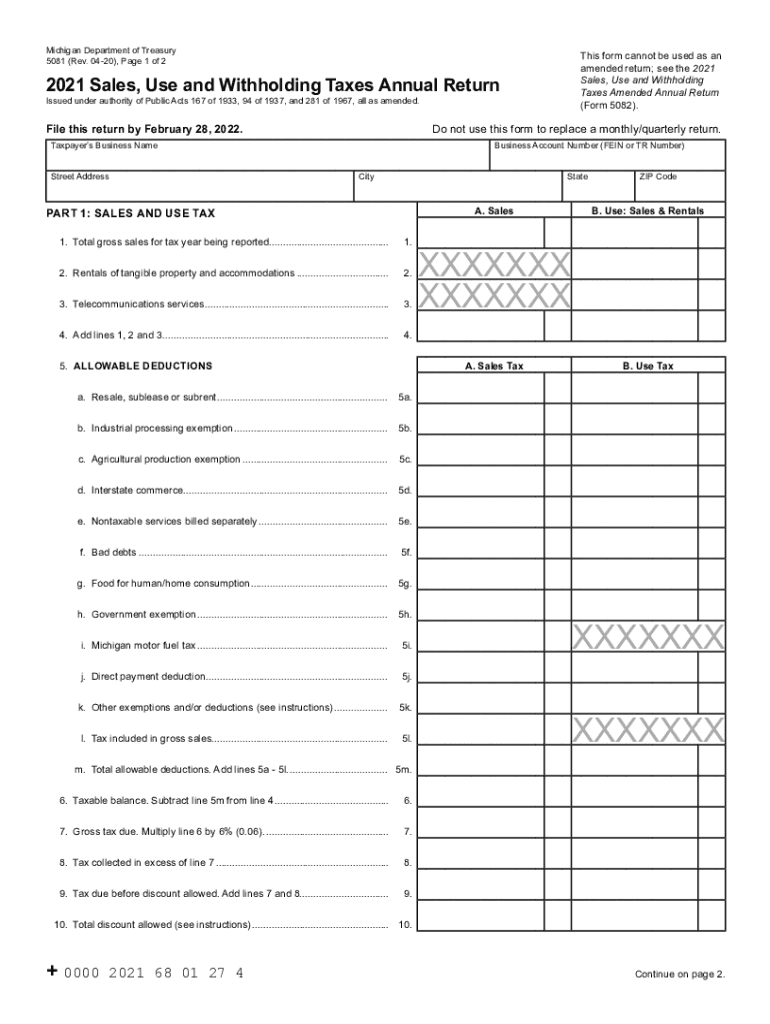

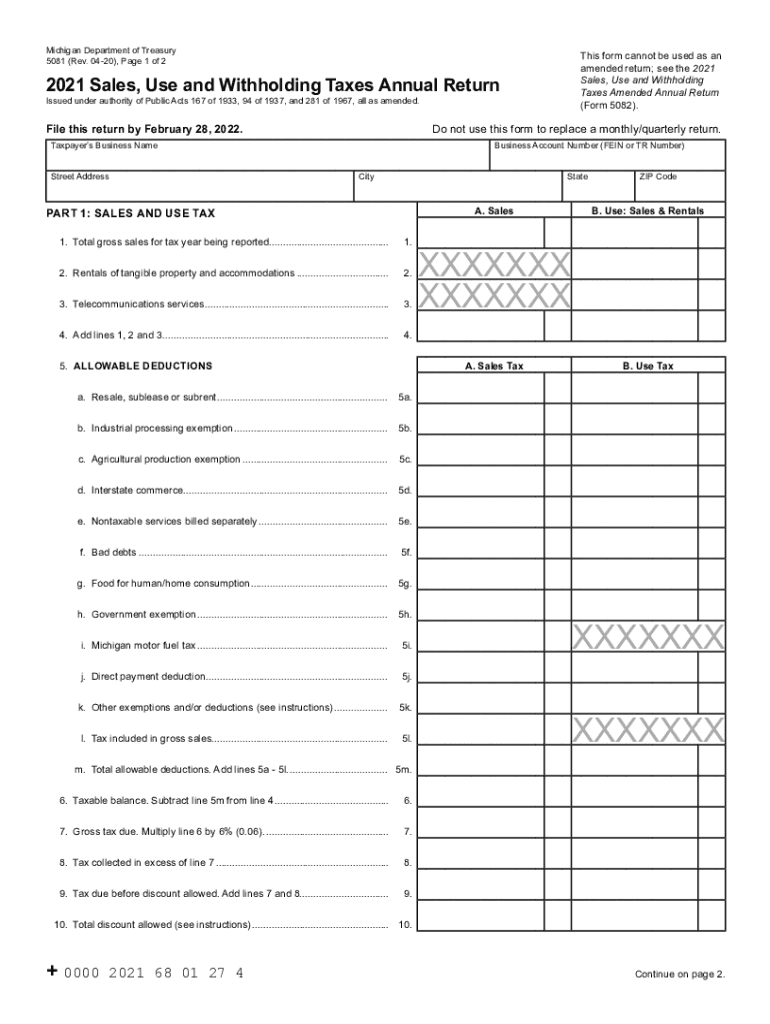

MI 5081 2021 free printable template

Show details

Reset Formalism Here to Use Michigan Treasury Online to File Electronically

Michigan Department of Treasury

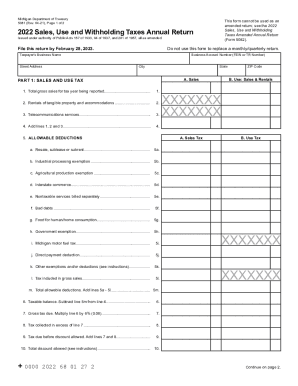

5081 (Rev. 1019), Page 1 of 2This form cannot be used as an

amended return; see the 2020

Sales,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 5081

Edit your MI 5081 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 5081 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI 5081 online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI 5081. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 5081 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 5081

How to fill out MI 5081

01

Obtain the MI 5081 form from the appropriate agency or website.

02

Fill in your personal information including your name, address, and contact details.

03

Provide the relevant identification number as per the instructions.

04

Complete all sections of the form as required, ensuring to follow any specific guidelines.

05

Review the filled form for any errors or omissions.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the form to the appropriate authority, either by mail or electronically if allowed.

Who needs MI 5081?

01

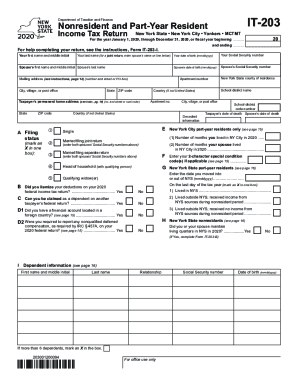

Individuals applying for certain benefits or services that require identification verification.

02

Professionals in specific industries who are mandated to complete the MI 5081 for compliance purposes.

03

Anyone who has been instructed by an agency or organization to complete the MI 5081 for processing their application.

Fill

form

: Try Risk Free

People Also Ask about

What is Michigan tax form 5081?

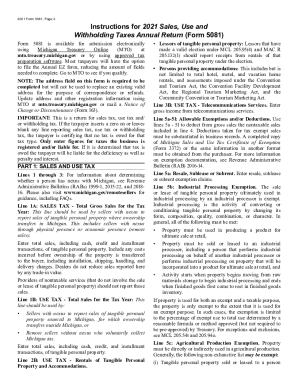

IMPORTANT: This is a return for sales tax, use tax and/ or withholding tax. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use tax or withholding tax, the taxpayer is certifying that no tax is owed for that tax type.

What is mi standard deduction for 2023?

4.1 - Michigan Standard Deduction Unlike many other states, Michigan has no standard deduction. Certain itemized deductions (including property tax, qualified charitable contributions, etc) may be allowed depending on the income level and filing type of the taxpayer.

