TX Comptroller 12-302 2004 free printable template

Show details

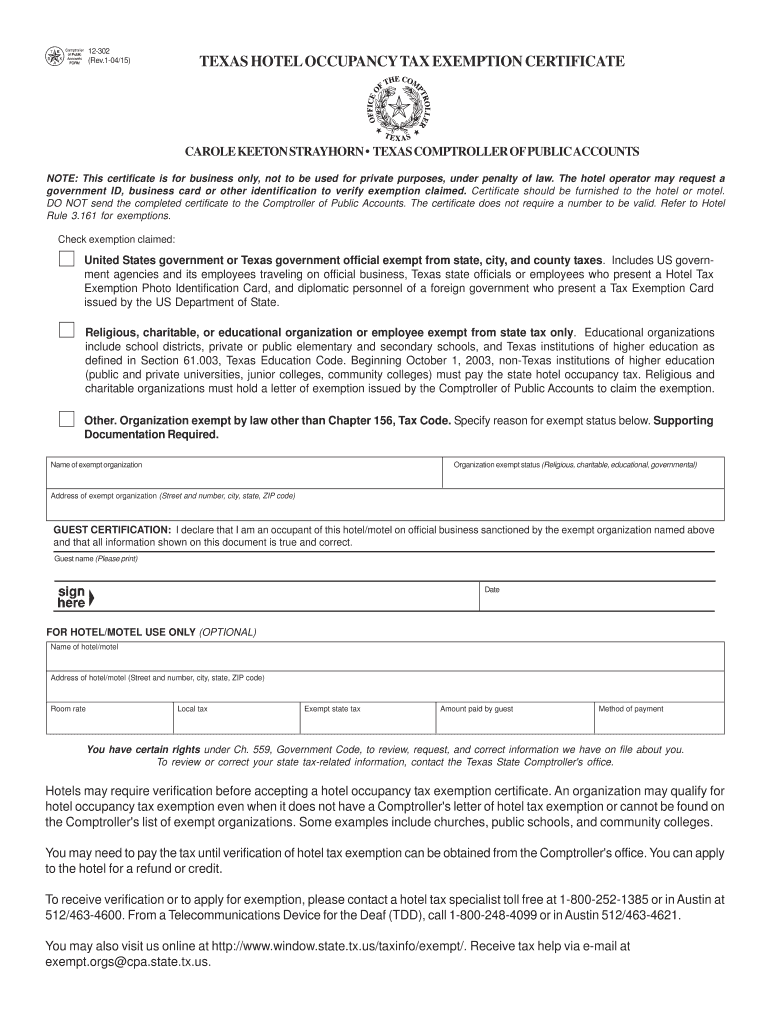

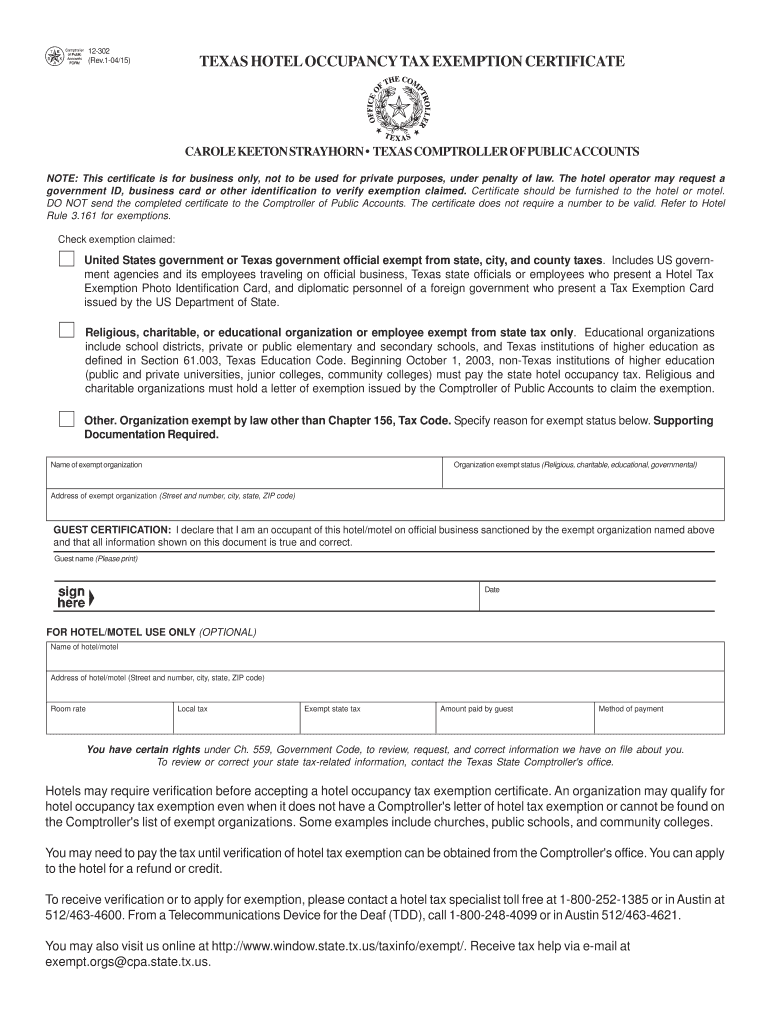

12-302 Rev.1-04/15 TEXAS HOTEL OCCUPANCY TAX EXEMPTION CERTIFICATE CLEAR FORM CAROLE KEETON STRAYHORN TEXAS COMPTROLLER OF PUBLIC ACCOUNTS NOTE This certificate is for business only not to be used for private purposes under penalty of law. The hotel operator may request a government ID business card or other identification to verify exemption claimed. Certificate should be furnished to the hotel or motel. DO NOT send the completed certificate to the Comptroller of Public Accounts. The...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas hotel tax exempt

Edit your texas hotel tax exempt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas hotel tax exempt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas hotel tax exempt online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit texas hotel tax exempt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 12-302 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas hotel tax exempt

How to fill out TX Comptroller 12-302

01

Begin by downloading TX Comptroller Form 12-302 from the official website.

02

Read the instructions provided on the form carefully.

03

Enter your legal business name exactly as it appears on official documents.

04

Fill in your Texas taxpayer number or federal employer identification number (FEIN).

05

Indicate the type of entity you are (e.g., sole proprietorship, corporation, etc.).

06

Provide the contact information, including address, phone number, and email.

07

Detail the nature of your business and describe the items or services sold.

08

If applicable, include any previous permit or registration numbers.

09

Review all entered information for accuracy.

10

Sign and date the form before submitting it to the TX Comptroller's office.

Who needs TX Comptroller 12-302?

01

Businesses in Texas that are seeking to claim a sales tax exemption.

02

Organizations or individuals making tax-exempt purchases.

03

Entities that need to provide their exempt status to vendors.

Fill

form

: Try Risk Free

People Also Ask about

Does Texas have a sales tax exemption form?

The Texas Sales and Use Tax Exemption Certification form is available from the Texas Comptroller of Public Accounts. This form should only be used for official University business. The Exemption Certification form is completed and signed at the department level.

What qualifies as tax exempt in Texas?

