the CT DRS CT-1041 can result in significant penalties. The Connecticut DRS may impose fines for late submissions or non-filing, which can accumulate on a monthly basis until the form is submitted. Additionally, interest may accrue on any unpaid tax balances associated with the return.

What information do you need when you file the form?

When filing the CT DRS CT-1041, you will need specific information, including the estate or trust's taxpayer identification number (TIN), total income earned, and a breakdown of deductible expenses. Supporting documents such as bank statements and other financial records should also be organized to verify the income reported on the form.

Is the form accompanied by other forms?

The CT DRS CT-1041 may need to be submitted alongside various other forms, such as the federal Form 1041, depending on the circumstances of the estate or trust. It is essential to check state requirements to ensure that you are submitting all necessary documents to comply fully.

Where do I send the form?

Once completed, the CT DRS CT-1041 must be mailed to the Connecticut Department of Revenue Services at the address specified in the form's instructions. Ensure that the form is sent well before the due date to avoid penalties associated with late filing.

See what our users say