MI 5081 2020 free printable template

Show details

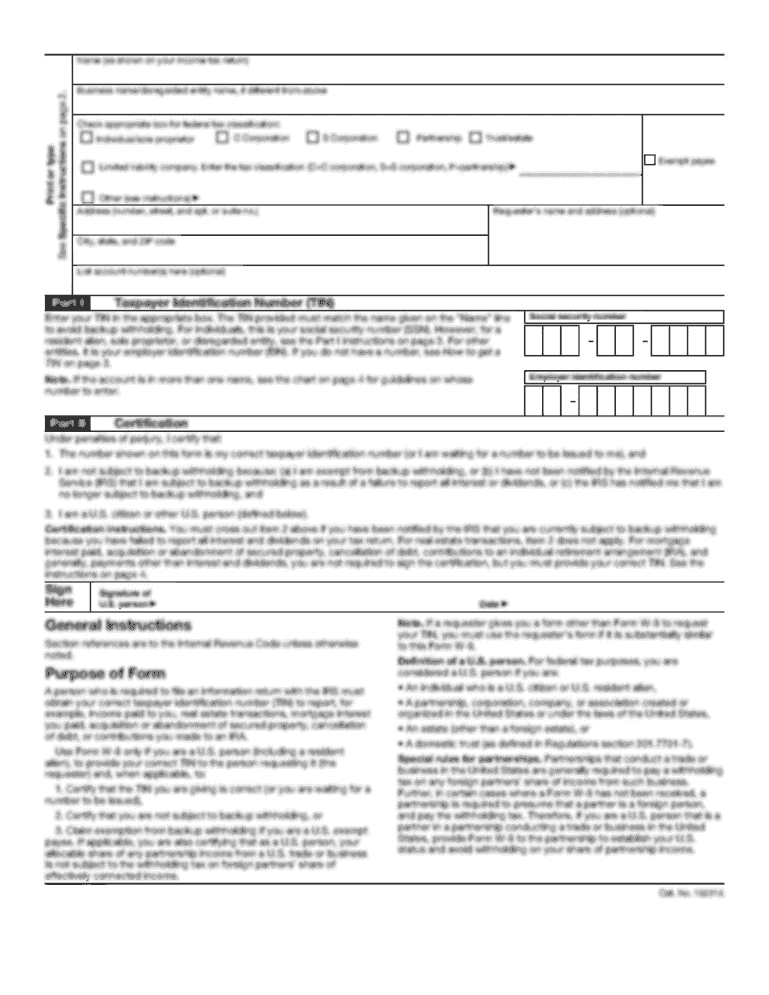

Reset Formalism Here to Use Michigan Treasury Online to File Electronically

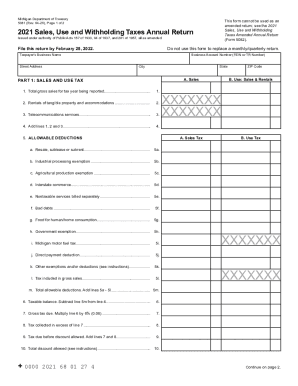

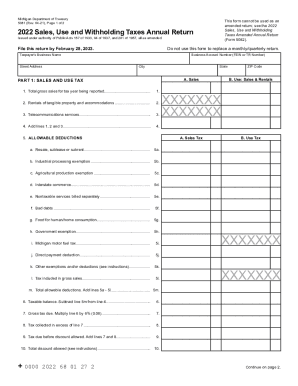

Michigan Department of Treasury

5081 (Rev. 1019), Page 1 of 2This form cannot be used as an

amended return; see the 2020

Sales,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 5081

Edit your MI 5081 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 5081 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI 5081 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI 5081. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 5081 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 5081

How to fill out MI 5081

01

Begin by downloading the MI 5081 form from the official website.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information such as name, address, and contact details in the designated fields.

04

Provide the required details regarding your income and financial situation.

05

Include any additional documentation that may be required as per the form instructions.

06

Review all entered information for accuracy.

07

Sign and date the form where indicated.

08

Submit the form via the specified submission method (mail, online upload, etc.).

Who needs MI 5081?

01

Individuals applying for certain state benefits or assistance programs.

02

People seeking financial aid or support from state agencies.

Fill

form

: Try Risk Free

People Also Ask about

What is the exemption for 2022 MI?

Line 25: Tier 3 Michigan Standard Deduction. Taxpayers who were born during the period January 1, 1953 through January 1, 1956, and reached the age of 67 on or before December 31, 2022, may be eligible for a Tier 3 Michigan Standard Deduction. EXEMPTIONSMAXIMUM INCOME0-1$16,3872$22,0513$27,7204$30,364

What is mi tax rate for 2022?

Michigan Tax Brackets for Tax Year 2022 Michigan is taxed at a flat tax rate of 4.25% for all levels of income.

What is the total use tax for the Michigan form MI-1040?

Use tax of 6% must be paid to the State of Michigan on the total price (including shipping and handling charges) of all taxable items brought into Michigan or purchases through the internet, by mail or by phone from out-of-state retailers that do not collect and remit sales or use tax from their customers.

What is MI-1040 form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

Are 2022 Michigan tax forms available?

The Michigan State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return. Alternatively, you can also only prepare and mail-in a MI state return. The latest deadline for e-filing a Michigan Tax Returns is April 18, 2023.

Who must file a MI tax return?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MI 5081 to be eSigned by others?

Once your MI 5081 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in MI 5081?

The editing procedure is simple with pdfFiller. Open your MI 5081 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit MI 5081 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MI 5081 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MI 5081?

MI 5081 is a form used in the state of Michigan for the reporting and reconciliation of income tax information, particularly related to the Michigan Individual Income Tax.

Who is required to file MI 5081?

Individuals and businesses that have a requirement to report or reconcile their income tax information in Michigan are required to file MI 5081.

How to fill out MI 5081?

To fill out MI 5081, individuals must provide personal identification information, report income details, claim any deductions or credits, and ensure all calculations are accurate before submitting the form to the Michigan Department of Treasury.

What is the purpose of MI 5081?

The purpose of MI 5081 is to provide a formal mechanism for taxpayers in Michigan to report their income and reconcile their tax obligations in accordance with state law.

What information must be reported on MI 5081?

Information that must be reported on MI 5081 includes taxpayer identification details, income sources, deductions, tax credits, and any other relevant financial information related to taxation.

Fill out your MI 5081 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 5081 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.