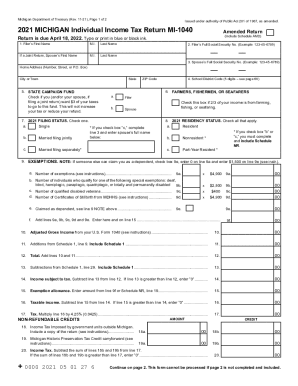

What is Michigan personal exemption for 2023?

Individual Income Tax The tax rate is 4.25% and taxpayers receive a personal exemption of $5,000 per dependent in TY 2022 and is estimated to be $5,300 in TY 2023.

What is Michigan tax withholding for 2023?

Michigan's 2023 withholding guide was released by the state treasury department. The state uses a flat 4.25% tax rate. The value of a state allowance increased to $5,400, up from $5,000 in 2022, the guide said. The state's taxable limits on pension and retirement benefit payments are also adjusted each year.

What services are exempt from sales tax in Michigan?

Michigan provides an exemption from sales or use tax on machinery or equipment used in industrial processing and in their repair and maintenance. The exemption does not include tangible personal property affixed to and becoming a structural part of real estate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MI 5081 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing MI 5081 right away.

How can I fill out MI 5081 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your MI 5081 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit MI 5081 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MI 5081 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MI 5081?

MI 5081 is a form used by businesses to report certain financial information to the state of Michigan.

Who is required to file MI 5081?

Businesses and organizations operating in Michigan that meet specific criteria related to tax obligations must file MI 5081.

How to fill out MI 5081?

To fill out MI 5081, gather the required financial information, complete each section of the form accurately, and submit it by the specified deadline.

What is the purpose of MI 5081?

The purpose of MI 5081 is to ensure compliance with state tax laws and to provide the Michigan Department of Treasury with accurate financial data for taxation purposes.

What information must be reported on MI 5081?

MI 5081 requires reporting of business income, deductions, and relevant financial transactions as specified by the Michigan Department of Treasury.

Fill out your MI 5081 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 5081 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.