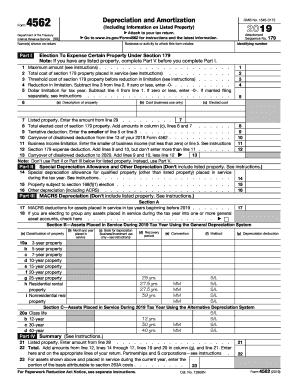

IRS 4562 2020 free printable template

Get, Create, Make and Sign IRS 4562

Editing IRS 4562 online

Uncompromising security for your PDF editing and eSignature needs

IRS 4562 Form Versions

How to fill out IRS 4562

How to fill out IRS 4562

Who needs IRS 4562?

Instructions and Help about IRS 4562

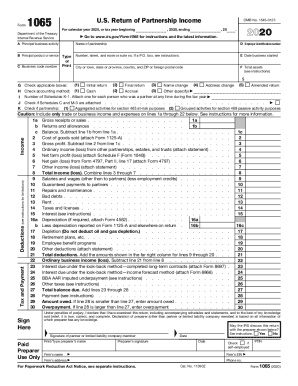

The forms related to assets used in your self-employment work, so the first form will be form 4562 for depreciation and amortization the second form is form 47 97 sale of business property the form 4562 depreciation and amortization is used to report self-employment depreciation and amortization expenses with your Schedule C and personal tax return the firm 4562 is only used in the year depreciation or amortization first Begins for the assets so the year you place these assets in service you will need to report on Form 4562 the total amount of depreciation and amortization then flow to Schedule C as a business expense to be deducted from income now if you did not purchase any assets during the year and place any new assets into use during the air then the total depreciation and amortization expense is simply reported on Schedule C and form 4562 does not need to be included if you sell or otherwise dispose of a business asset during the year then you must complete form 47 97 and report the gain or loss on your individual return line 14 just like your net income or loss from your business to calculate your gain or loss after disposing of an asset used for business you must know your adjusted basis in the asset in general your adjusted basis and any asset begins with its cost basis the cost basis includes the cost you paid to purchase this asset plus any cost to get the asset ready for its intended use in your business which could include shipping cost and installation costs you paid then — all depreciation ever taken on the asset on tax returns from the cost basis which equals the current book value is also called your adjusted basis to calculate the gain or loss the book value is subtracted from the proceeds received for more information on calculating a gain or loss refer to segment 5 talk to sale of business property now let's take a more detailed look at form forty-seven 97 part 1 reports the sale of property held for more than one year part 2 reports ordinary gains and losses which means the assets were not held for more than one year, and we're not given preferential treatment lastly part three reports the calculation of recapturing depreciation which applies to assets with the gain that have taken depreciation expense in the past if we look back at part one on line two I will cover the criteria that is needed to report each asset sale first is a description of the property the date the asset was acquired in the date sold the gross sales price which includes all proceeds you received when you dispose of the asset for any reason all depreciation based on the depreciation rules calculated for that asset now if the actual depreciation you have taken is greater than this amount which could easily occur if you took additional depreciation like section 179 report the actual amount you took here but even if you did not take depreciation as required at a minimum you must report the amount that would have been required the adjusted basis of the...

People Also Ask about

What type of depreciation is used for tax purposes?

What is form 4562 depreciation method?

What is a 4562 used for?

How do you record section 179 depreciation?

What type of depreciation is form 4562?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IRS 4562 without leaving Chrome?

Can I sign the IRS 4562 electronically in Chrome?

Can I create an eSignature for the IRS 4562 in Gmail?

What is IRS 4562?

Who is required to file IRS 4562?

How to fill out IRS 4562?

What is the purpose of IRS 4562?

What information must be reported on IRS 4562?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.