While the Texas sales tax of 6.25% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Texas. CategoryExemption StatusFood and MealsMedical DevicesEXEMPT *Medical ServicesEXEMPTMedicinesEXEMPT19 more rows

What items are tax exempt in Texas?

For example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to Texas sales and use tax.Baking Products – Nontaxable baking chips. baking mixes. cake sprinkles. edible decorations. icing.

How do I get a tax exemption certificate in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

What is exemption or Form 01 339?

A taxable item that is purchased for resale is exempt from sales or use tax if the seller accepts a properly completed Form 01-339, Texas Sales and Use Tax Resale Certificate (PDF), instead of collecting the sales tax due.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send texas hotel tax exempt for eSignature?

Once your texas hotel tax exempt is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my texas hotel tax exempt in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your texas hotel tax exempt directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out texas hotel tax exempt on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your texas hotel tax exempt, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is TX Comptroller 12-302?

TX Comptroller 12-302 is a form used in Texas for reporting unclaimed property filed with the Texas Comptroller of Public Accounts.

Who is required to file TX Comptroller 12-302?

Entities holding unclaimed property, including businesses, financial institutions, and government agencies, are required to file TX Comptroller 12-302.

How to fill out TX Comptroller 12-302?

To fill out TX Comptroller 12-302, provide the entity's information, list all unclaimed properties, including owner names and last known addresses, and follow the instructions for completing and submitting the form.

What is the purpose of TX Comptroller 12-302?

The purpose of TX Comptroller 12-302 is to report unclaimed property to the state and ensure compliance with Texas unclaimed property laws.

What information must be reported on TX Comptroller 12-302?

Information required on TX Comptroller 12-302 includes the holder's name, address, contact information, details about each unclaimed property, including the owner's name, last known address, and the amount of the property.

Fill out your texas hotel tax exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Hotel Tax Exempt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.