Get the free Mutual FundPeriodic Investment Plan Request Form - AST Investor ...

Show details

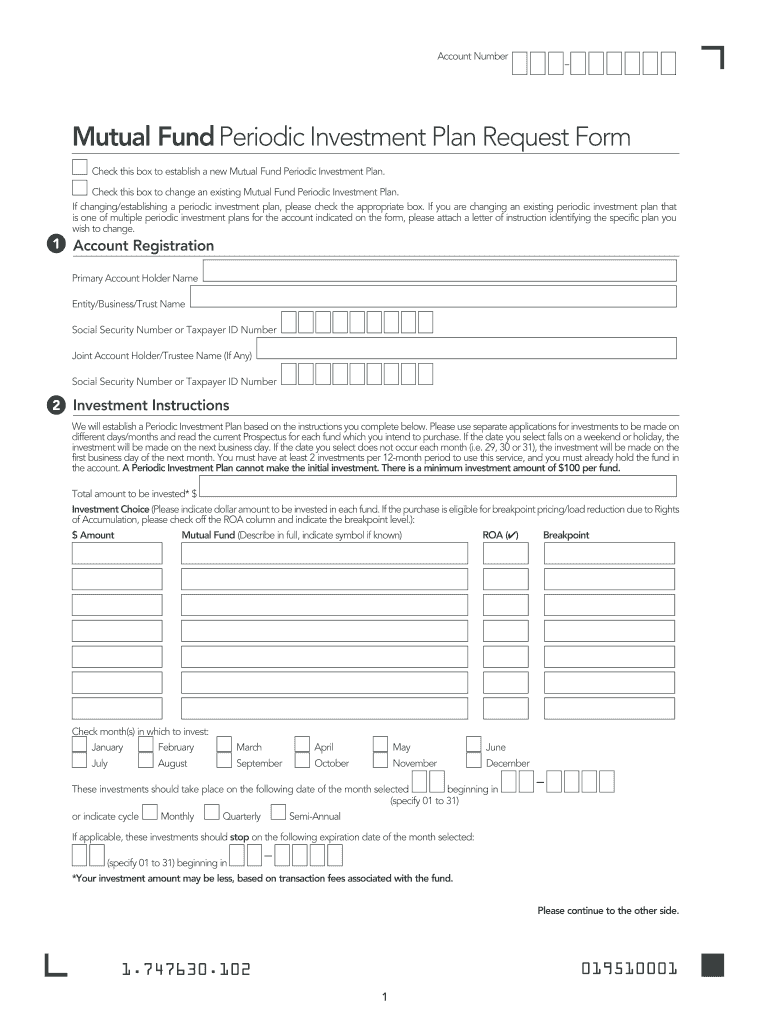

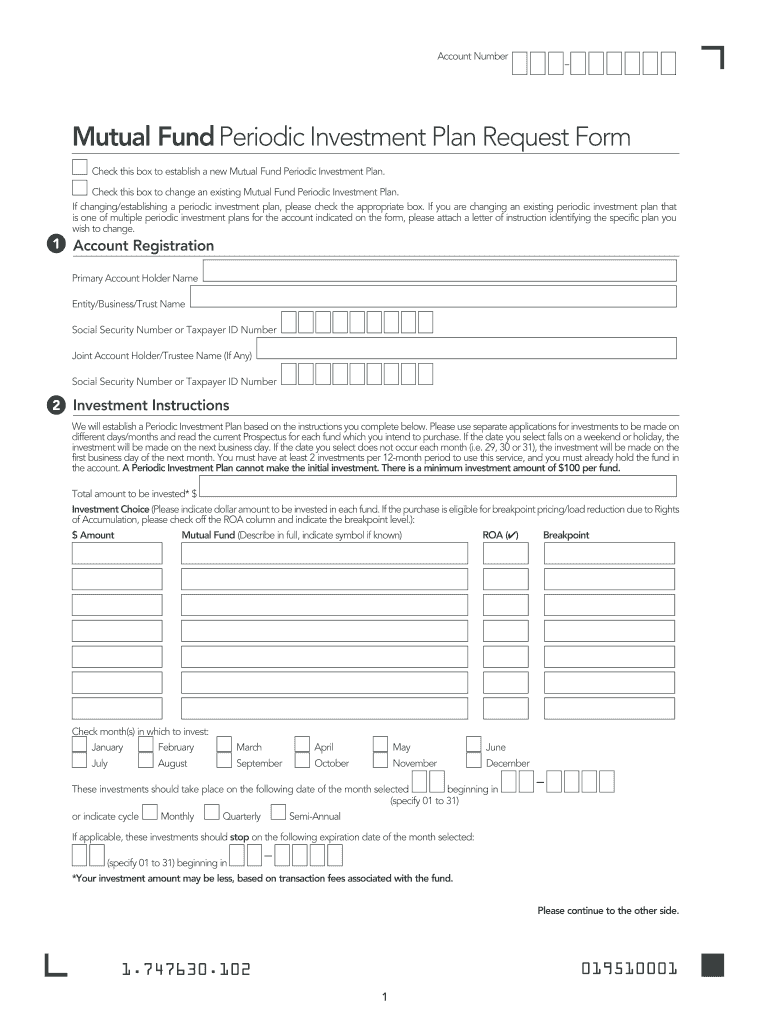

Account Number Mutual Fund Periodic Investment Plan Request Form Check this box to establish a new Mutual Fund Periodic Investment Plan. Check this box to change an existing Mutual Fund Periodic Investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual fundperiodic investment plan

