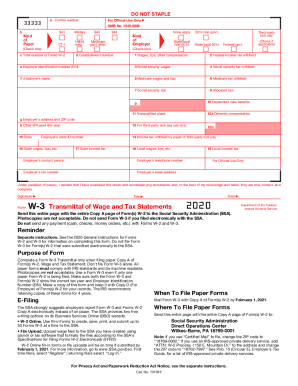

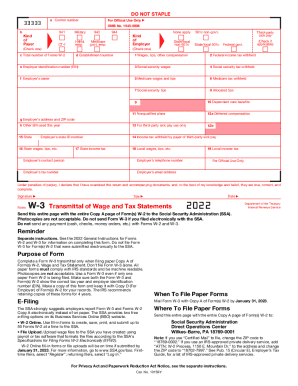

IRS W-3 2021 free printable template

Instructions and Help about IRS W-3

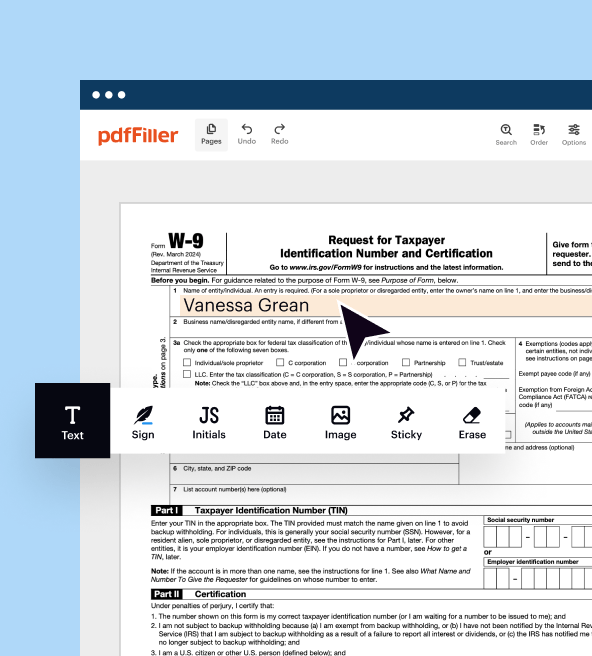

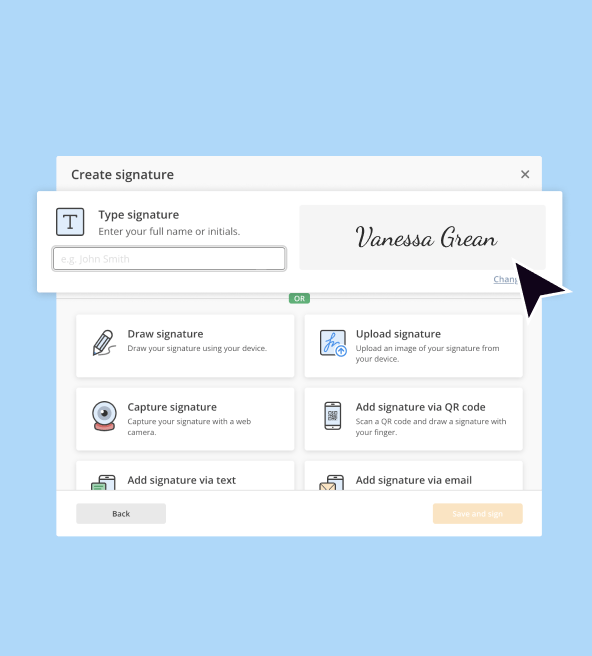

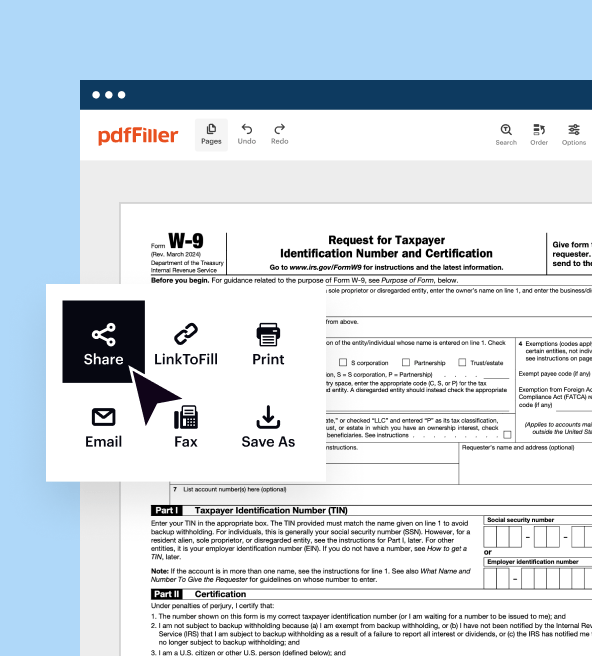

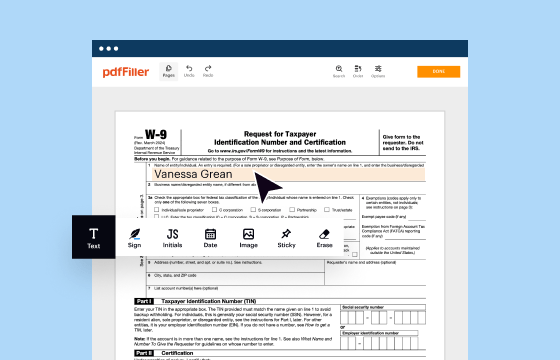

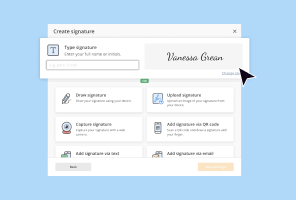

How to edit IRS W-3

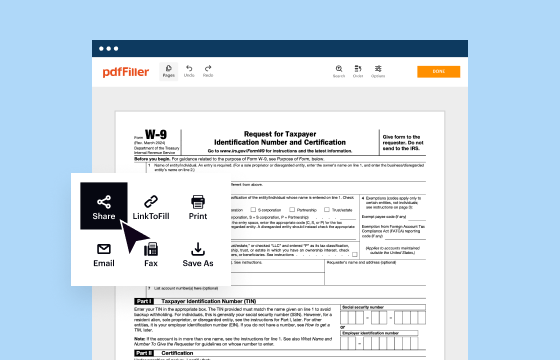

How to fill out IRS W-3

About IRS W-3 2021 previous version

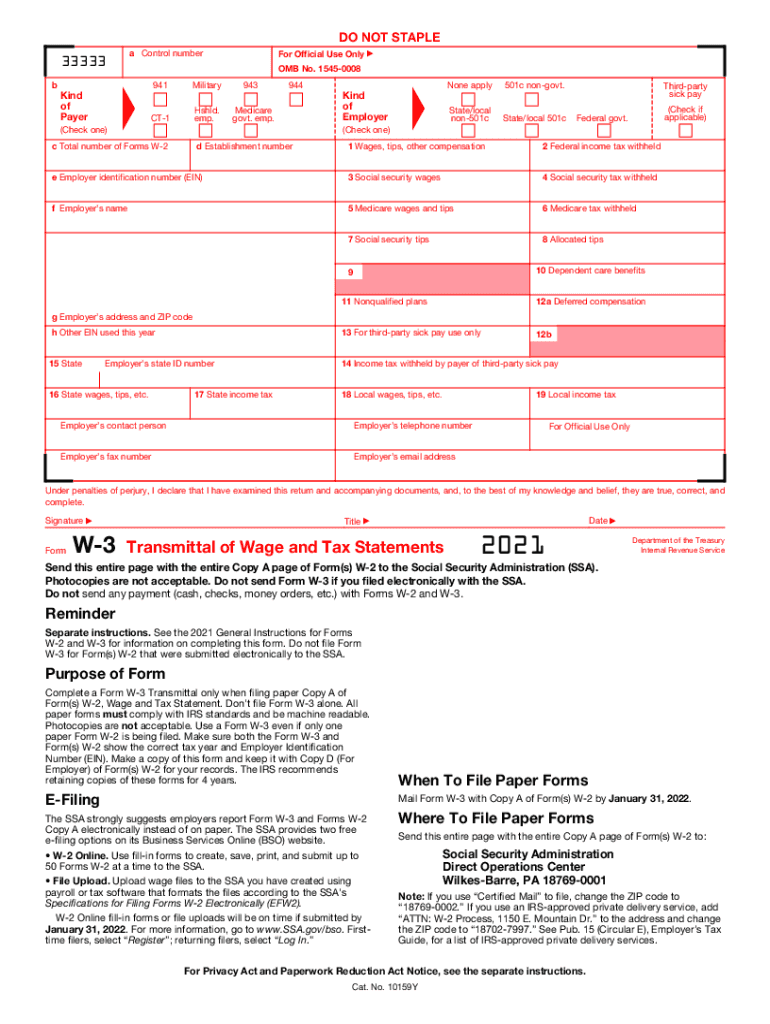

What is IRS W-3?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-3

What should I do if I discover an error on my submitted IRS W-3?

If you find an error on your submitted IRS W-3, you should submit a corrected form as soon as possible. You can do this by filling out a new W-3 and marking it as a 'corrected' submission. It's important to keep records of the original filing and the correction documentation for your records.

How can I verify the receipt of my IRS W-3 submission?

To verify the receipt of your submitted IRS W-3, you can check your e-file status through the IRS e-file site or contact the IRS directly. Keep record of your submission confirmation number, as it can help in tracking the process and resolving any issues that arise.

What are some common errors typically encountered when filing the IRS W-3?

Common errors on the IRS W-3 include incorrect name or identification number mismatches, missing or incorrect totals, and failure to file all required copies. It is essential to double-check all entries and ensure compatibility with filing guidelines to avoid these issues.

What should I do if I receive an IRS notice after submitting my W-3?

If you receive an IRS notice after submitting your W-3, read it carefully to understand the issue. Prepare necessary documentation to respond and address any discrepancies mentioned in the notice. Prompt action can help prevent further complications with your tax records.

Are there specific technical requirements for e-filing the IRS W-3?

Yes, when e-filing the IRS W-3, ensure that your software is compliant with IRS standards. Most modern tax software provides this compatibility, but it’s wise to verify that you are using an updated version and have a reliable internet connection to avoid issues during submission.

See what our users say