Edit your mutual fundperiodic investment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual fundperiodic investment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mutual fundperiodic investment plan online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mutual fundperiodic investment plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual fundperiodic investment plan

How to fill out mutual fund periodic investment plan:

01

Determine your investment objectives and risk tolerance: Before filling out a mutual fund periodic investment plan, it is important to assess your investment goals and the level of risk you are willing to take. Consider factors such as your financial goals, time horizon, and comfort with market fluctuations.

02

Research mutual funds: Research and identify mutual funds that align with your investment objectives. Look for funds with a track record of consistent performance, low fees, and a strong investment strategy. Consider factors such as the fund's asset class, investment style, and expense ratios.

03

Consult a financial advisor: If you are unsure about which mutual funds to choose or need guidance in filling out the investment plan, it is advisable to consult a financial advisor. They can provide personalized advice based on your financial situation and help you make informed investment decisions.

04

Complete the necessary paperwork: Once you have chosen the mutual funds you wish to invest in, contact the fund provider or visit their website to obtain the necessary paperwork. This may include an application form, investment agreement, and disclosures. Fill out the forms accurately and ensure that all required information is provided.

05

Determine investment amount and frequency: Specify the amount you wish to invest in the mutual fund periodically. This can be a fixed amount or a percentage of your income. Additionally, determine the frequency of your investments, such as monthly, quarterly, or annually. Make sure you consider your cash flow and budget while deciding on these parameters.

06

Provide necessary personal and financial details: The investment plan may require you to provide personal and financial information such as your name, address, social security number, employment details, and bank account information. Make sure all information is accurate and up-to-date.

07

Review and sign the investment plan: Carefully review all the terms and conditions mentioned in the investment plan. Understand the fees, expenses, and any potential risks associated with the mutual fund. Once you are satisfied with the information, sign the investment plan, acknowledging your agreement with the terms and conditions.

08

Set up automatic payments: Many mutual fund providers allow investors to set up automatic payments from their bank accounts. This ensures that you consistently contribute to your investments as per the periodic investment plan. Provide the required details for setting up automatic payments, such as authorization for electronic fund transfers.

09

Monitor and review your investments: Regularly monitor the performance of your mutual fund investments and review your investment plan periodically. Keep track of the returns, fees, and any changes in the market conditions. Reassess your investment objectives and risk tolerance over time and make necessary adjustments to your investment plan if needed.

Who needs mutual fund periodic investment plan?

01

Individuals with long-term financial goals: A mutual fund periodic investment plan is suitable for individuals who have long-term financial goals such as retirement planning, saving for a child's education, or building wealth over time. It allows for consistent and disciplined investments over an extended period.

02

Investors seeking diversification: Mutual funds offer investors the opportunity to diversify their portfolio by holding shares in multiple companies or asset classes. A periodic investment plan can enable individuals to gradually build a diversified investment portfolio over time, reducing exposure to risk associated with a single investment.

03

Individuals looking for convenience and automation: A mutual fund periodic investment plan allows for automated contributions to the investment, making it convenient for individuals who prefer a hands-off approach. It eliminates the need for manual investing and ensures regular participation in the market without constant monitoring.

04

Investors with limited capital: A periodic investment plan is suitable for investors with limited capital as it allows for small and regular investments over time. This approach can help individuals enter the investment market gradually and take advantage of dollar-cost averaging, potentially reducing the impact of market volatility.

05

Investors looking for professional management: Mutual funds are managed by experienced investment professionals who make investment decisions on behalf of investors. For individuals who do not have the time or expertise to actively manage their investments, a periodic investment plan offers the benefit of professional management and expert decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mutual fundperiodic investment plan from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including mutual fundperiodic investment plan. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the mutual fundperiodic investment plan electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your mutual fundperiodic investment plan in minutes.

How do I complete mutual fundperiodic investment plan on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your mutual fundperiodic investment plan, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is mutual fund periodic investment plan?

A mutual fund periodic investment plan is a strategy where investors regularly invest a fixed amount of money into a mutual fund at scheduled intervals.

Who is required to file mutual fund periodic investment plan?

Individuals or entities who have opted for this investment strategy are required to file mutual fund periodic investment plan.

How to fill out mutual fund periodic investment plan?

To fill out a mutual fund periodic investment plan, investors need to specify the amount to be invested, the frequency of investments, and the mutual fund in which the investments will be made.

What is the purpose of mutual fund periodic investment plan?

The purpose of a mutual fund periodic investment plan is to provide disciplined and systematic investments in mutual funds, regardless of market conditions.

What information must be reported on mutual fund periodic investment plan?

The mutual fund periodic investment plan must include details such as the investor's personal information, the chosen mutual fund, the investment amount, and the frequency of investments.

Fill out your mutual fundperiodic investment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Fundperiodic Investment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.